Mortgage – HousingWire |

- Lenders see appraisal modernization as a top priority

- Indecomm’s GeniusWorks targets middle-office costs

- Opinion: Why we need a mortgage rate reset

- PLS market is on track to notch record volume this year

- Pennymac plans to lay off another 207 employees

- Fratantoni: Why FHFA and GSEs should revisit their pricing framework

- Proposed VA appraisal law looks to even the playing field

- Cherry Creek Mortgage names new chief revenue officer

| Lenders see appraisal modernization as a top priority Posted: 24 May 2022 12:05 PM PDT A Fannie Mae survey published in mid-May found that mortgage lenders see value in appraisal modernization, specifically in the implementation of non-traditional appraisals and inspection-based appraisal waivers. However, they have several more pressing priorities when it comes to what they’re investing in. Out of 200 senior mortgage executives surveyed, who represent 188 lending institutions, 94% think that appraisal modernization efforts will simplify the origination process. The main benefit of appraisal modernization, according to the first-quarter sentiment survey, is that it will help shorten the loan origination cycle time. One mid-sized lender echoed the opinion of others that appraisals still take too long. "Currently, the appraisal process is the biggest issue facing the mortgage industry," the mid-sized lender said. "It causes significant delays, higher costs due to involvement of [appraisal management companies], and there are fewer experienced practitioners that understand more complex collateral assignments." Lenders surveyed also think that modernizing appraisals could help enhance appraiser capacity and lower borrower costs. With a declining number of appraisers in the field and rigorous requirements to enter the profession, lenders say that appraisers are stretched thin in how many properties they can get to. Implementing desktop appraisals would help alleviate this. "They cannot get to all the houses we need appraised," said one mid-sized lender that participated in the survey. "If they can, they want to charge more money for the appraisal. The charge gets passed on to the consumer so it’s hurtful for consumers." Despite a majority of lending institutions agreeing that adopting new technology for appraisals would be beneficial, survey takers identified several other priorities that were even more important. Forty percent of lending institutions reported that a consumer loan application digital portal was either a first or second priority of their investment and eMortgages — eNote, eRecording, and eClosing — came in a close second with 39%. The desire to invest in appraisal modernization came in third place, with 29% of lending institutions reporting that this was a top-of-mind investment. Lenders also mentioned concerns and roadblocks with adopting new appraisal modernization tools. Some of the biggest challenges listed by lenders include: speed, or lack thereof, of industry implementation and integrating these tools with loan origination systems. Appraisal modernization efforts in the housing industry have ramped up because of the pandemic. In March 2022, the Federal Housing Finance Agency (FHFA) made hybrid appraisals a permanent fixture. Both Fannie Mae and Freddie Mac now allow appraisals to be conducted remotely, using public records such as listings and tax appraisals, for purchase loans. Meanwhile, the Department of Housing and Urban Development (HUD) recently extended its timeline for allowing desktop appraisals for certain transactions impacted by the pandemic. The policy now expires on December 31, 2022. Concerns remain, however, around whether automated valuation models (AVMs), used in desktop appraisals, have the potential to bake-in and amplify racial bias, in part by relying on historical sales comparison values. The post Lenders see appraisal modernization as a top priority appeared first on HousingWire. |

| Indecomm’s GeniusWorks targets middle-office costs Posted: 24 May 2022 10:22 AM PDT Indecomm Global Services, a New Jersey-based mortgage automation and services provider, aims to court more lenders through its new automation-enabled origination solution, GeniusWorks, which is intended to cut the cost of middle-office origination functions: set-up, processing and underwriting. GeniusWorks operates in conjunction with Indecomm's suite of automation solution softwares to take loan files at set-up and return them to the lender to meet requirements in closing a mortgage. It’s meant to streamline all workflow, processes, decisions and tasks at middle-office origination so lenders can save time and money when processing loans, according to Indecomm. "Our models predict that lenders will achieve a meaningful 30% reduction in cost-per-loan at the middle office and a 50% reduction in the number of lender touches per loan," according to a statement from Narayan Bharadwaj, Indecomm's senior vice president of automation. "This efficiency allows lenders to operate profitably even during periods of economic uncertainties and without the constant yo-yo of having to manage their capacity up or down." The middle-office origination functions still haven't been digitized in the mortgage origination process. Even before the pandemic, mortgage tech companies turned to point-of-sale (POS) systems to make applying for a mortgage easier and faster online, increasing efficiency for front-office origination functions. The pandemic then spurred a digitization of loan closings including e-Close and e-Sign functions, but processing and underwriting still required manual work. Indecomm's roll out of GeniusWorks follows its launch of DecisionGenius, a mortgage automation solution for the mortgage middle office that assesses the income, credit, assets and collateral of a borrower. Users are able to see all the information needed to make an underwriting decision in one place, according to a new release Indecomm issued in March. GeniusWorks can apply DecisionGenius and IncomeGenius, an automated income calculation software, for tasks and touchpoints that require decision management capabilities, such as complex income calculations or underwriting analyses, the firm said. Indecomm, founded more than 25 years ago, has more than 200 mortgage industry customers, including large and mid-sized lenders, servicers and mortgage insurers, according to its website. The company is focused on an automation-first approach to developing products and services that leverage robotic process automation, supervised automation and machine learning. According to Indecomm, the firm saw 32% revenue growth from the 2019-2020 fiscal year, a three-fold increase over the previous year, driven by automation and technology solutions for mortgage operations. The post Indecomm's GeniusWorks targets middle-office costs appeared first on HousingWire. |

| Opinion: Why we need a mortgage rate reset Posted: 24 May 2022 10:16 AM PDT When writing about the ’80s banks and passbooks, I started to see a pattern emerge concerning customers and refinance loans and rates. They were so high; then so low. I started thinking about farming. Farmers know that you can't keep putting the same plants in the same dirt season after season. You kill your soil. You ruin the balance of nutrients. You over work the chemistry. It stunts plant growth and yields. It changes how they grow. We have overworked our ground and it needs a rest. Housing Wire's expert, Logan Mohtashami keeps saying we need a reset. He says in a Tweet earlier this month, "I believe some of the confusion around higher rates is that some people expected more demand destruction faster. This is why I stress higher rates need duration to work its magic." Crop rotation one: Homeowners stay in their homes for 30 yearsRates have been on the decrease since 1981. It was a rotation of crops back then to adjust inflation. In the early ’80s, rates were above 18% for a fixed-rate loan. Most people paid those loans for 30 years, on time. Some moved and, in that process, got better rates. Refinances were not marketed then like they are today, nor were they the norm for a homeowner. Back then, the real estate agent found a home and the purchaser went to their bank and got a loan. This is a customer of an agent, and a customer of a bank, conducting a financial transaction and contractual purchase transaction. Most times, the bank relationship was established before the home was found. The customer bought a home to stay in for 30 years. This was viewed as a one-time transaction — one growing season. Multiple crops per year: Move-up buyers and refinancingThe internet, online banking and more lenders made the word "refinance" one that grew our industry. Look at just one person who purchased a single-family home in the mid-1990s —they outgrew the starter home and needed the ‘forever’ home they dreamed of. What if that one loan turned into three to six loans? When rates were 8% in 1995, this customer bought that forever home. They went to their bank and get a 30-year fixed rate loan. By 2004, they heard they could refinance, possibly get some cash out. Some went risky with a popular ARM loan and got a 6.5% rate. It saves them $200 a month, and feels good. Servicers of the ARM loan start calling them in 2008 for a locked rate or fixed, lower rate. They happily accept 5.50% fixed. This saves them $150 more a month, and it is stable in this wild upside-down market. By 2017, they figure they are overpaying when their buddies get a 4% rate. So, they go to an online bank to shop rates. Twenty people call them, and they lock in at 4% fixed rate. During COVID-19, rates were 3.25% and with nothing else to do, the homeowner can save money and refi again — rates will never be this low again, right? The servicer called one more time in June of 2021, equity was high, rates are at 2.4% and, man, you must do this one. This is as low as rates go. Over 25 years, this one person has been a mortgage customer of six different mortgage companies, each saving him over $100 per month. Even if the homeowner moved or made a purchase in the middle of this process, one of the refis would have been a purchase. And, that purchase likely needed more refinances when rates fell. Some of these people got second homes or investment properties. The rates have gone down over and over since the 1980s. When rates increased, they were nothing but small blips that paused a borrower. Homeowners always had a good reason to refinance. It’s time for a resetNow, rates are up. They rose more than the news could keep up. By the time they reported 4.5%, rates were really over 5%. Now, the homeowner will sit tight for a few years. We need a reset and one that will continue into 2023. To the borrower, rates have always been going down. The borrower has saved hundreds per month every time. We have drained the soil and run out of places to grow our crop. The market has fixed it for us. But the seeds are still being stored for the next crop. People are still buying homes.The 2022 inflation market fixed it for us. Homes cost more and rates are through the roof. Refinances are less than half the business being done today. Servicers and refi shops are in a drought. How do we clean the fields? We wait. After a year or more of these rates, things will be different. For starters, there will be fewer of us — loan officers, banks, brokers. Layoffs, consolidations, acquisitions, mergers and joint partnerships will change the landscape. Technology, artificial intelligence (AI) and possibly cryptocurrency will change the transaction. Rates will eventually come down, opening the door to the next boom. The hundreds of thousands of homes sold in 2022 and 2023 above 5% will want to save that $200, so the cash-out refinances and ARM loans all need to reset. The survivorsThere are fewer mortgage people doing all the work. The people left are the survivors. The companies that are left are the ones who combined resources and people. The tech they have ready will be efficient and consumer friendly. The relationships will be long term and lead to long-term business partners. Marketing and customer incubation will involve education, counseling and long-term contact well after the transaction. Processing will speed up with automated VOEs and instant verified bank statements. UW will be easier and faster with day one certainty. Virtual docs will speed up and make disclosures and closings less cumbersome. Mortgages will be easier to do and complete. The field will be primed for the seeds to grow again. They will grow fast and plentiful. Refinances will take over the market. There will be more loans than we can efficiently process for years. New business and old business will create a new refi boom. The builders will have more inventory. Home prices should stabilize. The new relationships with Realtors and lenders will be beneficial to all parties. We will make hay when the sun shines. We will reap what we sow, and it will be good for our business. BJ Witkopf is a mortgage specialist with Assurance Financial. This column does not necessarily reflect the opinion of HousingWire's editorial department and its owners. To contact the author of this story: To contact the editor responsible for this story: The post Opinion: Why we need a mortgage rate reset appeared first on HousingWire. |

| PLS market is on track to notch record volume this year Posted: 24 May 2022 04:00 AM PDT  Despite the turbulence in the U.S. economy fueled by inflation, international tensions and rising mortgage rates, the private-label securities (PLS) market recorded a strong first quarter, at nearly $43 billion in issuance, and is projected to finish 2022 with record volume. That $43 billion mark represents the second-highest issuance total since the global financial crisis (GFC) some 15 years ago and also was nearly two-and-a-half times above issuance volume for the first quarter of 2021, according to a recent market assessment by Kroll Bond Rating Agency (KBRA). The report focuses on so-called RMBS 2.0 deals, defined as all post-GFC residential mortgage-backed securities issuance in the prime, nonprime (including non-QM) and credit-risk transfer (CRT) spaces — the latter typically issued by the government-sponsored enterprises. "In our view, this [performance] is due to the inherent diversification of RMBS 2.0 deals among subsectors differently sensitive to interest rates, a large variety of issuer types, and a quickly appreciating home-price environment," the KBRA report states. Those dynamics lead KBRA to project record nonagency (private label) residential mortgage-backed security (MBS) issuance for the year, though at a declining rate in the coming quarters. "We continue to expect 2022 will close as a record post-GFC issuance year with almost $131 billon in aggregate [RMBS 2.0] issuance," KBRA reports. "… KBRA expects Q2 2022 to close at approximately $38 billion, and Q3 to decrease further to $29 billion across the prime, non-prime, and credit-risk transfer segments because of rising interest rates and an unfavorable spread environment for issuers. "… To date," the KBRA report continues, "issuance spreads [have] widened rapidly for all sectors as supply and demand volatility hit nearly all-time highs." The spread is a measure of relative yield value between two types of debt instruments, such as a benchmark U.S. Treasury bond and a mortgage-backed security. As spreads widen in an unfavorable way for issuers, MBS prices tend to decline. Bond prices, however, move in the opposite direction of yield — with a higher yield (the ratio of a bond's coupon to its price) deemed compensation to an investor for the added risk in a volatile market. Among the factors industry experts contend are contributing to the volatility in the MBS market, and consequent deal-execution challenges, are fast-rising interest rates in combination with the Federal Reserve's tapering of its MBS holdings. "So the Fed is clearly on a rate-hiking cycle," said Seth Carpenter, chief global economist at Morgan Stanley, in a presentation at the recent Mortgage Bankers Association's (MBA's) Secondary and Capital Markets Conference & Expo in New York City. "They raised rates 25 basis points in March," Carpenter continued. "They raised rates 50 basis points in the May meeting. And [Fed] Chair [Jerome] Powell was clear that the next couple of meetings looked like 50 basis points [hikes], so call it the June meeting and the July meeting." Carpenter said Morgan Stanley expects rate bumps after July are likely to return to the 25 basis points level until "we get to a peak of about 3.25% [for the Federal Funds rate] early next year." For now, the Fed is not purchasing new MBS to hold in portfolio, and it also is allowing a portion of its existing portfolio to run off its books as those securities mature. But what happens if the Fed's run-off strategy isn't sufficient to meet its MBS divestment goals? "They’re going to let their mortgage-backed security portfolio prepay without being reinvested, and there will be a cap of $35 billion [a month] starting at half that for the next three months," Carpenter explained. "Our forecasts from my colleagues at Morgan Stanley suggest that given what the Fed has in their portfolio, [MBS] prepayments [run-off] are unlikely to get up to $35 billion a month. "Will they end up then selling mortgage-backed securities on an outright basis to get up to that $35 billion level? I think the answer has to be the following: We’re not sure." The Fed's continuing effort to wind down its $2.7 trillion MBS portfolio is expected to fuel widening spreads in the MBS market because it creates more supply to be absorbed, Bloomberg intelligence analyst Erica Adelberg explained in a recent Bloomberg report. That, in turn, puts downward pressure on pricing, Regardless of how the Fed proceeds in shrinking its MBS portfolio, however, Mike Fratantoni, chief economist for the MBA — who also spoke at the recent MBA conference — expressed confidence that the MBS market will weather the storm. He described it as the "second most liquid market in the world." "There are buyers domestically and abroad for mortgage-backed securities," he added. The issue ahead that Fratantoni zeroed in on is investors' reactions to perceived market volatility, sparked by uncertainty. "Even if it’s not going to result in a [Fed] sale [of its MBS holdings] … every sort of rumination about that has the potential to lead people to change their position," he said. Sonny Weng, vice president and senior credit officer at ratings firm Moody's Investors Service, explained in a recent interview focused on the PLS market that because of inflation and the volatile rate environment, coupled with an abundance of MBS supply — due, in part, to the Fed's monetary policies — investors are demanding a higher MBS coupon, or the rate of interest paid annually on a note at par value. The gap between rates on mortgages currently, compared with the much lower rates in 2021, also is creating another layer of deal-execution challenges. A recent market report by digital mortgage exchange and loan aggregator MAXEX reflects that reality. "…Private-label securitization (PLS) spreads continued to move wider throughout April as issuers digested lower-rate mortgages [3% or lower] that remain in inventory as current market rates rise rapidly," MAXEX states in its May market report. Weng added: "And obviously, when your mortgage pool has a lower [interest] rate, and you also have to cover certain fees, a higher coupon translates into a higher funding cost for the issuers." There is a light at the end of that pipeline, however, according to MAXEX. "We expect this trend to continue in the short term until issuers' pipelines stabilize and, over the coming months, note rates closer to 5% migrate to PLS [private label securities]," the company's report states. KBRA also indicates that impacts from the pandemic and the war in Ukraine "are important factors in our issuance projections for 2022, and these factors may also influence 2023." "Mortgage rates are generally expected to increase further as the Fed attempts to cool down rampant inflation and the housing market, impacting issuance as well," KBRA's market-forecast report states. "…We expect the prime sector to decline in 2022, mainly due to sharp interest rate increases that have decreased overall mortgage production…. "Similar themes could continue through 2023, causing prime issuance to be negatively impacted further. The non-prime sector's expected issuance is projected to increase moderately in 2023 as spreads normalize after rising precipitously in Q2 2022." Another bright spot going forward this year for the PLS market, according to KBRA and MAXEX, is the potential for solid non-agency PLS issuance backed by investment properties and other more "esoteric" offerings. "… We are still seeing an increase in the number of second homes and investor property loans being traded through the exchange to avoid the LLPA [loan-level price-adjustment] increase instituted by the FHFA [Federal Housing Finance Agency] for second-home and high-balance loans delivered to the agencies after April 1," the MAXEX May market report states. KBRA reported that MBS issuance backed by mortgages on nonowner-occupied properties (NOO), such as investment properties and second homes, "was strong in Q1 2022, with over 10x year-over-year growth." "We continue to expect further issuance in this segment…," the KBRA forecast report states. "This expectation is partly due to existing NOO securitization pipelines built through the end of 2021 and early 2022. "… In addition to traditional RMBS 2.0 issuance, reverse mortgage, mortgage servicing rights-backed issuance, home equity line of credit-backed deals, PLS CRT, Ginnie Mae early-buyout (EBO), and other esoteric RMBS transactions are also poised to increase in the remainder of 2022 and 2023 as interest rates rise further." The post PLS market is on track to notch record volume this year appeared first on HousingWire. |

| Pennymac plans to lay off another 207 employees Posted: 23 May 2022 03:00 PM PDT California-based nonbank mortgage lender Pennymac Financial Services will lay off 207 additional employees in June and July following a workforce reduction filing of more than 230 employees in March. According to Worker Adjustment and Retraining Notification (WARN) notices submitted to the Employment Development Department (EDD) on April 28 and May 9, the company plans to cut 207 jobs in two rounds on June 27 and July 8, in letters to the EDD reviewed by HousingWire. Bumping rights do not exist for these positions and employees are not represented by a union, according to the WARN notices filed by the firm. Layoffs of 190 employees at Pennymac were first reported by National Mortgage News. However, Pennymac confirmed 207 employees will be permanently laid off in June and July, without providing details on the workforce reduction. Pink slips will arrive for California employees at six offices in Thousand Oaks, Pasadena, Roseville, Westlake Village, Agoura Hills, and Moorpark. The latest round of WARN notices will impact 59 loan officers in the Thousand Oaks, Pasadena, and Roseville offices. The office at Thousand Oaks accounted for the largest layoff notifications — of 97 employees, including 25 loan officers. Most of the other positions to be eliminated were analysts and managers in back office operations. Top management jobs, such as vice presidents for underwriting and partial credit guarantee (PCG) transaction management, will also be reduced, according to Stacy Diaz, executive vice president of human resources at PennyMac, in letters to the EDD. In the Moorpark office, the firm will eliminate 52 positions, including 14 loan officers. That location will also let go of its vice president for servicing. Other layoffs include 35 in the Pasadena location, including 21 loan officers, 16 in Roseville, where 13 are loan officers, and 25 loan officers in Westlake Village. Pink slips will also arrive for two employees in Agoura Hills. In March, Pennymac filed WARN notices to the EDD in California detailing plans to lay off 236 employees. A total of 96 positions were eliminated in two offices in Westlake Village where most of the people impacted were home loan specialists. The Roseville office laid off 81 positions, while Pasadena lost 24, Agoura Hills lost 19, and Moorpark lost 16. Pennymac reported a pretax income of $234.5 million in the first quarter this year, driven by its servicing portfolio and about $520 billion in unpaid principal balance. In the beginning of the year, Pennymac said it aimed to boost its consumer direct lending business. The company announced it was investing $3.9 million to open a new mortgage origination center in Franklin, Tennessee, in January to enhance Pennymac's operations coast-to-coast "while supporting the organization's overall growth initiative," said Doug Jones, president and chief mortgage banking officer at Pennymac. Among its multi-channel production business, Pennymac's consumer direct market rose to 1.7% this year from 1.6%, according to Jones. In the first-quarter earnings call with analysts, Jones said he expected the company to grow market share in that channel as it leverages "servicing portfolio, new technology and advanced data analytics capabilitie." The correspondent channel had the largest market share across Pennymac's business at 15.8% in the first quarter. Loan servicing followed at 4.1% and broker direct channel trailed at 2.2%. Mortgage lenders are rushing to cut costs amid surging mortgage rates and a sharp decline in refis and mortgage originations. Fairway Independent Mortgage Corp. is the latest lender to lay off staff across the country. While Fairway did not provide any comment, a dozen former employees told HousingWire they were let go through phone calls from their supervisors during the second week of May. Other lenders, including Owning Corp., Interfirst, Mr. Cooper, and Wells Fargo, also turned to layoffs while some firms, such as Rocket, offered a voluntary buyout to some of their staff. The post Pennymac plans to lay off another 207 employees appeared first on HousingWire. |

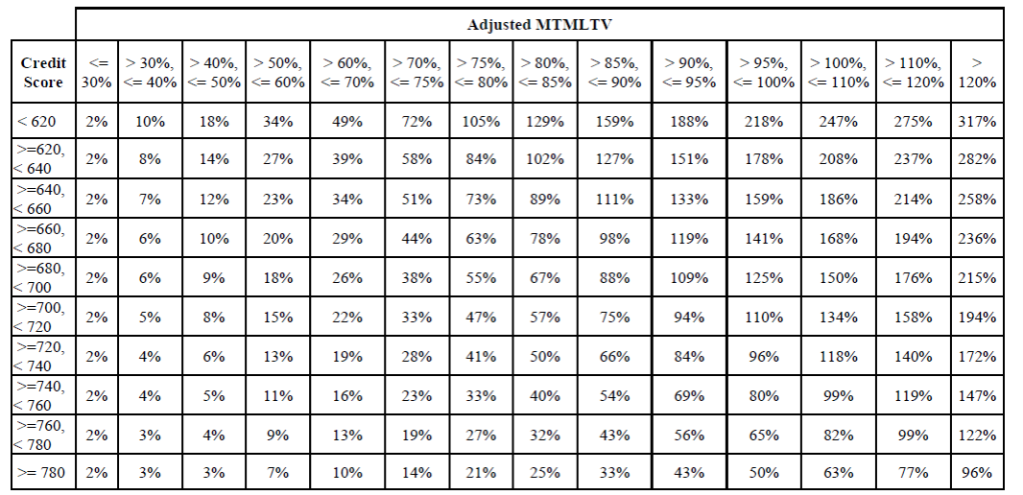

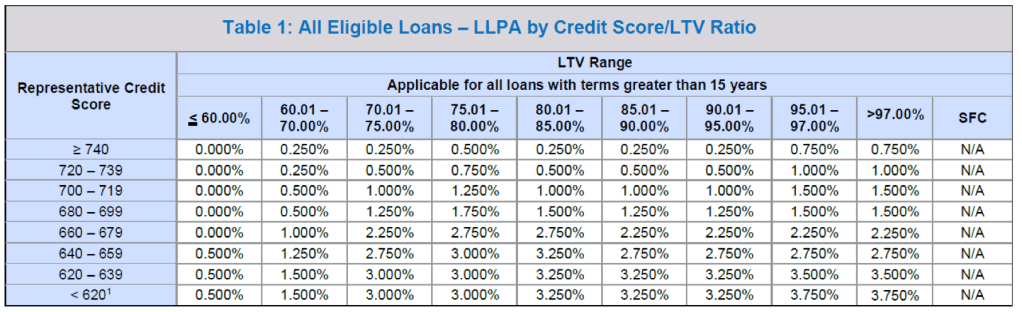

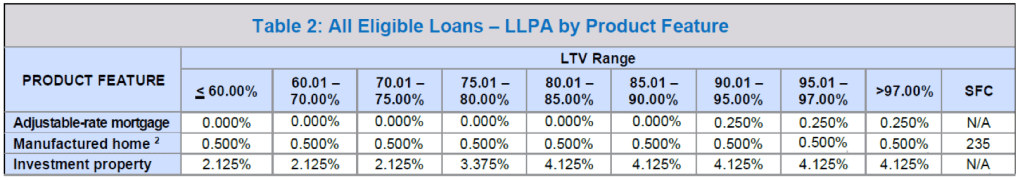

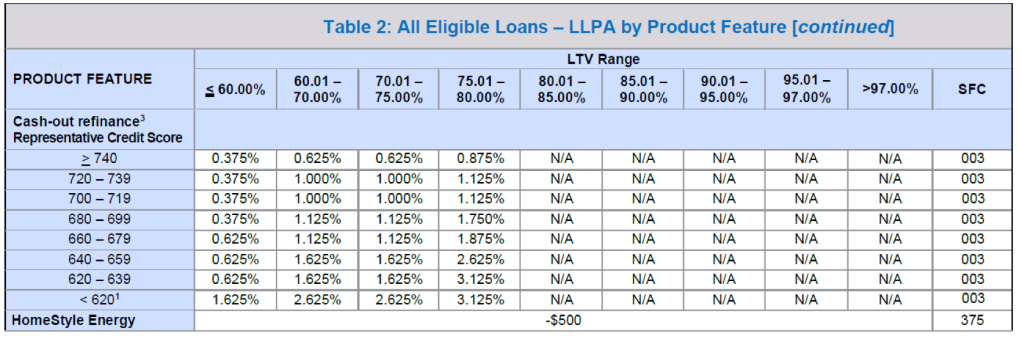

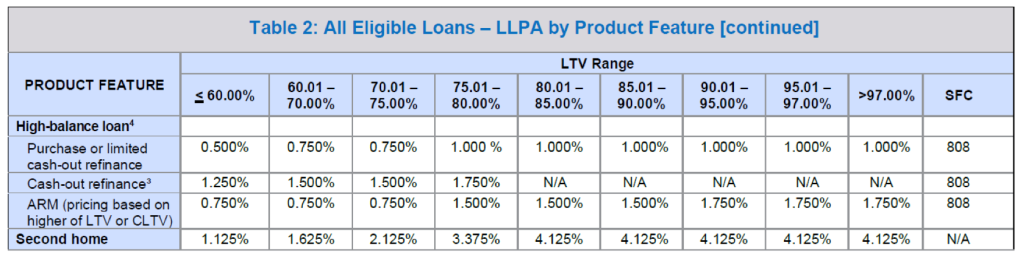

| Fratantoni: Why FHFA and GSEs should revisit their pricing framework Posted: 23 May 2022 02:07 PM PDT Potential homebuyers in today's market are facing a number of challenges, including increasing mortgage rates and a sizeable supply and demand imbalance that is pushing home-price appreciation to very high levels throughout the country. MBA's Purchase Application Payment Index (PAPI) has increased by 32% thus far this year, indicating that payments have risen much faster than personal income. Primary mortgage market rates are a function of several factors. First, mortgage rates are influenced by benchmark rates, including longer-term Treasuries. These rates are impacted by the strength of the economy, the level of inflation, and the expected direction of monetary policy, among other factors. Secondary market rates, yields on mortgage-backed securities, are determined by factors that influence the supply and demand of these securities. These include expected prepayment rates, expectations of net supply to the market, and drivers of net demand from different investors including banks, Fannie Mae and Freddie Mac (the GSEs), asset managers, global investors, and in recent times, the Federal Reserve. The spread between primary and secondary rates is impacted by yet another set of drivers, including the level of available capacity in the industry — which can vary significantly over the cycle; servicing values, which are impacted by market demand for MSRs, including any changes to servicing costs; and credit pricing, which includes guarantee fees, loan-level price adjustment (LLPAs), and mortgage insurance premiums (MIPs). The primary mortgage market is intensely competitive, as I highlighted in a column earlier this year. Lenders are essentially price-takers in this market. If they raise their offered rates much above the market, they will lose the business. If they lower them much below market rates, they won't be able to cover their costs in the long run. In this column, I will walk through how FHFA, Fannie Mae and Freddie Mac determine their pricing, and why recent pricing changes to high-balance loans and second homes deserve a review for reconsideration, particularly if the Federal Housing Finance Agency (FHFA) wants the GSEs to use these products to generate sufficient funds to further subsidize loans to “core mission” borrowers. The secondary market entities face a different challenge. Fannie Mae, Freddie Mac, FHA, the U.S. Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA) have substantial market and pricing power. When Fannie and Freddie — through their regulator, FHFA, — decide where to set prices, or when FHA sets the MIP, they are not facing a situation of perfect competition, and hence have the ability to set prices at levels that might be different than where competitive markets would go. However, there are certainly limits to the pricing power of these agencies. While private markets, either portfolio or private-label security (PLS) executions, may not readily be able to compete for agency business, if rates are pushed too high, these alternative executions may offer a better deal for lenders and their customers, particularly for low-risk loans. On the other hand, for some parts of the business that may be higher risk, if agency pricing is too high, these borrowers may not have another place to turn. I began my career in the mortgage industry at Fannie Mae, helping to develop some of the analytical models that provided inputs into Fannie's guarantee pricing model. While I have not been at a GSE for some time, by following FHFA's guarantee fee report and other public information, my understanding is that the conceptual basis for credit pricing has not changed. On a fundamental basis, the credit price for a loan, the base guarantee fee and the LLPAs, should cover both the expected losses from the loan and GSE administrative costs. The GSEs earn float income for the period of time they hold principal and interest payments, which provide a small offset to these costs. However, the largest component of credit pricing is a function of the capital that each GSE needs to hold against a stress level of credit losses associated with the loan (e.g., the level of losses for that type of loan experienced during the Great Financial Crisis (GFC) as a result of large declines in home prices and a deep recession). To put numbers on it, while a certain loan might have an expected loss (in normal economic conditions) of 40 basis points (1% probability of default, 40% loss given default), in a stressful environment, that same type of loan might have a loss of 200 basis points (4% probability of default, 50% loss given default). Like an insurance company, a GSE needs to be sure it has sufficient resources to weather an appropriately severe stress event. Setting aside an appropriate amount of capital, and charging enough to earn a market rate of return on that capital, should do that. You might recall the recent debates over FHFA's revisions to the GSE capital requirements. Market participants know that setting required capital for the GSEs too high would artificially inflate credit pricing and could reduce credit availability in the market. Setting it too low puts the GSEs at risk of another failure in the event of a severe recession or housing market crash. Beyond the top-line capital numbers, the precise calibration of required capital for different types of loans can have momentous impacts on how these products and loan-level attributes fare in the marketplace. Exhibit 1 shows the grid of capital requirements for loans with different loan-to-value (LTV) ratios and credit scores from the FHFA capital rule. Exhibit 2 shows the "multipliers" used in the rule: for a loan with any given LTV ratio and credit score, loans with these attributes are projected to have a multiple of these loss rates in stressful conditions. (As a quick example of how to read this: the base risk weight for a 720-740 credit score, 80-85% LTV ratio loan is 50%. That implies 4% capital given the 8% capital requirement. Now go to Exhibit 2 for the multipliers: A one-unit purchase loan (1.0 multiplier) for an owner-occupied home (1.0 multiplier) would require 4% capital, i.e., no adjustment. A cash-out refi (1.4 multiplier) on a condo (1.1 multiplier) would require (1.4×1.1=1.54 x 4%) = 6.16% capital). Exhibit 1: Base risk weights from FHFA's Enterprise Capital Final Rule, Table 2 to Paragraph (c)(1)  Source: Enterprise Capital Final Rule for Website.pdf (fhfa.gov), Page 263 Exhibit 2: Multipliers from FHFA's Enterprise Capital Final Rule, Table 6 to Paragraph (d)(2), see: Enterprise Capital Final Rule for Website.pdf (fhfa.gov), page 265. Economists, data scientists, statisticians, market participants, and others could argue all day about these numbers and the underlying data and models that created them. For example, many view the multiplier on TPO loans may be too high. However, following a notice and comment process and several rounds of reviews, these fundamental credit risk estimates for a wide variety of mortgage loans are generally defensible. But we have not reached the end of the story. While these estimates of relative risk that enter the capital requirements are a critical component of the guarantee fees and LLPAs that the GSEs charge, the GSEs and FHFA take another step when it comes to setting pricing, subjectively adjusting relative prices to require a premium on certain types of loans, while cross-subsidizing others. Exhibit 3 shows a portion of the current LLPA grids for Fannie Mae. Of course, these LLPAs are in addition to base guarantee fees (which include a 10-basis-point add-on which goes to the government, not towards covering credit costs), which are running at about 55 basis points, of which 45 basis points go to the GSEs. Using a 5:1 multiplier, total credit pricing for an 80% LTV ratio, 740 credit score, otherwise vanilla loan would be 45 + (50/5) = 55 basis points. As mentioned above, due to their market power, the GSEs are price-makers rather than price-takers, at least to some extent. While there are alternative executions available for some categories of loans that the GSEs guarantee, these alternatives may involve more friction, more risk, and/or different regulatory or other requirements. With respect to risk, at least historically, non-agency executions have been more susceptible to financial market disruptions, while the agency channel has been able to remain open given the government support. However, while these alternatives may typically be more expensive, market conditions combined with GSE pricing may change that comparison. As noted above, if GSE prices are too high, lower-risk loans may go to depository balance sheets or PLS. If pricing on higher-risk loans is too low, the GSEs may take market share away from FHA or other government agencies or they could be adversely selected, winding up with a larger share of higher-risk loans than they had intended. What does Exhibit 3 show when compared with Exhibits 1 and 2? With respect to credit scores and LTV ratios, both required capital and credit pricing increase significantly with higher risk in both tables. Looking at the drop in pricing above 80% LTV ratios, loans which require private mortgage insurance or other credit enhancement, there is some recognition of the support provided by MIs, at least at higher credit scores. The cross subsidization appears in the relatively flat pricing gradient at higher LTV ratios for stronger credit scores in Exhibit 3, while Exhibit 1 shows a steeper relationship along these lines with respect to stress losses and required capital. Let's now examine the most recent set of pricing changes that were implemented as of April 2022. Shown in the last section of Exhibit 3/Table 2, these (large) LLPAs are for high-balance conforming loans and for second homes. However, loan size does not show up as a risk factor meriting a multiplier in Exhibit 2. Typically, default risk is somewhat higher for smaller loan sizes, all else equal, and there is somewhat more risk of higher loss given default for very expensive properties. However, it does not seem likely that the fundamentals would warrant a 50-175 basis point LLPA for high balance conforming loans. If it did, Exhibit 2 would likely show a multiplier. Similarly, while the LLPAs are 112-412 basis points for second home loans, Exhibit 2 shows second homes receiving the same 1.0 multiplier as owner-occupied properties. For higher LTV ratios, the LLPAs for second homes are now the same as those for investment properties. These price increases were intended, at least in part, to generate revenue which could be used to cross-subsidize loans that are closer to the core mission of the GSEs, particularly helping underserved markets and first-time homebuyers. These are worthy goals, but the question is whether such price changes, which seem to be very far removed from risk fundamentals, may not be effective at raising revenue if they push lenders to seek alternative executions. Exhibit 3: Selections from Fannie Mae LLPA Grids as of 4/6/2022     Source: display (fanniemae.com) So what's next? Mortgage lenders are battling through a steep decline in origination volume as the market transitions to predominantly purchase business. More than ever, every basis point will count as lenders and borrowers work to address worsening affordability conditions. As a result, credit pricing may get more attention in 2022 than it has in some time. The industry is anticipating a reduction soon in the FHA MIP, given the agency's strong capital position and further declines in delinquency rates. This would certainly help many potential first-time homebuyers. However, given the challenges in affordability and headwinds facing the housing market, this also is a good time for the GSEs and FHFA to make adjustments to their pricing framework, ensuring that their pricing effectively supports market liquidity and helps to fund their missions. Michael Fratantoni is MBA’s Chief Economist and Senior Vice President of Research and Industry Technology. This column does not necessarily reflect the opinion of HousingWire's editorial department and its owners. To contact the author of this story: To contact the editor responsible for this story: The post Fratantoni: Why FHFA and GSEs should revisit their pricing framework appeared first on HousingWire. |

| Proposed VA appraisal law looks to even the playing field Posted: 23 May 2022 12:27 PM PDT A piece of legislation introduced in the Senate in mid-May could streamline the appraisal process for VA loans. The legislation would modernize the Department of Veteran Affairs‘ appraisal requirements by allowing desktop appraisals, and in some circumstances, waving appraisals all together. Currently, all VA appraisals must be performed in-house. If passed, the legislation, introduced by Sen. Dan Sullivan of Alaska and Congressman Mike Bost of Illinois, would address a long-standing gripe that VA appraisal requirements are both lengthy and costly. Bost said in a statement that the VA appraisal requirements are a strain on veterans trying to compete in a hot housing market and that this legislation would make VA borrowers more competitive. "VA home loans have given millions of veterans and their families the opportunity to purchase a home. Yet, on average, veterans wait longer and pay more during the closing process due to VA's out-of-date appraisal requirements," said Bost. "This bill will make sure that veterans are not unfairly disadvantaged during the home buying process and allow for a modern, digital appraisal process, which will get them into their new home faster." In March 2022, the Federal Housing Finance Agency (FHFA) made hybrid appraisals a permanent fixture. Both Fannie Mae and Freddie Mac now allow appraisals to be conducted remotely, using public records such as listings and tax appraisals, for purchase loans. Meanwhile, the Department of Housing and Urban Development (HUD)recently extended its timeline for allowing desktop appraisals for certain transactions impacted by the pandemic. The policy now expires on December 31, 2022. Sponsored Video The Mortgage Bankers Association supports the legislation. Last week, Mark Jones, CEO of Amerifirst Home Mortgage and a member of the MBA, testified before the House subcommittee on Economic Opportunity, and encouraged the subcommittee to align VA’s appraisal processes with other housing entities. “[The MBA urges the subcommittee to] consider directing the VA to not only modernize and streamline its current processes, but also align them with those of the FHA and the housing Government Sponsored Enterprises — Fannie Mae and Freddie Mac — to the greatest extent possible,” he said. Jones also expressed concern with future increases to VA home loan funding fees. “MBA urges Congress to ensure that these funding fees are set at levels commensurate with the risks associated with VA-guaranteed home lending — and to conduct oversight and analysis of past funding fee increases rather than levying further increases,” he said. Jones added that past funding fee increases may have put the funding fee schedule into “misalignment with the actual risk profile of veteran borrowers.” The post Proposed VA appraisal law looks to even the playing field appeared first on HousingWire. |

| Cherry Creek Mortgage names new chief revenue officer Posted: 23 May 2022 10:28 AM PDT Full-service lender Cherry Creek Mortgage announced Rick Hogle has joined the company as its chief revenue officer. In his new role, Hogle will manage the firm's retail operations, overseeing growth and development of retail sales and the production network, while supporting the firm's business channels. He’s also tasked with developing a recruiting platform to engage and enlist new talent and improving internal coaching to strengthen the personal and professional growth of all associates. Hogle has more than 20 years of experience, including about 15 years with Supreme Lending. He served as chief strategic officer there before being promoted to national sales manager, then to director of operations, and, ultimately, chief operating officer. Hogle began his mortgage career in 2001 at New Century Mortgage, where he became a branch manager. According to Rick Seehausen, CEO of Cherry Creek, Hogle prides himself on successfully unifying sales and operational teams. "We are thrilled to be bringing on a dynamic change agent who will continue to build on the unity between our operations and sales units and instill a culture and vision that aligns everyone in the organization to achieve a common goal," Seehausen said in a statement. Hogle said he’s “delighted and honored” to join Cherry Creek’s “thriving retail organization." How to make digital marketing easy and effective for mortgage professionals The shift to a purchase market makes effective digital marketing even more important, and collaborative marketing technology can generate more demand while reducing time spent on marketing. This white paper explains what collaborative marketing is and how forward-thinking lenders are already using it to drive growth. Presented by: Evocalize"When you bring together great people, empower them with a common mission, and equip them with the tools, knowledge, and processes for success, the sky's the limit," he said. Cherry Creek Mortgage, headquartered in Colorado, is licensed in 43 states, including Alabama, Connecticut and Michigan. Cherry Creek was among the 41 independent mortgage banks that sent a letter to the Federal Housing Administration as part of the Community Home Lenders Association urging the administration to cut mortgage insurance premiums. The letter, sent Wednesday, urged the FHA to eliminate its “life-of-loan” policy, which the lenders say overcharges FHA borrowers, prompting many of them to refinance out of the FHA program altogether. The letter also encouraged the FHA to reduce annual premiums by 30 basis points to 0.55%, saying it’s the only way achieve racial equity and increase homeownership. The letter echoed the concerns of industry stakeholders who have said they want Julia Gordon, the newly confirmed FHA commissioner, to prioritize. Some, including an advisor for the National Association of Realtors, expect a reduction of premiums within 30 days of Gordon’s May 11 confirmation. HUD so far has resisted lowering the up-front and life-of-loan fees, saying it has “no near-term plans” to change FHA’s mortgage insurance premium pricing. For example, the Mutual Mortgage Insurance Fund has a capital ratio of 8.03% as of September 2021, more than quadruple the required statutory minimum. The post Cherry Creek Mortgage names new chief revenue officer appeared first on HousingWire. |

| You are subscribed to email updates from Mortgage Industry News Delivered Daily from HousingWire. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment