Mortgage – HousingWire |

- Fix-and-flip lender Kiavi lays off 7% of employees

- HUD affordability plan doesn’t include lowering FHA premiums

- Shared-equity firm Point expands into 2 more states

- FAR president on the role home equity can play in supporting retirement strategies

- SEC looking at Better.com over alleged securities law violations

- Mortgages are in free fall at JPMorgan Chase

- Auctions see high owner-occupancy rates for foreclosed homes

- Purchase mortgage rates shoot back up to 5.50%

| Fix-and-flip lender Kiavi lays off 7% of employees Posted: 14 Jul 2022 02:56 PM PDT Non-QM lender Kiavi, which specializes in fix-and-flip and investor loans, has laid off 39 employees, sources told HousingWire on Thursday. An email sent to employees on Wednesday morning said Kiavi reduced the size of the firm by about 7% “to reduce our cost structure and protect the financial health of the company.” Kiavi has more than 300 employees, according to the firm's website. "We were and are still doing so well," an employee who requested anonymity told HousingWire. "The problem is we're not backed by the government sponsored enterprises (GSEs). Because we are in the hard money space, we don't have a lot of investors willing to buy our assets because of the rate hikes, is what our CEO told us." Of the 39 employees laid off, 12 cuts hit the human resources team. Cuts also hit operations, risk and compliance, legal, finance, business operations and marketing teams, according to a presentation held on Wednesday afternoon. Employees will be terminated on Friday, July 15. They will receive 12 weeks of severance payment, according to the employee. Kiavi, founded in 2013 and led by CEO Michael Bourque, expanded to three states in June and now operates in 32 states and Washington, D.C. The company closed on a $218 million private-label securitization of residential transition loans (RTLs) in June, which was expected to provide capital to support about $750 million in loan originations over the life of the deal. The lender was planning to offer construction loans but rising interest rates put a halt to that and forced Kiavi to issue pink slips. A spokesperson for Kiavi did not return requests for comment. “After updating our financial projections for the recent changes, we identified a cost savings target necessary to ensure we can generate sufficient cash in 2023,” a presentation slide shared with impacted employees showed. Kiavi, which rebranded from Lending Home in November, ranked as the top short-term lender in the fix-and-flip space in 2021, with $2.7 billion in originations, up about 78% from 2020, according to a recent report by Inside Mortgage Finance (IMF). The post Fix-and-flip lender Kiavi lays off 7% of employees appeared first on HousingWire. |

| HUD affordability plan doesn’t include lowering FHA premiums Posted: 14 Jul 2022 02:31 PM PDT The Federal Housing Administration (FHA) is taking steps to address the affordability crisis by boosting supply, but it’s not lowering fees it charges borrowers just yet. Senior officials at the Department of Housing and Urban Development, which houses the FHA, said today during a press briefing that it would focus on improving financing for manufactured homes and revamp its renovation financing. A senior HUD official said that updating its 203K program to make it more usable is a "high priority." The renovation program requires between 10% and 20% of the total loan amount be set aside as a contingency and imposes a 1% origination fee on the borrower. Another area of focus for the administration is improving its financing for manufactured housing. FHA financed about 34% of the $15.2 billion manufactured home purchase mortgages in 2021, according to HMDA data. HUD offers insurance for manufactured housing mortgages under its Title I program, which is more than 50 years old. The program's maximum loan term is 20 years. "It's been a long time since anyone has given [Title I] a lot of love," a senior HUD official said. Specifically, HUD officials said they are looking to "raise the Title I loan limits so that those loan limits are appropriate for today's market." FHA's loan limit is $69,678 for chattel financing. That's significantly less than the average sales price of a new manufactured home without land, transportation, or set-up costs of $108,100 in 2021, according to researchers at the Urban Institute. But the same official cautioned that chattel financing for manufactured homes — where the borrower does not own the land underneath it — is not an ideal solution. While FHA does finance some chattel loans, it is an extremely small share of the market. In 2021, FHA financed 0.5% of the $5.7 billion chattel market. "When someone owns a manufactured home but doesn't own the land under it, that’s not the kind of sustainable homeownership that we are trying to promote,” the HUD official said. "If [the borrowers] don't own the land under the unit, they're at some risk that their landlord will kick them off the land, or raise their rents in an unaffordable or unsustainable way," the HUD official added. But not all manufactured homes titled as personal property are titled separately because the borrower rents the land underneath. According to an analysis of Home Mortgage Disclosure Data by the Urban Institute, 28% of borrowers with chattel financing also own the land underneath their home. In some cases, the borrower's family member or acquaintance owns the land. The HUD official said that the department will be taking a look at protections it can bring to financing of manufactured housing communities. In 2021, Freddie Mac introduced lease pad protections — including renewable leases, unless there is good cause for non-renewal — for manufactured housing communities it finances. "We have to look at things like the financing of manufactured housing communities, to see if we can bring more protections into that environment," the HUD official said. That includes "more good financing for the good operators that we know are out there, whether it's a resident owned or more traditional owned community." But the FHA appears reluctant to reduce borrower fees on FHA financing, one tool in its toolkit numerous mortgage stakeholders have argued for. In May, more than three dozen independent mortgage banks urged the FHA to cut mortgage insurance premiums. So far, although many observers predicted that newly confirmed FHA Commissioner Julia Gordon would move swiftly to cut mortgage insurance premiums, two months have gone by since her confirmation without a reduction. "When we approach mortgage insurance premiums, it includes a range of conditions, [including] budgetary implications, tradeoffs within appropriations process, and FHA's role in the broader housing system," a senior HUD official said. "But I can assure you we are always looking at this in a dynamic way." The post HUD affordability plan doesn’t include lowering FHA premiums appeared first on HousingWire. |

| Shared-equity firm Point expands into 2 more states Posted: 14 Jul 2022 01:27 PM PDT Palo Alto, California-based fintech Point, which offers home-equity investment (HEI) contracts to homeowners, is expanding its services into Nevada and Ohio. With the expansion, Point's HEI contracts are now available in 18 states and the District of Columbia, according to the company. "Nevada homeowners are sitting on more than $150 billion in tappable home equity, and Ohio homeowners have more than $330 billion," said Eddie Lim, CEO and co-founder of Point. "The vast majority of homeowners in both states have tappable equity and are sitting on an incredible amount of wealth in their homes. Point's HEI contracts provide homeowners with cash upfront in exchange for a contract providing Point with a slice of the homeowner's equity. That share, via Point's home equity investment contracts (HEIs), is typically around 10% or so. "As an HEI is equity financing, it doesn't add a monthly payment to a homeowner's expenses," Point's announcement of its market expansion states. "Homeowners can access up to $500,000 and have the flexibility to buy their equity back at any time within the 30-year term with no penalty. "…To qualify, the home needs to be valued at least $155,000 and the homeowner must retain at least 20 percent of the equity after Point's investment." Point, which claims on its website to "have served over 5,000 homeowners," has set the financing pillars in place to help propel its growth and take advantage of market conditions. Last year, Point and specialty finance and real estate investment firm Redwood Trust — which holds an investment stake in Point — completed a first-of-its- kind securitization deal backed by HEI contracts. The private-label securities transaction closed in late September 2021 and represents a new liquidity channel to help fund future HEI pacts. The offering involved issuing $146 million in securities through a conduit dubbed Point Securitization Trust 2021-1. In addition, earlier this year, Point announced that it had raised $115 million through a Series C fundraising round led by venture capital firm WestCap. The capital will be used to accelerate Point's growth in the expanding home-equity market, according to the company's co-founder and CEO Eddie Lim. Point said that it plans to use the funding to augment its product line as well as its market footprint — with a goal of being in a total of 28 markets by early 2023. Point also has raised about $54 million in venture capital through three previous funding rounds, according to Crunchbase. The venture capital investment is in addition to $1 billion in separate capital commitments from investors that Point has lined up to help fund its HEI contracts. Point is not alone in chasing opportunity in the home-equity market. One of its main competitors in the space, for example, San Francisco-based Unison, also is aggressively extending its market reach. Unison, through its platform, offers homeowners the opportunity to tap their home equity without taking out a loan — via a home-equity investment product that it calls a residential equity agreement (REA). Unison announced earlier this week that it was expanding its services to Nebraska, following the opening of an office in Omaha earlier this year. Unison, as of June 30, boasts having in force $6.1 billion in equity-sharing agreements with some 9,000 homeowners across 29 states and the District of Columbia Earlier this year, Unison bolstered its liquidity options by completing a $443 million private-label offering backed by shared home-equity loans — with plans to pursue future securitizations as well. The growth in the home-equity market, and its attractiveness to companies like Point and Unison, is being driven by fast-rising home prices. Single-family home prices grew at an annualized rate of 19.4 percent in the second quarter of this year, according to Fannie Mae's most recent Home Price Index report. The Federal Reserve now estimates home equity nationwide is now valued at nearly $28 trillion. "CoreLogic analysis shows U.S. homeowners with mortgages (roughly 62% of all properties) have seen their equity increase by a total of over $3.8 trillion since the first quarter of 2021, a gain of 32.2% year over year," states the property-information and analysis company in its first-quarter 2022 Homeowner Equity Insights report. "[Through] the first quarter of 2022, the average homeowner gained approximately $64,000 in equity during the past year." Point CEO Lim said, however, that home equity isn't always easily accessible to help homeowners with "life's needs or to achieve a dream." "And with mortgage rates on the rise, refinancing is a less attractive way to leverage home equity," he said. "A Point HEI is a great option for homeowners who are 'house rich but cash poor.'" The post Shared-equity firm Point expands into 2 more states appeared first on HousingWire. |

| FAR president on the role home equity can play in supporting retirement strategies Posted: 14 Jul 2022 11:28 AM PDT The HousingWire award spotlight series highlights the individuals who have been recognized through our Editors' Choice Awards. Nominations for HousingWire's Vanguards are now open through Friday, July 22, 2022. Click here to nominate someone. As home prices continue to rise, one growing point of interest for many homeowners are reverse mortgages, with older Americans sitting on a record $10 trillion in home equity, according to data from the National Reverse Mortgage Lenders Association. “There’s no doubt that market volatility, inflation, and the impacts of high home price appreciation…have created headwinds for retirees and pre-retirees,” said Kristen Sieffert president at Finance of America Reverse. “Yet, with all the economic pressures facing older Americans this year, reverse continues to stand out as a really elegant solution for them. Market fluctuations and downturns often catch people’s attention, but they may not pay close attention to how much their home equity has grown during this time.” Last year, Sieffert was nominated as a HousingWire Vanguard for her work in transforming FAR into one of the largest reverse mortgage lenders in the country, including the company’s shift to becoming a more complete provider of holistic retirement solutions. Each year, Vanguards recognize an elite group of housing execs who are making an unmistakable impact on the housing economy. HousingWire reached out to Sieffert for an update on market conditions in the world of reverse and to learn more about the role leadership plays within FAR’s company culture. HousingWire: Reverse Mortgage Daily has reported that Home Equity Conversion Mortgage (HECM) endorsements were at historic levels for much of the first half of 2022. What trends have you seen at FAR? Kristen Sieffert: FAR saw a similar trend to start the year. Industry wide, reverse-to-reverse refinances were driving a lot of the incremental volume, with many borrowers benefiting from high home price appreciation and lower available rates. However, the market has shifted quite dramatically in the last couple of months. Rates rose quickly, and the benefits for those refinances are not nearly as strong as they were a few months ago. The interesting thing is that the demand is still really high, and coming from new origination borrowers, looking for ways to increase cash flow during this challenging time of market volatility. In speaking with potential and current customers, as well as many financial advisors, it’s clear that inflation, stock market pressures and overall affordability remain top concerns. With the ability to access large amounts of equity and lower or no monthly mortgage payments — key features of HECM as well as our proprietary HomeSafe and EquityAvail offerings — we anticipate our broad suite of offerings will continue to meet more peoples’ needs. Historically, during times of market volatility, reverse product options have been looked at more favorably, and we are seeing a similar trend occurring now. HousingWire: How is the reverse mortgage market positioned as we head into 2H’22 and 2023? Kristen Sieffert: There’s no doubt that market volatility, inflation and the impacts of high home price appreciation — which make it hard to downsize due to high prices and a lack of housing inventory — have created headwinds for retirees and pre-retirees. Living on a fixed income while facing these pressures is extremely challenging. Yet, with all the economic pressures facing older Americans this year, reverse continues to stand out as a really elegant solution for them. Market fluctuations and downturns often catch people’s attention, but they may not pay close attention to how much their home equity has grown during this time. Older Americans are sitting on a record $10 trillion in home equity. Higher expenses and monthly mortgage payments pose challenges for so many retirees who could benefit from tapping into their home equity. As a result, the market for reverse mortgages is both enormous and bursting with potential for innovative companies like FAR that are seeking to help more retirees find a solution that works best for them and their families. The most interesting thing to point out with the potential for the reverse market, though, is its implications for the traditional side of mortgage lending. In these more difficult economic times, many traditional mortgage and lending originators will need to find new ways to generate customers, and reverse connects them with a huge population of unreached customers and a new loan product that may not have been part of their offerings in the past. With continued awareness and education about the benefits of tapping into home equity, I expect more homeowners and financial professionals will begin to understand the critical role home equity can play in supporting retirement strategies, and we may start to see more traditional lenders expand their practices to include reverse mortgages and other home equity loans as we head into the next year. HousingWire: FAR recently earned 2022 Great Place to Work certification. What role does leadership play in building great work environments? Kristen Sieffert: There’s no doubt that leadership makes or breaks a company culture. The actions the leadership team takes daily, the way we communicate and the priorities we set for ourselves inevitably percolate down into our teams and make a huge impact on the company as a whole. That fact provides us with a significant amount of responsibility and opportunity to build the best community we can. As the president of FAR, I see it as my daily mission to build a vibrant work environment that is purpose-driven and supportive of our talent, allowing our company to remain innovative and forward-looking on behalf of our customers. I believe that putting our people at the center of our business and encouraging them to bring their whole selves to work is the key to a thriving environment. I am constantly asking myself and my teams what we can do better or differently to surprise and delight our team and customers, rethink the status quo, and build a future landscape of our own making that doesn't exist today. As a leader, there is nothing more empowering or rewarding than sharing this vision with my teams and watching them take on new challenges on behalf of America's retirees, and also for themselves. HousingWire: What tactics or strategies have you deployed to attract and retain great people to the reverse mortgage business? Kristen Sieffert: At FAR, we're always striving to put people at the forefront of what we do. Employee growth, strong relationships, and meaningful work are the hallmarks of our "10 Star" company culture and enable us to build talented, compassionate teams across our business. In terms of individual strategies, we regularly find ways to recognize and mentor employees and open up opportunities for professional development. In fact, this past year, we formalized our FAR mentorship program to help employees reach their career goals by pairing the right mentor with the right mentee. We utilize regular employee surveys to track and monitor our progress and we seek out opportunities to highlight the company and individuals with industry awards and other recognitions that help attract and retain talent. We recently expanded access to our annual President's Retreat — a premier event that recognizes our top performers, offers employees the chance to build an interoffice community, elevate their leadership skillsets, and spearhead creative new solutions for FAR borrowers. What was previously a sales rally is now an event that employees from all parts of the company can be nominated for and are eligible to attend. We also love to call out star employees in monthly emails and spotlight their excellent work at our quarterly town halls. Last, and something that has become one of my favorite traditions, is our annual word of the year. Each year we unveil a word that serves as the north star for our annual goals. It carries a significant meaning not only for what we can do together as a team within our business, but also for how our team can find new ways to thrive in their personal lives outside of work. Having this word allows our team to rally around common stories, and especially when the business is facing more challenging times — like the pandemic or the current market volatility — the word gives us a framework to connect deeply around a common theme that supports us in moving through the challenges united and with our heads held high. Together, these efforts culminate to create a strong company culture that supports our employees and delivers for our customers every day. The post FAR president on the role home equity can play in supporting retirement strategies appeared first on HousingWire. |

| SEC looking at Better.com over alleged securities law violations Posted: 14 Jul 2022 10:35 AM PDT The Securities and Exchange Commission (SEC) has launched an investigation into digital nonbank lender Better.com and its blank check company, Aurora Acquisition Corp., to evaluate allegations of federal securities laws violations, prompted by a former top executive’s recent lawsuit. Better.com and Aurora received requests for documents from the SEC's enforcement division in the second quarter of 2022. The requests were seeking information about Better's “business and operations,” as well as “matters relating to certain actions and circumstances” of Better founder and CEO, Vishal Garg, “and his other business activities,” according to SEC filings. "Better and Aurora are cooperating with the SEC," according to a document Aurora filed with the SEC Thursday. Better.com is a private company, but in May 2021 leaders announced plans to take it public with a $7.7 billion valuation via a merger with Aurora, sponsored by Novatar Capital. The transaction was expected to happen in Q4 2021. In early June, Sarah Pierce, former executive vice president for customer experience, sales and operations at Better.com, filed a lawsuit claiming the company and Garg violated securities and labor laws as the lender began working toward its public offering. In the lawsuit, Pierce alleges Garg — after firing 900 employees via Zoom in December, told the board of directors the company would report a profit by the end of Q1 2022 — which Pierce and other senior leaders explicitly said was impossible. Internal documents showed the company would not be profitable until Q3 2022, at the earliest. Better.com reported a $221 million loss in the first quarter of 2022, compared to a $137.5 million profit during the same period in 2021. Meanwhile, the company's workforce was reduced from 5,800 in March of this year to 2,900 as of May 15 — including 1,500 U.S.-based workers, 1,200 in India and 200 in the United Kingdom. Although company leaders still intend to take it public, Better.com is struggling to cope with the rising mortgage rate landscape, the decrease in refinancings and the need to invest in new products amid fierce competition. The post SEC looking at Better.com over alleged securities law violations appeared first on HousingWire. |

| Mortgages are in free fall at JPMorgan Chase Posted: 14 Jul 2022 09:12 AM PDT JPMorgan Chase leaders Thursday provided a glimpse of what's to come as mortgage lenders begin sharing performance data for the second quarter – and it's not pretty. Opening the earnings season, the bank reported double digit declines in originations, margins compressions and revenues in a free-fall, demonstrating how higher mortgage rates, the result of the Federal Reserve‘s tightening monetary policy, are hurting originators. To prepare for a potential recession in the U.S., the Jamie Dimon-helmed bank has been conservative in its servicing portfolio as the economy slows down. According to Dimon, the U.S. economy continues to grow, touting both a healthy job market and consumer spending. But geopolitical tensions, high inflation and ongoing uncertainty regarding how high rates ultimately will go, are all very likely to have imminent negative consequences on the global economy. On the bright side: "The consumer right now is in great shape. So, when we go into recession, they’re entering that recession with less leverage, in far better shape, than they did in 2020," Dimon said during a call with analysts. But, so far, the landscape is hurting the mortgage business. JPMorgan Chase, the fifth-biggest mortgage lender in the country, reported its origination volume totaled $21.9 billion from April to June, a decline of 11% compared to the prior quarter, while the consensus was down 2% to 8%. Originations decreased 45% in comparison with the second quarter of 2021. The bank experienced a larger decline in the retail channel, which has higher margins, originating $11 billion in the second quarter of 2022, down 27% quarter-over-quarter and 52% year-over-year. The retail channel went from 61% of the total origination in Q1 2022 to 50% in Q2 2022. Through its correspondent channel, origination volume reached $10.9 billion, a decrease of 36% year-over-year, but an increase of 14% when compared to the previous quarter. JPMorgan's home lending net revenue reached $1 billion in the second quarter, down from $1.3 billion in the same quarter in 2021 and $1.2 billion in the previous quarter of 2022. The bank's servicing rights increased to $7.4 billion in the second quarter of 2022 from $7.2 billion in the previous quarter and $4.5 billion in the same period of 2021. Meanwhile, net mortgage servicing revenues declined 7% from $245 million in the first quarter to $227 million in the second quarter. However, this year’s numbers overall toppled those of the same period of 2021; in Q2 it was $31 million. According to a team of analysts at Keefe, Bruyette & Woods (KBW), the results were consistent with expectations for weak mortgage banking earnings, but the smaller-than-expected positive servicing mark could be more company specific. "Gains on sale margins decreased -17 bps quarter-over-quarter, which was slightly worse than expected," according to a report from KBW analysts. "However, about two-thirds of this appeared to be largely driven by the shift in channel mix (lower retail/ higher correspondent)." On the mortgage servicing portfolio, the analysts said given the move-in rates during the quarter, the MSR mark came in below expectations. "MSR valuation increased by just 2% quarter-over-quarter, which was smaller than expected. This could potentially reflect some conservatism on expected servicing costs should delinquencies pick up in a slowing economy," according to the KBW analyst report. The post Mortgages are in free fall at JPMorgan Chase appeared first on HousingWire. |

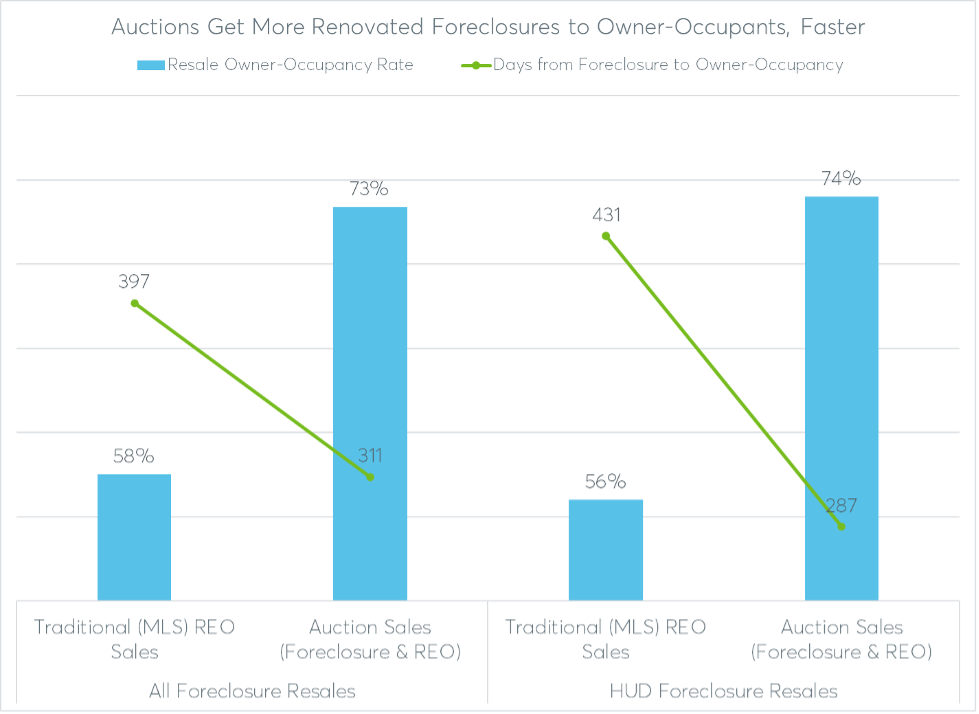

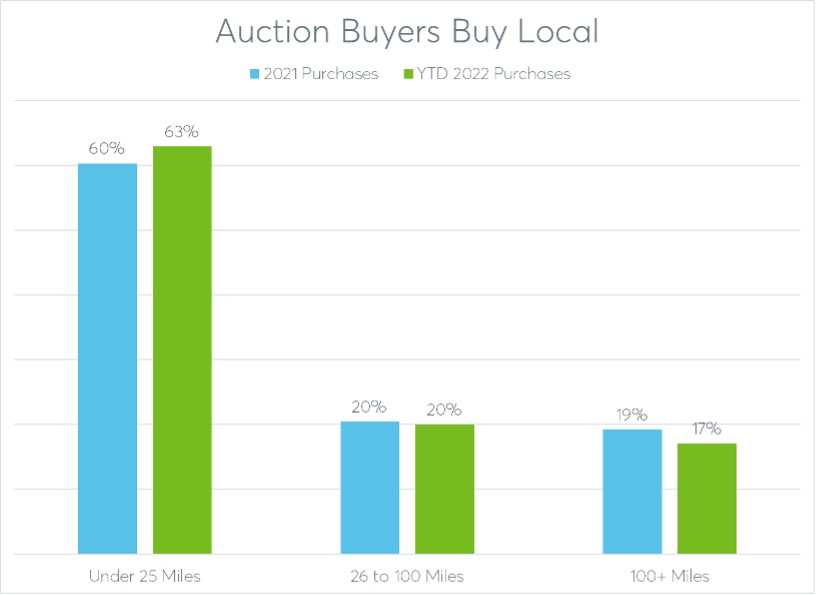

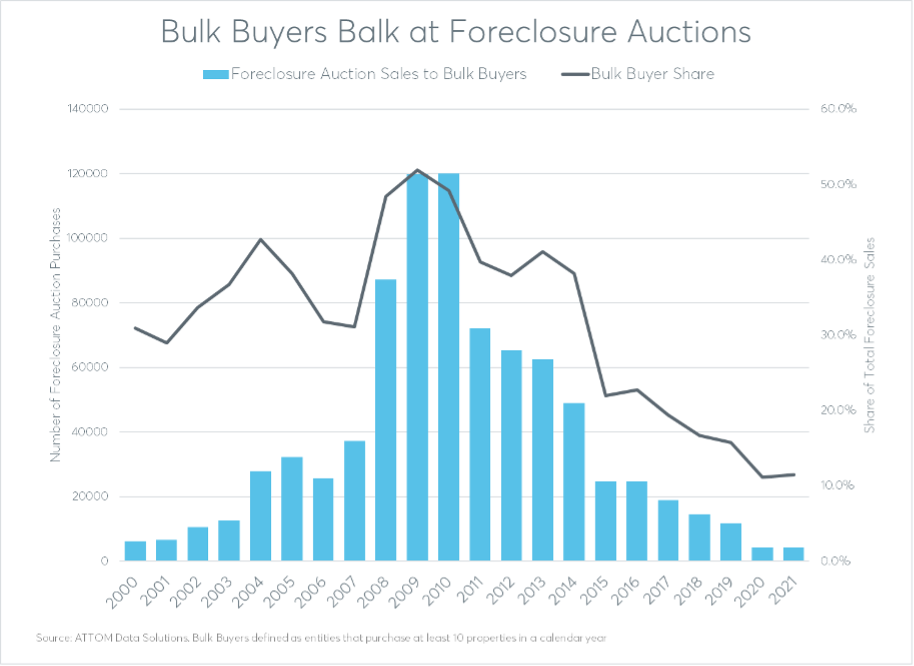

| Auctions see high owner-occupancy rates for foreclosed homes Posted: 14 Jul 2022 07:52 AM PDT The Federal Housing Administration's recently announced first look program for foreclosed property auctions is a welcome innovation that should help boost a trend that has been developing over the past decade: more foreclosed homes getting into the hands of owner-occupants and fewer getting into the portfolios of large-scale single family rental operators, often backed by Wall Street. Some might be surprised to hear about this trend toward higher owner-occupancy rates for foreclosed homes. It is counter to a popular and politically potent narrative grounded in the aftermath of the Great Recession, when large institutional investors scooped up thousands of properties at foreclosure auction. This narrative was once again repeated in the HousingWire article announcing the FHA first-look program: "Typically, FHA-insured foreclosed properties are snatched up by large investors and turned into rental properties." But proprietary data from Auction.com and public record data clearly show this oft-repeated narrative is yesterday's news.  Net owner-occupancy ratesAmong nearly 135,000 properties foreclosed between 2016 and 2020 that sold to third-party buyers at foreclosure auction on the Auction.com platform, more than half (54%) are owner-occupied as of 2022, according to public record county tax assessor data from ATTOM Data Solutions. That compares to a 49% owner-occupancy rate for more than 190,000 properties that reverted back to lenders at foreclosure auction. Most of these reverted REOs are eventually sold via the Multiple Listing Service (MLS). The data paints a similar picture specifically for foreclosed properties backed by FHA-insured loans, the subject of the recently announced first-look program. Over the same period (2016 to 2020), the net owner-occupancy rate for FHA foreclosures sold via auction was 57% compared to 50% for FHA foreclosures sold on the MLS. The higher owner-occupancy rate for distressed properties sold at auction than those sold on the MLS is a surprising stat given that the MLS is much more broadly known to retail, owner-occupant buyers. The role of renovatorsA deeper dive into the data helps to explain this surprising result. While most distressed properties sold at foreclosure auction don't go directly to owner-occupant buyers (the reasons for that have recently been well-explained by Urban Institute research), many end up with owner-occupant buyers by way of local investors who renovate distressed properties into a condition that is attractive and financeable — but still affordable — for owner-occupants. Among more than 73,000 properties sold to third-party buyers at foreclosure auction between 2016 and 2020 and then subsequently resold into the retail market, 73% (more than 53,000) were sold to owner-occupant buyers, according to the public record data. That compares to a 58% owner-occupancy rate for more than 121,000 properties that resold on the retail market after reverting back to the lender at foreclosure auction during the same period. It turns out local investors are also more efficient than banks and government agencies at renovating and reselling homes. The local investors resold their renovated homes to owner-occupants an average of 311 days after the foreclosure auction, about three months faster than the average 397 days it took to resell renovated REO homes. Again, the trends are similar for foreclosed properties securing FHA-insured loans: a resale owner-occupancy rate of 74% among properties purchased at foreclosure auction by third-party buyers compared to a resale owner-occupancy rate of 56% among those that reverted to the lender at the foreclosure auction. Among the FHA foreclosures, local investors resold their renovated homes an average of 287 days after the foreclosure auction, nearly five months faster than the 431 days on average to resell renovated REOs. I buy localBut what about the foreclosed properties that don't end up in the hands of owner-occupants? Are those going to "large investors" building single family rental empires, as claimed by the popular narrative? Once again, the data clearly points to this narrative being outdated.  Nearly 100% of Auction.com buyers in 2021 (99%) purchased 10 or fewer properties during the year, and 79% purchased just one property. The 99% of buyers accounted for 89% of all properties purchased during the year. Furthermore, 83% of all purchases on the auction site in 2021 were made by buyers who lived within 100 miles of the property purchased, while 63% were by buyers who lived within 25 miles. The median distance between buyers and properties purchased was just 17 miles. This data paints a much different picture of the typical foreclosure auction buyer than that painted by the popular narrative. These are not multi-state institutional investors purchasing hundreds of properties a year at foreclosure auction. These are local investors buying a few properties in communities where they live and work. Bye-bye bulk buyersThe popular narrative about foreclosure auction buyers is grounded in truth; it's just truth from more than a decade ago. Public record data looking at the total foreclosure sales market demonstrates this. In 2009, at the peak of the Great Recession's foreclosure crisis, more than half (52%) of all foreclosure sales were sold to entities who purchased at least 10 properties in a calendar year, according to data from ATTOM Data Solutions. But that share has gradually shrunk over the last 12 years. In 2020 and 2021, only 11% of total market foreclosure sales went to entities who purchased at least 10 properties in a calendar year.  Broader buyer spectrum The 11% of 10-plus property buyers in the total market is likely higher than the 1% on Auction.com for a couple reasons. First, site’s data is only looking at the number of properties purchased on the platform while the public record data is looking at total properties purchased. Secondly, properties sold through the auction platform are more visible and accessible to a broad spectrum of buyers than are properties sold through the traditional foreclosure sale model. In that model, the only marketing of foreclosure auctions is through notices in a local newspaper or legal publication. This technology-enabled transparency is creating equal opportunity for more buyers, including smaller-volume local investors who can now better compete against the large-volume institutional investors. Daren Blomquist is vice president of market economics at auction.com. The post Auctions see high owner-occupancy rates for foreclosed homes appeared first on HousingWire. |

| Purchase mortgage rates shoot back up to 5.50% Posted: 14 Jul 2022 07:00 AM PDT The rollercoaster continues for mortgage rates. After falling 40 basis points last week to 5.30%, purchase mortgage rates climbed back up this week to 5.50%, according to the latest PMMS survey from Freddie Mac. "Mortgage rates are volatile as economic growth slows due to fiscal and monetary drags," said Sam Khater, Freddie Mac's chief economist. "With rates the highest in over a decade, home prices at escalated levels, and inflation continuing to impact consumers, affordability remains the main obstacle to homeownership for many Americans." The survey results, which compile purchase mortgage rates reported by lenders during the past three days, comes on the heels of troubling inflation news. The federal government on Wednesday reported that the consumer price index rose 9.1% on a year-over-year basis in June, far above Wall Street’s estimate of 8.8%. It was the fastest pace for inflation since November 1981, and has generated concerns that a recession is just around the bend. Following the CPI results, the 2-year treasury yield and the 10-year counterpart inverted, which Wall Street analysts say is a telltale sign of a coming recession. The 2-year traded more than 9 basis points higher at around 3.138%. The benchmark 10-year rate, dropped nearly 4 basis points to 2.919%. Wall Street observers believe the Federal Reserve will increase rates by 75 or 100 basis points later this month to stamp out inflation. Mortgage rates of all stripes moved north on Wednesday following the CPI news. On HousingWire’s Mortgage Rates Center, pricing engine Optimal Blue had 30-year conforming rates at 5.782% on Wednesday. Loan officers told HousingWire this week that they were quoting rates in the low 6% range on conventional products, but about 100 basis points lower on jumbos. The surge in rates has cooled the housing market over recent months, with buyers fretting over reduced purchasing power and record-high home prices. Homebuilders have also reported higher cancelation figures and lower demand. What lenders should know about today's economic climate Between navigating a post-pandemic world, rate hikes and the threat of a recession, mortgage lenders across the country are managing a volatile housing market. Learn how updating your mortgage technology stack can help you get ahead in today's unpredictable lending environment. Presented by: PollyThe refinancing market in particular, has tanked. Fewer than 20% of mortgage locks in June were refis, and hardly any were rate-term products, according to data from Black Knight. According to Freddie Mac, the 15-year fixed-rate purchase mortgage this week averaged 4.67% with an average of 0.8 point, up from last week's 4.45%. The 15-year fixed-rate mortgage averaged 2.22% a year ago. The 5-year ARM averaged 4.35% this week, up from 4.19% the previous week. The product averaged 2.52% a year ago. The post Purchase mortgage rates shoot back up to 5.50% appeared first on HousingWire. |

| You are subscribed to email updates from Mortgage Industry News Delivered Daily from HousingWire. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment