Mortgage – HousingWire |

- Opinion: ICE’s Joe Tyrrell on the Black Knight acquisition

- Mortgage market affordability and inventory challenges

- Purchase mortgage rates fall 40 bps amid recession fears

- Sprout Mortgage to shutter

- Pennymac launches two MSR-backed private offerings

- In retreat, Wells Fargo cuts additional mortgage jobs

- Feds release list of poor rural areas that need affordable-housing lending

- FHFA to increase GSE fourth-party oversight

- New Residential makes another round of layoffs

- Home price growth slows but affordability pressures remain: Black Knight

| Opinion: ICE’s Joe Tyrrell on the Black Knight acquisition Posted: 07 Jul 2022 09:20 AM PDT In May, we announced our intention to acquire Black Knight. Since the announcement, we have heard from a number of lenders and partners about their excitement over our ability to accelerate the digital journey of our industry, our ability to invest in the modernization of the MSP servicing platform, and the open technology approach we bring to the deal. We have also received questions from across the industry about the news as well as requests for details on the value that would be created for lenders and consumers through this acquisition. The following are a few of the more frequently asked questions, along with details regarding our intentions. What do you believe will be the biggest impact for the industry with the acquisition of Black Knight? In terms of the biggest impacts that this acquisition will have on the industry, I would highlight a few areas. First, it will be the openness and choice that lenders will have, as we at ICE have consistently demonstrated our commitment over the past 20 years to access and transparency in the mortgage industry, which we plan to extend to the Black Knight business. We are investing in the modernization of MSP, in order to make it easier for lenders and servicers to access their data, interact with APIs and better enable partners to integrate with the Black Knight technology. In addition, we will drive greater integration across all the solutions, to improve the lender's experience and eliminate unnecessary friction. Also, we are accelerating our delivery of automation with a focus on cost reduction for the lender, which we expect will ultimately lower the cost of a mortgage for the consumer. We see big opportunities to reduce the cost of origination and the cost of servicing by leveraging increased automation throughout the life of the loan. It is also important to remember that Black Knight was being approached by a number of entities to acquire them, including private equity firms, as indicated in recent public filings. If ICE was not acquiring Black Knight, they would have been acquired by someone else, who may not be fully committed to serving lenders long-term, or to making investments that enable greater access to data and open networks, but instead focus on a series of immediate changes with a short-term perspective. ICE, on the other hand, has extensive experience in the mortgage industry, we have publicly stated our intention to invest significantly in a number of the Black Knight solutions, including MSP and Empower, and we are committed for the long-term in serving this industry and lenders specifically. What was the motivation for ICE to want to do this deal? Every year we are asked by our clients if we will provide servicing technology, because many lenders experience the inefficiencies when trying to onboard loans from a loan origination system into a servicing system. These lenders are having to manually key in data, they experience the adverse impact to homebuyers when interim payments are incorrectly applied, or find challenges when proof of homeowners insurance isn't properly carried over into the servicing system, as well as several other points of friction. Lenders also appreciate how we operate our solutions as open platforms and open networks and are anxious to have that same experience with their servicing system. This deal gives us the opportunity to address all these lender requests and make their experience significantly better. In addition, we have heard directly from lenders about the desire to create a life-long customer engagement experience. For many lenders, after the loan is funded, they lose connection to those homebuyers. Lenders see opportunities to proactively engage consumers, throughout the entire lifecycle of the mortgage, to help these households improve their cash flow through refinances that target elimination of risk adjustments that may have been made at the time of origination. Also, as we integrate our underwriting automation capabilities and our consumer engagement tools with both the servicing technology and the MLS solutions offered by Black Knight, we can enable lenders to provide households with the unique experience of being able to conduct searches for their next home based on those that they are fully qualified to buy. There are so many different numbers when it comes to "market share" when industry participants are discussing this deal. What are the real numbers of the deal related to market share for ICE? This acquisition is not about market share, it is about solving real problems in the industry related to accelerating the availability of automation, better integrations, improving the homebuyer's experience and providing greater access to data while lowering lender costs by taking advantage of technology to eliminate manual processes. Just as important to note is that all mortgage technology companies face robust competition in the marketplace, across all products. ICE faces numerous competitive threats from several well-established incumbent firms and newly established and well-backed entrants, who can and do take accounts away from both ICE and Black Knight. The combination of ICE and Black Knight changes nothing. In fact, using consensus estimates of 6,500 total lenders in the U.S., Black Knight provides LOS services to fewer than 2% of those lenders. This competition means we must continue to innovate and deliver value to our customers, all at a competitive price point. This is why we provide our customers with the option of selecting multi-year agreements, with built-in price protections. Most of our customers select four or five year terms, meaning that pricing cannot be arbitrarily changed for the duration of the contract, which is why so many of our lenders opt for longer terms. I believe that Black Knight contracts are similarly structured. The bottom line is that our lenders know that they have multiple options and that ICE has to fight to keep its customers every day, which means our competitive focus and our incentive to innovate in the mortgage technology space are here to stay. However, for those who don't work and live in the competitive mortgage space every day, we know that we need to help them understand all the competitive dynamics that exist, not only today, but also all of those on the horizon, from new entrants. We look forward to working closely with regulators, and other interested parties, to help them fully understand this market and all the choice that lenders maintain. With so much uncertainty in the industry, why do this acquisition now? I have been in this industry for over 25 years, and other than the difficulties that we all experienced between 2007 through 2009, I would say that it feels that right now we are entering a period of greater uncertainty than in recent memory. Lenders and service providers are laying off staff, while preparing for an environment of continued increases in interest rates and lower housing supply. But at ICE, with this acquisition, we are investing significantly in the industry, because we believe that homeownership should be possible for every U.S. household. We take a long-term view of the markets that we serve, and we understand that modernization requires investment, expertise and enabling clients and partners to participate in the journey. Unlike a financial acquirer, who may be more focused on cutting Black Knight costs and maximizing the prices they charge to their customers, we are acquiring Black Knight with the intention of investing over $200 million into modernization of MSP and Empower, creating greater access to data, providing more transparency, and by opening the platforms more broadly by delivering APIs to accelerate innovation through enabling partners and lenders to have a greater role in delivering automation. We are doing all of this by leveraging our significant expertise in making data available to market participants and modernizing markets around the world, as we have done for the New York Stock Exchange and other exchanges that we operate across the globe. Do you feel this deal will hurt competition or spur innovation? We have stated publicly that we intend to continue to offer all current Black Knight products, so there will continue to be the same choice that is available to lenders today. When it comes to innovation, we don't believe that full automation of the industry can be done by any one single company. That is why we have embraced the ability to help new entrants come into the market and to be able to help distribute their innovations to our clients. ICE is usually the first company that most start-ups approach to create awareness of their offerings and get help distributing their products. In the last 12 months alone, we have integrated and introduced 67 new partner solutions to our clients, with many of those coming from new start-ups. We do not have any exclusive relationships with these companies, as they partner with many LOS companies. We also invite all industry providers to participate in our user conference and show their solutions directly to our customers. ICE operates open networks, and we provide access to our APIs, so both lenders and partners can foster and introduce innovation. We intend to extend this approach to all the Black Knight solutions as well, which will open even more access to MSP, Empower, Optimal Blue and all the other current offerings. New innovation actually comes from better integrations, so by creating even more openness within the Black Knight products, we will make it easier for other systems to integrate them more tightly, just as we have done at ICE. ICE Mortgage Technology (and formerly Ellie Mae) has talked a lot about automating everything automatable in the mortgage industry. Does anything change in your automation mission if ICE acquires a loan servicing system? It doesn't change our automation mission at ICE, but what it does allow, is our ability to accelerate the delivery of value to lenders and homebuyers. Not only is the mortgage process still heavily analog, but it is also highly fragmented, especially from a homebuyer's perspective. If I am purchasing a home, I have one experience when I am shopping for a mortgage, I have another experience when I apply, then another when I am submitting required documents and then still another once my loan is funded and I am making payments or checking my balance. Homebuyers are often having to go through this entire process by interacting with multiple systems and interfaces, as opposed to having one consistent experience from start to finish. We see an opportunity for creating a single consumer experience, where a lender can provide every home buyer step and action through an intuitive single consumer engagement solution. What happens with employees for Black Knight and ICE Mortgage Technology? We intend to continue to make all Black Knight solutions available in the market, which means we need to have the people who know how to run and continue to innovate those solutions. What is most exciting about bringing the teams together is the depth of mortgage experience that both companies have. What level of investment is ICE looking to make in the mortgage space moving forward? We are focused on innovation that improves the homebuyer experience, lowers the cost of origination and advances the analog to digital evolution in the mortgage industry. In addition to continuing the ongoing investments in all the products and services that both ICE and Black Knight make available today, we are committing more than $200 million dollars to accomplish the modernization and openness that I mentioned relative to some of the Black Knight solutions. Beyond that, we are also increasing our investments in our full suite of underwriting automation tools which we call our Analyzers. We are also creating the ability for the industry to store RON videos in MERS and associate it with a MIN number, as we continue our investment in the eClose space. Why would a lender be concerned about this deal and why do you think they should be excited? Any time that there is any sort of change, there will always be some who will be unsure of what that change will mean for them. I would point those folks to a few important facts. First, ICE has a deep and extensive experience of adding value to lenders when we acquire and integrate new solutions. We leverage a third-party firm to independently calculate the return on investment for lenders when they take advantage of our integrated acquisitions. That ROI for lenders has increased from $570 to over $1,400, per loan, over the course of the last few years and that ROI represents a direct impact to lowering the lenders cost of origination. Lenders should have incentives to pass these cost savings to home buyers as they try and compete to originate more loans. We see an opportunity to grow this ROI even more for lenders through our acquisition of Black Knight, further lowering their cost of origination. We also intend to provide servicers with greater access to their data in MSP and to enable lenders, partners and servicers to build upon all of the platforms that we will offer, through robust APIs. We are excited to enable lenders and servicers with these capabilities. As a former lender myself, there is a lot to be excited about. Joe Tyrrell is President of ICE Mortgage Technology. This column does not necessarily reflect the opinion of HousingWire's editorial department and its owners. To contact the author of this story: To contact the editor responsible for this story: The post Opinion: ICE’s Joe Tyrrell on the Black Knight acquisition appeared first on HousingWire. |

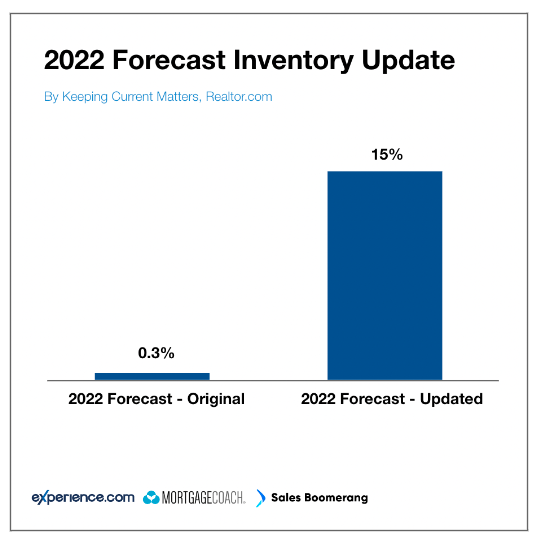

| Mortgage market affordability and inventory challenges Posted: 07 Jul 2022 07:11 AM PDT We are in a unique moment in the history of housing. With a rapid spike in interest rates, inventory at historic lows, home prices rising at unprecedented levels above income, and a purchase market that is both highly anxious and digitally reliant, mortgage and real estate professionals must be strategic to capture the market opportunity today. We interviewed more than 25 mortgage industry experts to gather the best insights, strategies, and recommendations to pivot and win in today's market. We have partnered with HousingWire to release a few excerpts from the report. To view the complete research, click here. 2022 State of the Mortgage Industry: Affordability and Inventory It was no surprise that affordability hit the top of the list in every interview. Black Knight reported that May was the least affordable housing market in 16 years. Inventory has increased slightly with rising rates, but economists agree that the progress is nowhere near enough to bring us out of the current inventory crisis. Lead Analyst for HousingWire, Logan Mohtashami, calls it "a savagely unhealthy market."  Inventory rising, historically low. Let's start with the good news. For the first time in three years, we have seen an increase in homes on the market and price reductions. In Portland, Oregon, for example, one loan officer noted that new listings doubled in the second half of May from 800 to 1,900 new listings. In Seattle, Dan Keller reported 47% of all listings had price reductions. Inventory is projected to increase significantly higher than originally forecasted for the year. However, looking at the data over the span of history, we are still at record all-time lows. According to Mohtashami, we should be at a range of 1.52 to 1.93 million homes on the market, and we are currently at around 1.0. According to Black Knight, active listings remain 67% below pre-pandemic levels with 820,000 fewer listings than would be expected at this time of year. As for price reductions, while these have increased to an average of 22%, this number would be closer to 30% in a traditional market. Lastly, homes are listed today for an average of 13 to 16 days, depending on the market, but we should see that closer to 30 to 45 days. Growth rate of income vs. home prices. Affordability challenges have been driven by more than just low inventory. Again, looking at the market over the past 40 years, debt and income have not kept up with rises in housing costs. Median home prices have risen by 60% since 1980, while median family income has only risen by 25%. Slow construction and restrictive zoning laws. One of the major causes of low inventory has been due to slowed construction. Builders and contractors across the country have experienced challenges in getting basic materials and labor, which has created significant delays. After the housing crisis of 2008, many homebuilders went out of business, and for years following the recovery, building did not pick up to the level needed to accommodate demand. Worker shortages and supply chain issues in the pandemic further widened the inventory gap. In an interview with NPR, one builder stated, “If I had twice as many guys, I would still not have enough… And my subcontractors, they’re all hurting for people.” In addition to labor and materials, builders have struggled to meet the increasing demand for multifamily units due to restrictive zoning laws. Delayed household formation has increased the demand for multifamily units, designed for one or two-person households (Urban Institute). However, many neighborhoods restrict the building of multifamily units or ADUs. Institutional Investors. In 2021, we saw the highest rate of investor-purchased properties than ever before. Austin Niemic, executive vice president at Rocket Pro TPO, stated one of the reasons that affordability is a challenge in their markets has been due to "institutional buyers getting in and buying homes at scale." New data published in Business Insider found that investors bought 33% of U.S. homes on the market in January, the highest percentage in over a decade. In recent months, investors have more heavily leveraged real estate to hedge against inflation, pushing more first-time homebuyers out of the market. For more trends and strategies aggregated from more than 25 of the mortgage industry's leading experts, click here and view the full report. The post Mortgage market affordability and inventory challenges appeared first on HousingWire. |

| Purchase mortgage rates fall 40 bps amid recession fears Posted: 07 Jul 2022 07:00 AM PDT Purchase mortgage rates this week continued their recent downward trend, dropping 40 basis points to 5.30%, according to the latest Freddie Mac PMMS Index. A year ago at this time, 30-year fixed rate purchase rates were at 2.90%. The PMMS, a government-sponsored enterprise index, accounts solely for purchase mortgages reported by lenders during the past three days. "Over the last two weeks, the 30-year fixed-rate mortgage dropped by half a percent, as concerns about a potential recession continue to rise," Sam Khater, chief economist at Freddie Mac, said in a statement. Another index showed the 30-year conforming rates also declined from last week. Black Knight's Optimal Blue OBMMI pricing engine, which includes some refinancing data — but excludes cash-out refis to avoid skewing averages – measured the 30-year conforming rate at 5.68% Wednesday, down from last week's 5.89%. Meanwhile, the 30-year fixed-rate jumbo was at 5.10% Wednesday, down from 5.42% from the previous week. Mortgage rates tend to move in concert with the 10-year U.S. Treasury yield, which fell to 2.93% Wednesday, down from 3.10% a week before. The federal funds rate doesn't directly dictate mortgage rates, but it does steer market activity to create higher rates and reduce demand. How lenders can navigate a shifting market with non-QM loan options In an effort to counter margin compression and satisfy a new generation of homebuyers, lenders are looking to offer loan options that better fit the average borrower. HousingWire recently spoke with John Keratsis, President and CEO of Deephaven Mortgage, about the potential benefits of non-QM lending in today's tight housing market. Presented by: DeephavenFollowing the Federal Reserve's interest rate hike of 75 basis points on June 15, mortgage rates climbed for two weeks, but started to decline last week, as expected by mortgage industry economists. Mike Fratantoni, Mortgage Bankers Association's (MBA) chief economist and senior vice president of research and industry technology, told HousingWire that after the Fed's meeting in June and the removal of some of the market's uncertainty over the path of rising rates, that rates would settle back to something closer to 5.5%. Despite the decline in rates, borrowers' demand for mortgage loans fell this week – mortgage application volume declined 5.4%, according to the MBA. Refi apps decreased 7.7% from the previous week and purchase application were down 4.3% from a week earlier. Khater said that while the drop in rates provides "minor relief to buyers, the housing market will continue to normalize if home price growth materially slows due to the combination of low housing affordability and an expected economic slowdown." According to Freddie Mac, the 15-year fixed-rate purchase mortgage averaged 4.45% with an average of 0.8 point, down from last week's 4.83%. The 15-year fixed-rate mortgage averaged 2.20% a year ago. The 5-year ARM averaged 4.19% this week, down from 4.50% the previous week. The product averaged 2.52% a year ago. The post Purchase mortgage rates fall 40 bps amid recession fears appeared first on HousingWire. |

| Posted: 06 Jul 2022 03:24 PM PDT Non-QM lender Sprout Mortgage is shutting down operations, multiple workers said on Wednesday. The company informed the more than 300 workers of the shut down in a conference call on Wednesday, a former staffer said. Sprout had already instituted several rounds of job cuts in the months leading up to the shutdown, the ex-employee said. The closure of Long Island-based Sprout, headed by industry veteran Michael Strauss, represents the second non-QM mortgage lender to close in recent weeks amid historic volatility. First Guaranty Mortgage Company, controlled by asset management giant PIMCO, abruptly stopped operations less than two weeks ago after encountering turbulence caused by a sharp rise in rates and challenges in selling loans to investors. In April, HousingWire chronicled the struggles of lenders in the non-QM space as rates surged. Shea Pallante, the president of Sprout, at the time told HousingWire that the company prefers to “focus our efforts on maximizing production during any changing rate environment. We're confident that the non-QM sector — and Sprout in particular — will not only ride out the turbulence but outperform expected growth rates.” The status of loans in Sprout’s pipeline was not immediately clear. A spokesperson for the company did not immediately respond to a request for comment. Staying nimble in a fast-paced market with the right mortgage technology In the rapid-fire, volatile mortgage marketplace, lenders need technologies to help them remain nimble and successfully navigate constant change. Advanced product, pricing and eligibility technology creates efficiencies and helps lenders compete in a fast-paced market. Presented by: Black KnightFormer employees said Pallante held the conference call at 4:30 p.m. and said the lender would be shutting down immediately. He did not offer severance and employees were quickly locked out of their systems, former employees said. Several staffers told HousingWire that Sprout’s shut down occurred one day before pay day, and they did not receive their pay checks. In summer of 2021, Sprout announced plans to set up a distributed retail operation, with plans to grow its retail channel through increased direct sales to consumers and residential investors, dedicated brick-and-mortar, and joint ventures. Sprout does most of its business through mortgage brokers. It also has a low-margin correspondent business. Check back for updates on this breaking news story. The post Sprout Mortgage to shutter appeared first on HousingWire. |

| Pennymac launches two MSR-backed private offerings Posted: 06 Jul 2022 02:00 PM PDT Subsidiaries of Pennymac Financial Services Inc. (PFSI), which ranks as one of the top five mortgage lenders nationally, are seeking to raise more than $700 million in the debt markets through the sale of notes secured by mortgage servicing rights. The transactions include a note offering of $305 million sponsored by PFSI subsidiary PennyMac Mortgage Investment Trust that is "secured by certain participation certificates relating to Fannie Mae mortgage servicing rights [MSRs]," states a recent filing by PFSI with the U.S. Securities and Exchange Commission (SEC). Another subsidiary of PFSI, PennyMac Loan Services LLC, issued a separate private-label issuance of participation certificates valued in total at $400 million. The notes are backed by Ginnie Mae mortgage-servicing rights, according to a presale report by Kroll Bond Rating Agency (KBRA). Both note offerings receive a BBB rating from KBRA. The notes issued in both deals pay interest only until maturity, according to KBRA. The MSR market has been on a bit of a tear since the start of the year, with values rising rapidly and creating opportunities for many lenders to bolster their balance sheets. PennyMac Mortgage Investment Trust, a real estate investment trust (REIT), recently issued $305 million in Fannie Mae MSR-backed notes to "qualified institutional buyers" via an offering dubbed Series 2022-FT1, PFSI's SEC filing shows. The five-year notes bear an interest rate of 4.19% above the 30-day average Secured Overnight Financing Rate, or SOFR, according to the SEC document. The presale report for the separate PennyMac Loan Services-sponsored offering of $400 million in Ginnie Mae MSR-backed participation certificates, called Series 2022-GTI, also involves five-year term notes. The KBRA report does not disclose the interest rate on the notes to be sold — other than indicating the rate, as in the REIT's offering, will be set at some level above SOFR. The bond-rating reports for both offerings indicate that the agency MSRs serving as collateral do entail some risk. "For loans sold to, or guaranteed by, a government-sponsored enterprise or housing finance agency (such as Fannie Mae, Freddie Mac, or Ginnie Mae), the MSR asset is owned by the related servicer [PFSI or its subsidiaries in this case] but can be transferred away from the servicer by the agency due to the occurrence of a pre-determined set of infractions by the servicer," KBRA bond rating reports on the offerings state. "Depending on the severity of the infraction and other considerations, the agency may attempt to facilitate an orderly transfer of servicing for reasonable consideration of the value of the MSRs. "However, a troubled servicer may have difficulty realizing market-rate bids for its portfolio given its distressed state and the fact that MSR markets can be illiquid." Mitigating that risk, however, according to KBRA, is the fact that both Fannie Mae and Ginnie Mae have pre-existing relationships with PFSI; the size and market share of each "create alignment of incentive"; and the agencies have consented to the securitization of the MSRs. In the case of Fannie Mae, via an acknowledgement agreement, it has granted PFSI "the right to certain amounts based on sale proceeds, if the MSRs are sold by Fannie Mae, or appraised market value, if the MSRs are retained by Fannie Mae," the KBRA bond-rating report states. Ginnie Mae's agreement with PFSI, per KBRA, limits the agency's ability to "extinguish MSRs" without giving PFSI or its affiliates a chance to first "cure any breach … under the Ginnie Mae contract." Monthly valuations of the MSRs for both offerings will be performed by Incenter Mortgage Advisors, KBRA reports. Incenter has managed more than $1.5 billion in MSR sales and purchases, according to KBRA. Tom Piercy, managing director of Denver-based Incenter Mortgage Advisors, explained in an interview for a prior story that as interest rates rise, the value of MSRs generally increases because the risk of early repayment of mortgages decreases. And fast-rising rates in 2022 have quelled the once-booming refinancing market, which is a major driver of mortgage prepayments. The post Pennymac launches two MSR-backed private offerings appeared first on HousingWire. |

| In retreat, Wells Fargo cuts additional mortgage jobs Posted: 06 Jul 2022 01:47 PM PDT Wells Fargo, the third-biggest mortgage lender in the country, will lay off 125 employees in its home lending division in Iowa by the end of August. The bank will cut 11 jobs in July and 114 in August, according to Worker Adjustment and Retraining Notification (WARN) notices submitted to the Iowa Workforce Development. The bank eliminated 72 mortgage jobs in Iowa across earlier layoffs. "The home lending displacements are the natural result of cyclical changes in the broader home lending environment, as has been acknowledged by most mortgage providers across the industry in recent weeks," Lylah Holmes, a spokesperson at Wells Fargo, told HousingWire. The bank will provide severance and career counseling. "Of those impacted in home lending so far this year, about 35% are moving into other roles within Wells Fargo," Holmes said. But the bank declined to say how many employees have been laid off in the home lending business overall this year. Wells Fargo's revenues in the home lending business totaled $1.5 billion in the first quarter this year, a 19% drop compared to the previous quarter and 33% lower than the same period in 2021. "The mortgage origination market experienced one of its largest quarterly declines that I can remember, and it will take time for the industry to reduce excess capacity," Charlie Scharf, Wells Fargo's CEO, said analysts in April. According to bank executives, originations and margins were under pressure in the second quarter – the bank's Q2 2022 earnings are expected to be released on July 15. Wells Fargo executives in early June said the bank was considering pulling back on its mortgage business, where, beyond the challenges related to a decline in originations, it has also struggled with scandals related to minority lending. The post In retreat, Wells Fargo cuts additional mortgage jobs appeared first on HousingWire. |

| Feds release list of poor rural areas that need affordable-housing lending Posted: 06 Jul 2022 12:08 PM PDT The federal banking regulators responsible for overseeing the Community Reinvestment Act (CRA) obligations of lenders they regulate have released the 2022 list of distressed or underserved rural census tracts where community-development loans, investments and services are eligible for special CRA consideration. Community-development efforts eligible for the special consideration include affordable-housing lending in these lower-income rural census tracts. The CRA was enacted in 1977 to encourage financial institutions to meet the credit needs of the local communities they serve — with a focus on addressing the community development in low- and moderate-income individuals. CRA regulations define lending and other activities focused on affordable housing for low- and moderate-income individuals as a form of community development, according to the Federal Reserve Bank of Minneapolis. Bank-information services provider Sheshunoff Consulting and Solutions adds that under the CRA "affordable-housing activities must benefit or be likely to benefit LMI [low- and moderate-income]" individuals. An analysis of the census tracts identified by federal banking regulators for 2022 as "Distressed or Underserved Nonmetropolitan Middle-Income Geographies," reveals the following: States with the largest number of underserved or distressed census tracts: Georgia, 147; North Carolina, 145; Texas, 144; Kentucky, 130; Michigan, 117; and Mississippi, 101. States with the lowest number of identified underserved or distressed census tracts: Hawaii, 1; Nevada, 2; Indiana, 4; Massachusetts, 5; Maryland, 7; New York, 7. (The nation's most populous state, California, had 28 rural census tracts identified as underserved or distressed, according to the 2022 list released by regulators.) Finally, the following states do not appear on the list: Delaware, Connecticut, New Hampshire, New Jersey and Rhode Island. The federal banking regulators responsible for enforcing CRA are the Federal Deposit Insurance Corp., or FDIC; the Federal Reserve Board; and the Office of the Comptroller of the Currency. "Revitalization or stabilization activities in these geographies [census tracts] are eligible to receive CRA consideration under the community development definition," states the Office of the Comptroller of the Currency's announcement revealing the list of eligible census tracts nationwide. A nonmetropolitan middle-income geography — a low-to-moderate income rural area — can be defined as distressed if it is a census tract that meets one or more "trigger" factors, according to the Federal Financial Institutions Examination Council. The triggers:

The post Feds release list of poor rural areas that need affordable-housing lending appeared first on HousingWire. |

| FHFA to increase GSE fourth-party oversight Posted: 06 Jul 2022 11:47 AM PDT The Federal Housing Finance Agency (FHFA) will increase its oversight of fourth parties – companies that contract with firms doing business with Fannie Mae and Freddie Mac. The FHFA is also considering beefing up its fourth-party oversight guidance for Fannie Mae and Freddie Mac. To that end, in 2022, it will monitor trends in fourth-party risk management, and evaluate Fannie Mae and Freddie Mac’s exposure to fourth parties, according to a report the FHFA Inspector General issued at the end of June. The report said that fourth parties are an area of growing concern for both the regulator and the GSEs. Overseeing those fourth parties poses a challenge, however, since in most cases the enterprises do not have a direct relationship with them. There are exceptions for some firms, like Amazon Web Services, because they are both third and fourth parties. Fourth party relationships pose a greater risk in light of recent cybersecurity breaches, the agency watchdog wrote. For the FHFA, the pandemic "demonstrated the fragility of the supply chain and raised awareness of fourth-party risk," the report said. In one cybersecurity breach, an example Fannie Mae also highlighted in a quarterly filing, a foreign threat actor in 2019 infiltrated the networks of a U.S.-based company. A file containing malicious code was later "unwittingly released" to SolarWinds customers, via software updates. For the FHFA and the government sponsored entities, oversight of fourth parties is difficult not only because of their indirect relationship with the enterprises, but because there are so many of potential fourth parties. The GSEs both focus scrutiny on the fourth parties they believe to be higher-risk, but they often rely on second hand information to make that determination. Fannie Mae has, and Freddie Mac is developing, a list of "material fourth parties," including those that have access to confidential information. For Fannie Mae, large subservicers fit that bill, and they also have direct relationships with the enterprises. Fannie Mae said it can monitor subservicers in the same way it monitors servicers. FHFA and Freddie Mac did not immediately respond to requests for comment. Fannie Mae declined to comment. Fannie Mae and Freddie Mac both told the FHFA watchdog that they rely on information from third parties about their oversight of fourth parties. The GSEs might not know where a fourth party is located, its controls, or what kind of oversight the third-party provider has, the report said. But the GSEs do have some oversight mechanisms for fourth parties, through their relationship with third parties. During contract negotiations, for example, the enterprises can include provisions for subcontractor oversight. The GSEs may also conduct due diligence and monitoring of the third-party risk management programs of their third parties. In some cases, third parties must get enterprise approval before engaging with fourth parties. In Fannie Mae's standard contract, third parties must inform them of new subcontractors. For subcontractors that provide services that are part of the contract with Fannie Mae, the enterprise can use its authority to "review" the new subcontractors. But GSE approval is not needed for other fourth parties. Freddie Mac told the FHFA Inspector General that it also reserves the right to approve subcontractors and "material fourth parties," and requires that third parties notify them of new subcontractors. But Freddie Mac does not seek to approve those fourth parties, according to the report. The FHFA IG, an agency independent of the FHFA, has been raising awareness about third party risk for years. Last year, the IG found that from 2014 to 2020, FHFA did not conduct any targeted exams of Fannie Mae's third-party risk management program. The agency has repeatedly argued for Congress to give it statutory authority to directly examine third-party service providers. In February, the FHFA also floated the idea of examining nonbank servicers in its draft four-year strategic plan. After industry pushback, the language was left out of the final version of the plan. The post FHFA to increase GSE fourth-party oversight appeared first on HousingWire. |

| New Residential makes another round of layoffs Posted: 06 Jul 2022 10:36 AM PDT Lender and servicer New Residential Investment Corp. laid off originations staffers last week, sources told HousingWire. The lender has made several rounds of cuts since February. Employees in processing, underwriting, and closing jobs were the main targets in the last week's layoff round, according to multiple interviews with former employees. The latest layoff affected employees in both junior and senior roles. The company is paying two weeks of severance per year of service, a former employee said. New Residential, the parent company of NewRez and Caliber Home Loans, declined to comment about the layoffs. "It came unexpectedly," said a former employee who requested anonymity. "On Wednesday, we got called into a Teams meeting, and they turned off the comments, so we could not even ask any questions." In his division of about 40, about half the employees were let go, he said. In February, New Residential sent pink slips to 386 employees, about 3% of the mortgage workforce, less than a year after acquiring Caliber Home Loans, a multichannel lender, in a deal valued at $1.675 billion in April 2021. News of the layoffs comes about six months after Sanjiv Das announced his resignation as CEO of Caliber. "As we continue to create synergies between companies, we are creating a structure to streamline business channels and create long-term growth," a New Residential spokesperson wrote to HousingWire at that time. There were multiple rounds of layoffs in originations at the end of February, March, April and May, affecting both Newrez and Caliber teams, former employees said. Documents filed with the Securities and Exchange Commission (SEC) show that New Residential had 12,293 employees in December 2021, and 11,324 in March 2022. The company funded $26.9 billion in mortgages in the first quarter, down from $82.3 million in the previous quarter. But New Residential reported $690 million in net income, a 267% increase from the previous quarter, boosted by the servicing portfolio. To reduce costs, New Residential announced in June that it had decided to internalize the company's management. Michael Nierenberg will continue to be the chairman of the board, chief executive officer, and president. The internalization will save approximately $60 million to $65 million. The company is also changing its name to Rithm Capital, reflecting the diversification of its businesses as more than just a mortgage real estate investment trust. Last year, it closed the acquisition of Caliber Home Loans and Genesis Capital LLC. New Residential will start trading on the NYSE as "RITM" on or about August 1, 2022. The post New Residential makes another round of layoffs appeared first on HousingWire. |

| Home price growth slows but affordability pressures remain: Black Knight Posted: 06 Jul 2022 10:24 AM PDT Home price growth slowed in May, showing signs of a cooling housing market. But housing is the least affordable it has been since the mid-1980s as mortgage rates rise and home values soar, driven by low housing inventory, a new Black Knight report suggests. The annual home price growth index, measured by Black Knight, grew 19.3% in May from a revised 20.4% in April marking the largest single-month deceleration since 2006. Prices, however, are still up 1.5% month over month, which is nearly twice the historical average for May, according to Black Knight’s monthly mortgage monitor report. "While any talk of home values and 2006 might set off alarm bells for some, the truth is that price gains would need to see deceleration at this rate for more than 12 months just to get us back to a 'normal' 3-5% annual growth rate," said Ben Graboske, data and analytics president at Black Knight. "That said, the pace of deceleration could very well increase in the coming months, as we've already begun to see in select markets such as Austin, Boise and Phoenix." The strongest deceleration was in Austin, Texas where home price growth rate dropped 12.2 percentage points followed by Boise, Idaho (-12.1 percentage points) and Spokane, Washington (-7.1 percentage points), all of which saw significant home price growth in recent years, according to Black Knight. While 97 of the nation’s 100 largest markets saw home price growth slowing, affordability is at its worst point since the mid-1980s, when sharp hikes by the Federal Reserve led to double-digit mortgage rates, which often resulted in greater than 50% payment-to-income ratio. Back then, affordability pressures were almost entirely rate-driven and incomes largely kept up with home price growth, the report said. Today’s falling affordability is due to rising rates and soaring home values largely driven by low inventory levels. The average home price is now more than six times the median household income. As of mid-June, it takes about 36% of the median household income to make the mortgage payment on average-priced home purchase, which is well above the 34% post-1980s peak in July 2006. That payment is higher than $2,100 for the first time on record, up nearly $750 so far this year and almost double the $1,089 required at the beginning of the pandemic. However, the largest jump in housing inventory in the past five years also was in May, as pending listings began to normalize and existing listings sat longer on the market. Despite more than 107,000 homes listed for sale in May, inventory remains at a 60% deficit. That equates to about 770,000 fewer properties on the market than there would typically be at this time of the year, according to Black Knight. “All major markets are still facing inventory deficits, but some have seen their shortages shrink much faster than others,” Graboske said. Among them are some of the hottest housing markets, including San Francisco and San Jose, California, and Seattle, Graboske added. "Unsurprisingly, these are also among the markets seeing the strongest levels of cooling so far this year, with annual home price growth rates in each down more than three percentage points in recent months." Regarding mortgage rates, rising 30-year rates have now “all but eliminated traditional rate-term refinance incentives in the market,” Black Knight’s report said. In an 18-month span from late 2020 to the present, the market saw the population of high-quality refi candidates soar to an all-time high, near 20 million, and plunge to the lowest level since the beginning of the century. In early 2022, some 11 million refinance candidates remained but that population fell by 95% year to date with less than 500,000 remaining as of June. According to Black Knight, most of the remaining candidates held their mortgages since 2003 or prior, suggesting a reluctance to either refinance or restart a 30-year commitment. Rate/term locks are down 90% from the same time last year and accounted for less than 5% of rate locks on the Optimal Blue platform in May. Cash-out locks were down 42% year over year and data through mid-June suggests they’re now down even more, to 50% from the same time last year. The post Home price growth slows but affordability pressures remain: Black Knight appeared first on HousingWire. |

| You are subscribed to email updates from Mortgage Industry News Delivered Daily from HousingWire. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment