Mortgage – HousingWire |

- Finance of America’s Patti Cook reflects on 45 years in the industry

- The PLS market hits a bump in the road

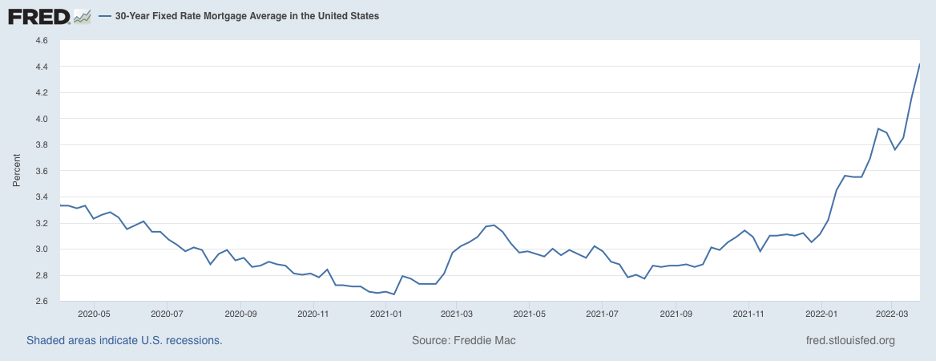

- Mortgage rates reach highest level since 2018

- Rate hikes haven’t depressed interest in purchase mortgages – yet

- Inside Figure’s bold plan for crypto mortgages

- HMDA: The top 10 VA lenders by volume in 2021

- Opinion: HUD needs to lower the MIP and do it now

- Inside the government’s feeble fight to end redlining

- HMDA: The top 10 FHA lenders by volume in 2021

- The big nonbanks stir up a non-QM turf war

| Finance of America’s Patti Cook reflects on 45 years in the industry Posted: 01 Apr 2022 04:04 AM PDT  In February, Finance of America CEO Patti Cook announced her retirement after a successful career in finance that spanned 45 years. HousingWire sat down with this Woman of Influence winner to find out some of the important lessons she learned along the way. HousingWire: One of your first jobs in the industry was at Salomon Brothers, starting in 1979. What part of that job did you love? Patti Cook: When I look back on my time at Salomon Brothers, what drew me to that work and kept me there was the innovation coming to the fixed-income markets during that decade. When you look at how fixed-income developed, mortgage-backed securities were brand new at the time and I was right at the forefront of that work. CMOs or collateralized mortgage obligations were developed. Then, that led to REMICs — real estate mortgage investment conduits — and the market really took off from there. Salomon Brothers was at the epicenter of the innovation taking place in fixed-income and I really loved that firsthand experience working with mortgage-backed securities, CMOs, REMICs and securitization more broadly. HW: You worked at Salomon Brothers when it was rare to see women on Wall Street. What did you take away from that experience that has shaped the roles you've had since then? Patti Cook: My experience there really led me to my "excellence every day" mantra. When you commit to excellence every day, it gets rewarded. For me, I wasn't focused on women being unique in the workplace or having a bigger mountain to climb or anything like that. I genuinely feel I was lucky to have that job and I demonstrated that in my approach to work. I put my head down, worked hard every day, and I was rewarded for it. That commitment to excellence and working hard — even on the days when you might not feel up to it — really shaped my outlook and has been a key driver in my success. HW: From 2004-2008 — at the height of the financial crisis — you served as EVP and chief business officer at Freddie Mac. What was it like to be there as it went into conservatorship? Patti Cook: That was certainly quite the experience. I can say that there is no playbook for a situation like that. There was no safety net. We were working with some of the smartest people in the room — leaders from the Fed, Treasury and at the highest levels of government — to develop a response and sort out the right solution. Our focus was on calming the markets and ensuring stability. In some ways, when I look back at that time, it was like we all had a front row view of history in the making. HW: Was there any thought then that conservatorship would last so long? Patti Cook: At the time, we were singularly focused on fixing the situation and bringing stability to the markets. We weren't concerned with the long-term view of how they get out of conservatorship. During that time, that wasn't the focus of our work. We were focused on shoring up the markets. HW: Working at lenders, financial firms and Freddie Mac, how do you think about the consumer, the borrower, today? Patti Cook: I think it's all about empowerment for the customer. If you consider the last few decades and how the industry's view of the customer has evolved, it is all about putting power in the hands of the customer. I don't think we talked about the customer in that way 20 years ago. What we've evolved to is a model where we provide customers with the tools and expert guidance they need to help enable them to make better financial decisions. That also leads me to how we approach our business today at FOA. We strive to offer the widest breadth of products and services, so we can help our customers at whatever stage of life they're in. Our No. 1 priority and focus today is on the customer and putting them first. HW: You've held the top leadership role at some of the largest companies in our industry. What is one key to your success? Patti Cook: My guiding principle has always been to work very hard while always treating all people with respect. This approach has helped me build trust and knowledge, which I've accumulated throughout my career and which, in turn, has made me a better and more effective and compassionate leader. I feel very fortunate to be able to look back on a long career that has been filled with such rewarding experiences. HW: Who have been some of your mentors? Patti Cook: I view mentors as those in life who motivate you along the way. The truth is that for me this has and will always be my family. Everything that I've done throughout my career — all of the hard work and nights and weekends at the office — have been driven by my desire to provide for my family and help ensure that they were well educated and had everything they needed to be successful. I wanted them to be proud of me. That's what motivated me. It's still what motivates me. HW: What are some of the qualities you can identify early on in a junior team member that are great predictors of success? Patti Cook: One of the things I believe I am really good at is identifying young talent and then doing what I can to help nurture those careers. This means making myself available to impart wisdom and counsel and helping to ensure that they have access to the tools and resources to facilitate their professional development. I always assume people are smart enough, but I think the best predictor of success is one's work ethic and desire to learn. Where someone went to school is much less important to me than their willingness to raise their hands, roll up their sleeves and just work hard. I am not the product of Ivy League schooling. I ascribe so much of my success to my relentless desire to learn and stay ahead of the industry. When I see similar qualities in individuals, I will naturally gravitate to them. HW: Was it one of your personal goals to take a company public during your career? Patti Cook: The short answer is not in my wildest dreams. I'd actually go so far to say that being the CEO of a company was never one of my goals. Not because I didn't dream big, but because when you look at my career path and where I started, corporate life was not on my road map until later on in my career and even then not until the last few years. The lesson there is that it's very hard to forecast your career. Your path emerges over time and if you work hard and treat people with respect during that journey, I believe that you are presented with opportunities that perhaps weren't there just a few years or even months before. It's really remarkable. HW: A purchase market presents unique challenges for lenders. How is Finance of America approaching what could be a difficult year for originators? Patti Cook: Finance of America was built purposefully different. Our continued success is a direct result of our unique business model that has helped us maintain operating profitability despite the mortgage market evolution. The mortgage industry is currently facing a tough environment and the demand for refinancing has dramatically decreased from the highs of 2020 as rates have increased. These macro conditions have led to a shift from refinancing to home purchase. We believe Finance of America is well-positioned to take advantage of the expected growth in the purchase and non-agency market while still remaining able to leverage the episodic refinance opportunities as we did in 2020. Additionally, we will continue to see significant growth in our Specialty Finance and Services or SF&S segment. This segment includes our reverse mortgage business, our commercial fix-and-flip business, our home improvement business, and our lender services and capital markets businesses. In the fourth quarter of 2021, SF&S accounted for more than 50 percent of our revenue and the bulk of our adjusted net income. We expect SF&S to be the main driver of growth and profitability in the foreseeable future. This was originally featured in the April Issue of HousingWire Magazine. To read the full issue, click here. The post Finance of America’s Patti Cook reflects on 45 years in the industry appeared first on HousingWire. |

| The PLS market hits a bump in the road Posted: 31 Mar 2022 12:55 PM PDT  The rate volatility that has gripped the economy since the start of the year and caused the mortgage-origination market to stumble is taking a toll on the private-label securitization market as well. Fast rising rates — the 30-year fixed rate is up nearly a point-and-half since the start of the year — have blunted mortgage originations, particularly refinancing, and by extension the loan volume available for securitization pipelines. Although it's still too early to know for sure how second-quarter performance for the private label securities (PLS) space will pan out, the market is currently under pressure, according to industry experts. MAXEX, an Atlanta-based digital mortgage exchange serving the PLS market, posted record growth in 2021, for example. In a recent letter sent to its customers, however, MAXEX indicated that it will be taking actions to address waning loan volume. That includes trimming its workforce. "The company recently completed a minor reduction of its workforce consistent with staff reductions occurring across the mortgage industry in response to loan volumes declining," the letter states. "MAXEX does not expect this will impact its operations, and no additional staff reductions are anticipated." MAXEX — in which J.P. Morgan is a significant investor — declined to comment on how many employees were let go at the company. MAXEX officials also did not disclose the company's total workforce count — although its LinkedIn account shows that it has fewer than 150 employees. Clearly, a small reduction in headcount at MAXEX is not a game changer in a mortgage industry that employs 130,000 by some estimates, but it's significant that the loan-trading platform is pairing back its workforce at all. "MAXEX experienced record growth in 2021, with year-over-year revenue increasing over five times and the number of exchange participants more than doubling," the company states in the letter to its customers. The MAXEX exchange now supports some 300 loan originators/sellers and more than 20 active loan buyers. The recent downsizing news from MAXEX also comes on the heels of a strong first-quarter showing for the PLS market overall, compared with the same period in 2021. Over the first three months of this year, some 60 PLS offerings valued at $31 billion hit the market, compared with 35 PLS deals valued at $14 billion over the same period in 2021, according to deals tracked by the Kroll Bond Rating Agency — and the rating firm's net doesn't even capture all the PLS transactions over the period. Like last year, J.P Morgan, through its private label conduit, J.P. Morgan Mortgage Trust, continues to be the 800-pound gorilla in the PLS market, accounting for about 20 percent of the market by volume year to date as of March 30, 2022. The investment bank side of New York-based banking holding company J.P. Morgan Chase & Co., sponsored seven private-label securitization deals over the first three months of this year collectively valued at $6.5 billion. That includes a $2 billion PLS offering in January, a $1.2 billion deal in February and $1 billion transaction in March. J.P. Morgan's PLS offerings include three deals backed by investment properties and four backed by jumbo loans. A good share of the first-quarter PLS deals, however, involved lower-rate loans from 2021, many of them refinanced loans, that finally made their way into transactions as the new year started. Once that reservoir of loans is depleted, it will be replenished by newer loans at much higher rates. The problem, for now, is that mortgage originations are way down on the refinancing front and purchase-loan volume is essentially flat — a byproduct, in large measure, of the volatile rate environment and tight housing inventory. "Refinance application volume is now 60 percent below last year’s levels, in line with MBA’s forecast for 2022,” said Mortgage Bankers Association Chief Economist Mike Fratantoni in a public statement released earlier this week. “Even with the ongoing climb in rates, purchase application volumes were little changed last week. "This is particularly auspicious, as we are now in the beginning of the spring homebuying season, and those shopping for homes are struggling with not only higher and more volatile mortgage rates, but also an ongoing shortage of homes on the market." The private-label securitization market ultimately mirrors, in part, mortgage production trends in the origination market, and the current trend line is marked by uncertainty, volatility and lower production levels. David Pelka, head of RMBS business and a principle with Minneapolis-based CarVal Investors, which is active in both the residential whole loan and RMBS markets, said it's difficult currently to forecast with any certainty where the light is at the end of the tunnel that the PLS market now finds itself traversing. "Mortgage volumes overall will be under pressure as long as rates are high, increasing and/or volatile," he said. "…It's currently quite difficult to see material certainty in new production volumes at higher rates (e.g., borrower demand) as well as corresponding securitization execution." John Toohig, managing director of whole loan trading at Raymond James in Memphis, explains the situation this way: "Yesterday’s paper [at lower rates] is underwater … [but] the new loans that are coming on now are starting to be better priced [at higher rates]," he said. "When you have 100 basis point move [or more] in three or four months, it is hard for that pipeline to kind of catch up. Toohig added that from the point of view of a nonbank lender that doesn't hold deposits and hasn't hedged properly, the recent run-up in interest rates and accompanying market contraction offers few good choices. "They can't just park the loans on the balance sheet because they have a warehouse line, and that warehouse is aging, and they have to sell those loans at some point," he said. "And that’s what’s pushing through the securitization system at the moment, … and those loans are now worth 95 [cents on the dollar]. "They’re trying to find the best way they can get out of them that's possible." In other words, the PLS market into March of this year was still digesting a large volume of lower-rate PLS deals that, in many cases, lost value and became harder to execute as rates spiked. Still, industry experts who spoke with HousingWire about the current market conundrum expressed confidence that the market will right itself once a rate plateau is reached and newer PLS deals backed by higher-rate loans flow into the market. Toohig said he, too, is confident that "we will start seeing prices normalize as [new mortgages are originated] at today’s current rates in the market." "It's going to take some time, however," he added. "That's why you’re starting to see the layoffs [in the industry] and that’s also because [overall mortgage] production has slowed down [too]. It's a very fluid situation." MAXEX is making a bet on the future as well. The company recently completed a series C preferred equity offering that was co-led by its existing institutional investors. The capital raised, the company said, will be used to expand the MAXEX platform, including its loan programs. “The current disruption in the mortgage market due to rising interest rates, rapidly decreasing volumes and economic uncertainty has created a unique opportunity for MAXEX to serve the growing needs of lenders and investors by providing a broader range of loan products while helping them reduce infrastructure and costs," MAXEX CEO Tom Pearce states in the letter to the company's customers. Andy Payment, head of marketing at MAXEX, said the company is not disclosing the terms of the recent equity offering. Payment did say MAXEX is continuing to pursue an expansion of its sales force, which the company announced this past December. "While we expect that expansion to slow somewhat given current market conditions, we remain committed to building a world class sales organization to serve our rapidly-growing user network," Payment said. In addition, he said MAXEX plans to expand its non-QM program offerings and services, "both through the traditional exchange as well as through our platform-as-a-service offering that leverages our infrastructure — multiple sellers to a single institutional investor." The non-QM market, which tends to do well in a purchase-market cycle, is focused on serving borrowers who don't hold traditional payroll jobs or otherwise don't qualify for mortgages inside the agency box. Those borrowers include the growing numbers of self-employed gig workers as well as real estate investors, foreign buyers, business owners and individuals with credit blemishes. "There are a number of factors facing the current market," MAXEX's letter to its customers states. "However, MAXEX is bullish on the long-term growth of the industry and our increasing relevance to market participants." The post The PLS market hits a bump in the road appeared first on HousingWire. |

| Mortgage rates reach highest level since 2018 Posted: 31 Mar 2022 07:09 AM PDT Mortgage rates keep climbing amid rising inflation, war in Ukraine, and disruptions to the supply chain, and there’s no sign that they’ll fall anytime soon. The latest weekly Freddie Mac PMMS mortgage survey, released Thursday, showed that the average purchase mortgage rate touched 4.67%, up 25 basis points from the week prior. That was the highest reading since December 2018, according to Freddie Mac. The GSE’s index accounts for just purchase mortgages reported by lenders over the past three days. Black Knight‘s Optimal Blue OBMMI pricing engine, which considers refis and data from the Mortgage Bankers Association, reported that rates on Wednesday averaged 4.81%, up about 10 bps from a week prior. And several loan officers who spoke to HousingWire this week said they had clients lock rates in the 5.1% range this week, though many homebuyers with ample cash reserves are buying down mortgage points. The central bank has signaled that it will raise interest rates another six times this year and several more in 2023 to control inflation, which reached the highest level in 40 years in February, at 7.9%. Normally, a period of rising mortgage rates cools housing prices. But this is no normal market. The March national median listing price for active listings was $405,000, up 13.5% compared to last year and 26.5% compared to March 2020, according to Realtor.com economist Danielle Hale. In large metros, median listing prices grew by 9.1% compared to last year, on average. Why lenders should think about non-QM now, not later Agency rates are on the rise and refinance volume is down. Originators who had their best year in 2021 will have to utilize something else to make up for this loss in 2022 and non-QM can be the answer. Presented by: Angel OakThe problem, of course, is inventory. National inventory of active listings declined by 18.9% over the last year in March, while the total inventory of unsold homes — including pending listings — declined by 12.5%, according to Realtor.com. The inventory of active listings was down 62.3% compared to 2020 at the onset of the pandemic, even though demand remains high. The latest Mortgage Bankers Association survey this week found that while interest in refi mortgages fell 15% from the prior week, interest in purchase mortgages rose a modest 0.68%. According to the PMMS report, the average 15-year fixed-rate mortgage averaged 3.83%, up 20 bps from the prior week. (On average homebuyers paid 0.8 mortgage points.) The 5-year Treasury-indexed ARM averaged 3.50%, up from 3.36% a week prior. The post Mortgage rates reach highest level since 2018 appeared first on HousingWire. |

| Rate hikes haven’t depressed interest in purchase mortgages – yet Posted: 30 Mar 2022 04:00 AM PDT Interest in residential mortgage loans fell 6.8% for the week ending March 25 as rates jump even closer to the 5% mark, according to the Mortgage Bankers Association's latest survey. Few borrowers these days have an incentive to refinance their mortgage. According to the MBA, refi applications fell 15% from the prior week and 60% from a year ago. Meanwhile, the seasonally adjusted purchase index increased 0.64% from one week earlier, showing resilience while rates climb, but was still down 10.1% year over year. "Mortgage rates jumped to their highest level in more than three years last week, as investors continue to price in the impact of a more restrictive monetary policy from the Federal Reserve," Mike Fratantoni, MBA's senior vice president and chief economist, said in a statement. The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $647,200) increased to 4.80% from 4.50%. Meanwhile, for jumbo mortgage loans (greater than $647,000), rates jumped to 4.40% from 4.11% in the same period. "Not surprisingly, refinance application volume declined further, as fewer borrowers have an incentive to apply at rates that are significantly higher than a year ago," Fratantoni said. In total, the share of refis in new applications went from 44.8% in the prior week to 40.6% in the current survey. Regarding purchases, Fratantoni said application volumes little changed last week, which is "auspicious" as those who are shopping for homes are struggling with higher and volatile mortgages rates, as well as an ongoing shortage of homes on the market. How local lenders can remain competitive in 2022's changing market As the strong refinance volume of 2020 and 2021 drops industry-wide, lending businesses find themselves at a crossroads: How will they manage the impact of fixed expenses until the next injection of loan volume? Presented by: Maxwell"Given these hurdles, it appears to be promising news that purchase application volume has not declined, as many potential buyers are likely feeling the squeeze in their purchasing power from the jump in rates," the economist said. The MBA found that the adjustable-rate mortgage share of the activity increased from 6.4% to 6.6% of total applications. The FHA share of total applications went from 8.8% to 9.3%, and the share of VA applications decreased from 9.8% to 9.5%. The USDA share increased to 0.5%, from 0.4% the week prior. The survey, conducted since 1990, covers over 75% of the retail residential mortgage applications. The post Rate hikes haven’t depressed interest in purchase mortgages – yet appeared first on HousingWire. |

| Inside Figure’s bold plan for crypto mortgages Posted: 29 Mar 2022 01:04 PM PDT  Mike Cagney didn’t expect to be releasing a cryptocurrency-backed 30-year fixed-rate mortgage product so soon. The plan was for Figure Technologies to launch such a product only after completing the merger with multichannel mortgage lender Homebridge Financial Services. But Cagney can’t wait: regulatory approval on the Homebridge deal hasn’t occurred yet, and frankly, demand for crypto mortgages is too strong. He’s launching in early April. "I’ve just been blown away by how many people are in a situation where they have significant crypto assets, and their lenders just won’t take it into consideration," Cagney, co-founder and CEO of blockchain-built Figure, told HousingWire. "Crypto is some of the best collateral because it’s not only liquid, but liquid 24 hours a day." The fintech is gearing up to release a 30-year fixed rate mortgage for borrowers to use bitcoin and/or ether as collateral. Two other companies have announced the product since December, including Miami-based digital lender Milo and Toronto-based cryptocurrency lending platform Ledn. Figure's crypto-backed mortgage will have a 100% loan-to-value ratio and monthly collateral adjustments: if cryptocurrency prices drop, the client needs to deposit more collateral or pay down the loan balance to get the ratio back to 100%. Otherwise, the company will liquidate the collateral, Cagney said. However, if the cryptocurrency price increases to a 125% loan to value ratio, the lender will release the excess back to the borrower. Figure will not rehypothecate the collateral – in other words: use it for their own purposes – and will have the digital asset platform Anchorage as a custodian of the cryptocurrencies. Figure will originate crypto-backed mortgages of up to $20 million, at a fixed interest rate of 5.99%. "For us to get paid, we need to be at that 5.99% rate. As the market gets comfortable with the product, the rate will look like the prime jumbo," Cagney said. (The prime jumbo rate is currently at around 5%.) Cagney said it is realistic to think Figure will reach between $500 million to $1 billion in origination volume in 2022. Figure will use its own cash to originate up to $100 million. And while Figure has no plans to raise capital for the product, it can tap other sources of funding if needed. Per Crunchbase, the company has raised $1.6 billion in venture capital, including a $200 million Series D round in May with 10T Holdings and Morgan Creek Digital, as well as a $100 million funding facility from JPMorgan Chase in January 2021. Cagney has talked to investors to assess their appetite for crypto-backed mortgages in the secondary market, mainly insurance companies and banks. "There is a lot of interest in it, because it has a higher coupon than the prime jumbo, but it is new, and so people want to get their arms around it," he said. Figure, which was founded in 2018, claims its blockchain-built underwriting system streamlines the origination process, locking the loan in five minutes and funding it over the course of five days – outside appraisal and title. Cagney, who founded and led student loan lender SoFi, has been outspoken about his goal to test the blockchain platform at scale, which he’ll be able to do once the deal for Homebridge is approved. "Probably the most significant issue was we had this grand thesis that we could save 90 basis points of expense to originate securitized loans on a blockchain," Cagney told HousingWire in an interview last May. "We had a blockchain architecture that we felt was scalable, secure, and did all the things the financial ecosystem needed to do. And we added a way to onboard and offboard currency out of the blockchain. "What we didn't have was a bank and originator ready to embrace the blockchain from an asset standpoint. And so nobody wanted to be a first mover to originate a loan on blockchain. And there are a lot of proof of concepts out there where people were doing it in parallel, but the loan still existed off chain and we didn't think that was really an effective proof of concept." Although interest in blockchain is gaining steam in mortgage, it is still very much a nascent technology. A recent Fannie Mae survey found that only 25% of lenders said they were familiar with the technology and its possible applications in the mortgage business. A majority of lenders (68%) said they have not yet looked into the technology. Of the 20% of lenders that have looked into blockchain, 41% said they plan to adopt it within four years. The post Inside Figure’s bold plan for crypto mortgages appeared first on HousingWire. |

| HMDA: The top 10 VA lenders by volume in 2021 Posted: 29 Mar 2022 12:01 PM PDT Origination volume in the Veterans Affairs (VA) universe amounted to $388 billion in 2021, an analysis of Home Mortgage Disclosure Act (HMDA) data by Polygon Research application HMDAVision found. This marks a notable dip in originations from 2020, a record-breaking year in which VA lenders pumped out approximately $427 billion in VA loans. The top 10 VA lenders by volume in 2021:

Freedom Mortgage Corporation continued to lead the pack, originating $43 billion in VA loans last year. Still, its VA originations fell by 23.17% from the prior year. Rocket Mortgage came in second by volume, originating $29.72 billion, a 5.40% dip year-over-year, while Missouri-based Mortgage Research Center, LLC (doing business as Veterans United) came in third place, increasing originations by 18% year-over-year to $29.70 billion in 2021. PennyMac Loan Services took fourth place, originating $17.5 billion in VA loans, a 44.83% increase and Pontiac-based United Wholesale Mortgage, not too far behind, originated $15.1 billion, a decline of 26% from 2020. Virginia-based Navy Federal Credit Union nabbed fifth place, originating $12.75 billion, up 32.12% from 2020 and LoanDepot came in a close sixth place, increasing their origination volume by 7.22% year-over-year to $12.1 billion. Caliber Home Loans came in seventh place, originating $10.6 billion in 2021, an increase of 9.10% year-over-year, credit union USAA Federal Savings Bank originated $7.8 billion, and wholesale lender HomePoint originated $7.2 billion, a 48.02% increase from 2020 origination levels. HMDA data shows that the average VA loan size in 2021 was $314,949 and the average interest rate for VA loans was 2.62%. For comparison’s sake, HMDA data revealed that the average FHA loan size in 2021 was $251,371, while the average interest rate was 3.03%. But some lenders charged higher interest rates than the average on VA loans last year. Fairway Independent Mortgage, which originated $5.6 billion in VA loans in 2021, had an average interest rate of 2.91% on VA loans, the data shows. USAA Federal Savings Bank also had an elevated interest rate of 2.86%, according to HMDA filings. CrossCountry Mortgage and Movement Mortgage both had an average interest rate of 2.85% on VA loans. HMDA data also shows that 54.5% of applicants for VA loans were white in 2021 and only 28.7% of applicants were minority borrowers. The remaining 16.7% of applicants opted out of disclosing their ethnicity. In February, HousingWire published an analysis of the 2022 outlook for first-time VA homebuyers. The post HMDA: The top 10 VA lenders by volume in 2021 appeared first on HousingWire. |

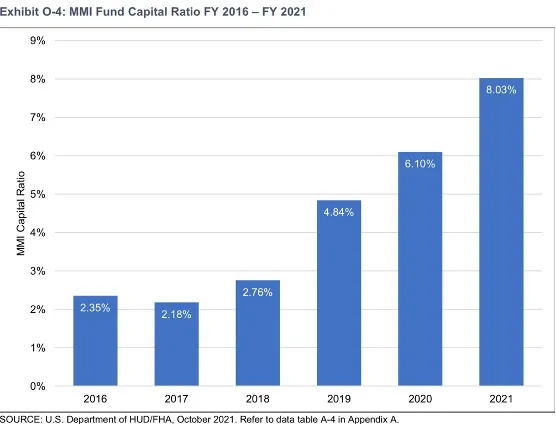

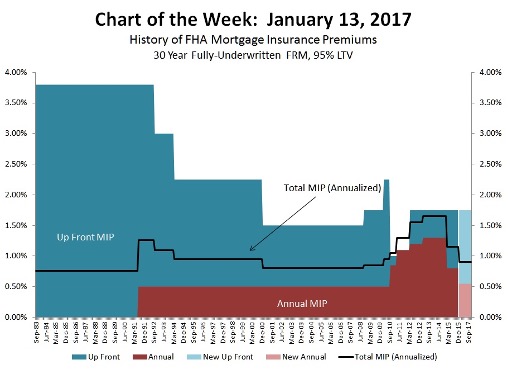

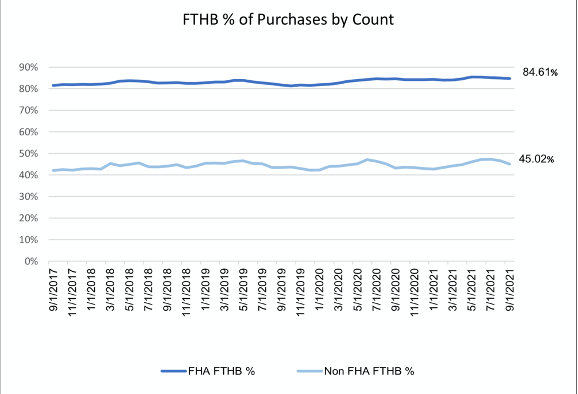

| Opinion: HUD needs to lower the MIP and do it now Posted: 29 Mar 2022 09:15 AM PDT This week, the Community Home Lenders Association (CHLA) repeated their call for FHA to lower premiums and to eliminate the life of loan premium on FHA loans. While I might have a different view on the life of loan premium, I applaud their call and cannot understand why HUD has not yet lowered FHA premiums. It's dumbfounding. In 2022, mortgage rates have risen faster than even most economists were forecasting, with 30-year fixed rates ending last week averaging 4.95%. The rise in rates has exceeded 200 basis points since early 2021, impacting those on the margin more than any other segment of the housing market.  On a $400,000 loan, the difference between a 3% mortgage and a 4.5% mortgage is $340 per month to a potential homebuyer. And while many argue that the current rates, near 5%, are still low by historical standards, this difference in rate in such a short timeframe is a stinging shot to those entry-level homebuyers struggling to scrape together a down payment for their home purchase.  What's surprising to me, as someone who served at HUD during the Obama administration, is that there is virtually no rationale in holding mortgage insurance premiums at the levels they are today considering the strength of the Mutual Mortgage Insurance Fund (MMI). HUD Secretary Marcia Fudge noted this strength in her report to Congress in November, noting, "The actuarial study shows the capital reserve ratio of the MMI Fund is 8.03 percent as of September 30, 2021, an increase of 1.93 percentage points over the previous fiscal year. This increase is driven in large part by a housing market that endured the pandemic overall with strong home price appreciation nationwide, sustained low interest rates creating strong refinance volume, and positive financial performance of the HECM portfolio for the first time since 2015." An 8.03% capital reserve ratio is record-setting from a historical perspective.  When I served as FHA Commissioner, beginning in 2009 I raised premiums several times. Initially only up front as FHA was capped on how much it could raise annual premiums and then, following legislative support from Congress, raising the annual and implementing the life of loan premium. These moves were done because the fund was severely hurt by the great recession of 2008. But today, the environment is totally different and I cannot understand why the Secretary has not acted yet to lower premiums. Secretary Fudge has testified and made speeches about wanting to help improve minority homeownership outcomes. In last year’s actuarial report, HUD trumpeted that, "FHA endorsements for mortgages made to Black and Hispanic borrowers are more than twice that of the rest of the market, according to Calendar Year 2020 Home Mortgage Disclosure Act data," which only emphasizes the importance of this program to entry-level first-time and minority homebuyers.  In fact, FHA is the vehicle primarily used by first-time homebuyers, as shown in this chart (at right) presented to Congress last fall. The executive team at HUD has gone to great lengths promoting more opportunity for minority homebuyers, attacking discrimination and implementing rules to enforce discrimination violations. This leadership has been important and well received by civil rights and community housing advocates. But keeping the fees this high and thus overpricing FHA borrowers, especially now with rates rising so rapidly, hits this same constituency right in the wallet and is impacting affordability. Words are important, but actions matter more. Reporting on a HMDA data release, Market Watch reported that, "In the second quarter of 2019, the Black homeownership rate dropped to 40.6%, down seven percentage points from roughly a decade earlier," the lowest levels since the 1960s. The Urban Institute and other think tanks have written scores of white papers and research reports talking about the challenge of improving homeownership outcomes. This is a crisis in housing access and opportunity and it's time for HUD and the Biden administration to take action. Expanding opportunities for down payment assistance, looking at new methods to evaluate credit histories beyond FICO, getting some of the large banks back into the program, and making substantial progress in the housing supply challenge are all critical to this effort. But the most simple and helpful move can be done right now with just the stroke of a pen by mortgagee letter. Lowering the MIP will lower payments and improve the qualification ability of the FHA borrower and would have an immediate positive impact at a very challenging time in the market cycle. HUD needs to act now and lower the MIP. It's long overdue and as a former FHA Commissioner in the last Democratic administration, and as one who had to raise premiums to secure the fund, I can state now unequivocally that this is a different time and action is needed. The call is simple: lower the MIP and lower it now. David Stevens has held various positions in real estate finance, including serving as senior vice president of single family at Freddie Mac, executive vice president at Wells Fargo Home Mortgage, assistant secretary of Housing and FHA Commissioner, and CEO of the Mortgage Bankers Association. This column does not necessarily reflect the opinion of HousingWire's editorial department and its owners. To contact the author of this story: To contact the editor responsible for this story: The post Opinion: HUD needs to lower the MIP and do it now appeared first on HousingWire. |

| Inside the government’s feeble fight to end redlining Posted: 29 Mar 2022 08:31 AM PDT  Redlining is a five-alarm word in the lexicon of American racism, but it really has a quite specific definition: The denying of credit in non-white, particularly Black neighborhoods. The federal government was for redlining before it was against it, instituting color-coded maps of fast-changing metropolises for the better part of the 20th Century. And redlining is very much still around. How much? The racial homeownership gap is now wider than it was in 1890. What is not widely known is the role federal banking regulators play in letting this practice continue. The main law policing redlining is the 1977 Community Reinvestment Act, or CRA. These bank regulators only enforce the CRA when banks seek a merger or acquisition. The broadly written 1960 Bank Merger Act, which President Joe Biden's administration wants strengthened, also requires banking regulators to consider a merger's impact on the community. But the federal government's merger review process is, at the end of the day, a formality, if a sometimes time intensive and messy formality. The three agencies in charge of such reviews — the Federal Reserve, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency — have not denied a single bank merger in 15 years. And if these agencies were to find that a merger ran counter to public interest because of a bank's discriminatory lending practices, it's not likely anyone would know about it. Like the waitstaff at a country club to a patron whose card was declined, regulators alert banks, often in phone conversations, of the potential for a denial, well before any public exposure. Banks then quietly withdraw their application, rather than face a public denial. Ostensibly, the Biden administration has reversed decades-long executive branch indifference to the CRA. Senior administration officials claim that rooting out "modern-day redlining" is a top priority. In a joint news conference last September, officials at the Consumer Financial Protection Bureau, the Department of Justice and the OCC proclaimed a crack down on "digital redlining." And in a March interview with former president Bill Clinton, Department of Housing and Urban Development Sec. Marcia Fudge, called attention to the continued practice of redlining. "We still have redlining in this country," Fudge said. "We are looking at where we have failed with the CRA, and we know we have."  DOJ and CFPB can bring lawsuits against alleged housing discrimination. And HUD can bring lawsuits claiming bias in mortgage lending. These agencies, though, do not have a seat at the table when banks, during a CRA exam or undergoing a merger review, provide a voluminous account of their lending practices. They cannot, in other words, do what the Federal Reserve, OCC and FDIC can do: Compel depositories to catch up to nonbank lenders in their minority loan practice. Indeed, depositories' mortgage lending to minorities is far behind that of nonbanks, a cruel irony since nonbanks do not have community reinvestment obligations. With bank regulators reluctant to wield their power, community groups often take up the mantle, but with mixed results. Such inaction is of great frustration to fair lending advocates and also longtime experts on the issue, like Calvin Bradford, one of CRA's original authors. "It's white, male and fairly racist all the way through. There haven't been women involved in high levels of the [banking] agencies, and no minorities, until fairly recently," said Bradford, presently the principal of Calvin Bradford & Associates Ltd. "It's been a racist part of the government that doesn't care, because its view was: if you're going to make safe loans, you should make them to white people.” The CRA, then and nowFor more than half a century, the federal government has been officially trying to atone for its role in redlining, which by one estimate cost minority communities $156 billion in equity. Congress passed the Community Reinvestment Act 45 years ago amid public outrage that discrimination in lending had endured, even after enactment of the 1968 Fair Housing Act. But there was a catch. Nowhere in CRA is there mention of race. This is in contrast to The Fair Housing Act, which directs banks to both not discriminate and further housing opportunities to groups who faced historic prejudice. Instead, the law required federal agencies to assign banks one of four grades based on the curve of how the bank's lending to low- and moderate-income borrowers compared to their peers. The law also required banks to lend within their communities. In other words, a bank based in Philadelphia, where the plurality of the population is Black, should invariably lend to Black borrowers.  Fast forward to today, and there are questions about whether CRA gave precise enough guideposts. For example, researchers at the Urban Institute found that low and moderate-income is a poor proxy for people of color. The law's ambiguity on some matters may have been deliberate. "[Dem. Sen. William Proxmire] was good at counting votes, and this just squeaked through," said Bradford, of the then-chair of the Senate Banking Committee. "He knew it wouldn't if we put race in." "As a politician, he was right," Bradford said. "But communities were right that not putting it in allowed people to find this escape valve of low and moderate-income." Perhaps as a result of this race-neutral stance, even banks that the DOJ accused of redlining pass their CRA exams. "For banks that have a satisfactory CRA score, it's still possible for those same institutions to face public scrutiny for redlining actions," said Jason Keller, a CRA consultant at Wolters Kluwer who previously spent 20 years at the Federal Reserve Bank of Chicago. Trustmark Bank, for example, settled charges of redlining in the Memphis area for $5 million with the DOJ, the CFPB and the OCC in 2021. But Trustmark has twice received an "outstanding" grade, and five more times a satisfactory grade. Federal government lawyers assailed Trustmark for redlining in Hispanic and Black neighborhoods. Although half of Memphis' census tracts are majority-minority, Trustmark did not assign a single mortgage loan officer to any of its branches in those areas, the federal government said. KleinBank settled with the DOJ in 2018 over allegations of redlining. But the Minnesota-based lender received a satisfactory grade on its CRA exams in each of the four preceding exam years. And, months after the settlement, banking regulators approved Old National Bank's purchase of Klein. Old National itself was sued by a fair housing group for redlining in 2021. But that did not stop the Federal Reserve from approving Old National's acquisition of First Midwest Bancorp in January.  Overall, consumer reviews of Lyft drivers have more critical feedback than CRA exams. In 2021, two banks received a grade of substantial non-compliance. Eleven banks received the grade of "needs to improve." The rest — 358 banks in all — were handed grades of satisfactory or outstanding. In the past 30 years, out of nearly 80,000 CRA examinations reported by the Federal Financial Institutions Exam Council, fewer than 250 banks received a grade of substantially noncompliant. That's .3%. "It's the opposite of the fox guarding the hen house — the rooster is in charge of the hen house," Bradford said. "[Banking agencies] do not want to deal with discrimination, partly because if you say discrimination, you create liability to make people whole." This state of affairs has irked not just advocates of fair lending but other federal agencies that touch redlining. According to a report earlier this month from Inside Mortgage Finance, DOJ has taken to launching more redlining investigations without the prompting of the FDIC, OCC or the Federal Reserve. Meanwhile, depositories greatly lag non-bank mortgage lenders and credit unions – who are not subject to the CRA – when it comes to minority lending. A February report by the Urban Institute found that, in 2018 to 2019, banks made 23% of their owner-occupant home purchase mortgage loans to borrowers of color, compared to 31% made by nonbanks. And a Bloomberg investigation found that Wells Fargo, the largest depository mortgage lender in America, approved fewer than half of Black homeowners' refinancing applications in 2020.  Banks, the Urban Institute's Linna Zhu, Laurie Goodman, and Jun Zhu argue, became more risk-averse following the Great Recession. They also are originating fewer mortgages overall, and when originating federally-backed mortgages, lending proportionately less to borrowers of color than non-banks. "Many banks exhibit their risk aversion by imposing underwriting overlays," per the Urban Institute authors, "That narrows the Federal Housing Administration and government-sponsored enterprises' credit boxes and makes it more difficult for borrowers without pristine credit to secure a loan." Who watches the watchmen?Months ahead of a 2015 merger between Goldman Sachs and GE Capital Bank, counsel for Goldman Sachs asked top Federal Reserve officials for feedback, documents obtained by a public records request and reviewed by HousingWire show. These officials include Michael Hsu, then the deputy associate director of the Federal Reserve's banking supervision and regulation division and now interim head of the OCC, and Scott Alvarez, then the Federal Reserve's general counsel. Before any public announcement of the potential merger was made, Goldman Sachs officials and Federal Reserve staff exchanged more than 100 emails, met in person at least once, and had numerous calls, sometimes on weekends, to discuss the upcoming deal. When a news story broke ahead of the announcement, Goldman Sachs officials discussed the matter with their regulator. Goldman Sachs gave Federal Reserve officials a powerpoint presentation on the merger. After consulting with the Federal Reserve, Goldman Sachs decided to delay the merger announcement by several weeks. The emails show that Federal Reserve officials were on an informal, first-name basis with the investment bank's lawyers, and addressed Rodgin Cohen — an attorney at Sullivan & Cromwell — by his nickname, Rodge. Goldman Sachs and Sullivan & Cromwell did not return requests for comment. Government watchdogs, policymakers and legal scholars have all sounded the alarm over whether banking regulators act in the interest of the public, or the industry they regulate.  A 2019 report by the Government Accountability Office, the independent auditing arm of Congress, found numerous weaknesses in OCC's public service. Back in 2017, GAO, in another critical audit, recommended that the Federal Reserve collect employment data to effectively counteract the revolving door between banks and their regulator. The central bank has not done that. Another factor is what motivates bank regulators. Yes, regulators are legally obliged to assess CRA adherence. But their job – and arguably reputations – hinges on preventing bank collapses. “In the end, if a bank goes under, no one is going to praise regulators for having held them to a high CRA standard,” said Mark Willis, who spent 19 years overseeing the community development program at JPMorgan Chase. The Federal Reserve's funding structure is another clear-cut connection to the banking industry. The agency does not receive appropriations from Congress. Instead, it relies on fees from its investments, and fees from the services it provides to banks. All excess income from those fees go to the U.S. Treasury. Thus, to do well, the Federal Reserve depends on banks doing well, too. The Federal Reserve's structure, which is intended to limit political interference that would disrupt its mission, may also limit disruptions to the financial institutions it regulates. David Dworkin, a former U.S. Treasury official and State Department veteran during the twilight of the Cold War, compared the Federal Reserve Board to the Soviet Politburo. "A small group of independently powerful leaders who have risen through the ranks defers to a powerful chairman until they don't," said Dworkin, now president and CEO of The National Housing Conference, a D.C. nonprofit. The Soviet Premier — the Fed Chair, in this metaphor — had enormous power. But he depended on maintaining strong support among the party bosses. "Nearly all of that drama occurred behind the scenes, prompting an entire industry of 'Kremlinologists' who tried to figure out what happened in the inner sanctum of the Politburo," said Dworkin. "Anyone who tries to predict the actions of the Fed today will find that quite familiar." Federal Reserve Board chairs, meanwhile, draw power from their relationships with the presidents of the regional Federal Reserve Banks, Dworkin noted. Their boards are majority elected by representatives from banks. Business expenseIn January, the CEO of Indiana's second largest bank, which had settled charges of redlining with the DOJ in 2019, assured investors that an upcoming acquisition would sail through regulatory review. The reason? Instead of balking at the latest consolidation in the world of housing finance, community groups with a particular interest in advancing minority homeownership cheered the move. Mark Hardwick, CEO of First Merchants Bank, bragged on an earnings call that he was "setting an example" of how to work with community groups, and it was already paying off. One such group, the National Minority Community Reinvestment Co-Operative, which bills itself as a coalition of organizations "committed to addressing the socio-economic needs of minority communities," had written to federal regulators in support of its December 2021 application to acquire Level One Bancorp. "Al Pina, who leads the NMCRC, for the first time in his career endorsed a merger," said Hardwick on a company earnings call in January. Six months prior, opposition from Pina and other groups to a different bank merger had resulted in a $40 billion community benefits agreement. But the group voiced no such opposition to the First Merchants merger, for reasons that are unclear. (The NMCRC did not respond to requests for comment, and First Merchants declined to comment.) Less than three months after it had applied for regulatory approval, the Chicago Federal Reserve and the FDIC gave their blessing, the bank told investors in February. Terry McEvoy, managing director at Stephens, who provides investors analysis of First Merchants, said that bank investors are taking more notice of community groups of late. "Something has changed," said McEvoy. "Will we get to a point where a specific bank merger is not approved because of this issue? I'm not sure. To date, we've only seen delays." Community groups often seize on the review process to negotiate concessions from banks. In numerous recent cases, they have accused banks of redlining, sometimes in the form of a lawsuit. They have had some success. In the past year, community group opposition to mergers cost banks more than $100 billion dollars in community benefits agreements, according to an analysis of Home Mortgage Disclosure Act data. Top-10 mortgage lender US Bancorp, whose merger with MUFG Union Bank is now before the Federal Reserve, is currently in talks for a $100 billion, five-year community benefits agreement. But none of the community groups' efforts have yet killed a merger. Take the case of WSFS Financial Corporation, a Delaware-based bank that sought to acquire Pennsylvania-based Bryn Mawr Bank Corporation. Groups including the National Community Reinvestment Coalition, a Washington, D.C.-based nonprofit that has negotiated some of the largest agreements in recent years, accused WSFS of being behind its peers in minority mortgage lending. In Philadelphia, public mortgage data showed 26% of all mortgages went to people of color. But only 13% of those WSFS originated went to people of color, NCRC wrote to the Federal Reserve and the OCC.  However, WSFS, during the same time period and in the same geographic area, received an "Outstanding" on its most recent CRA examination — the highest possible assessment. "The bank demonstrated good geographic and borrower distribution of loans and excellent lending activity," the OCC wrote in its 2020 CRA exam. It added that WSFS' community development lending contributed to the outstanding rating, and it praised the bank for using "innovative and flexible lending products effectively." OCC regulators also wrote that they did not identify "discriminatory or other illegal credit practices that require consideration" for the CRA exam. Rave reviews aside, WSFS did have to answer to NCRC's assertions. To clear its name, the bank's lawyers wrote to the Federal Reserve that NCRC's "insinuation of poor lending performance to minority and LMI communities is unfounded." WSFS didn't deny it trailed its peers in lending to Black borrowers in the Philadelphia area. But it took issue with just how behind it was. In 2018 and 2019, it lagged other lenders in the area by only 3.82% by dollar volume, and 5.85% by number of loans originated to Black borrowers, significantly less than the NCRC's claimed disparity. WSFS wrote that it originated 138 mortgage loans – worth about $19 million – to Black borrowers, out of its total 3,609 mortgage loans, or about $765 million by volume in 2018 and 2019. The difference in its minority borrowing compared to its peers, the bank argued, was because it had fewer minority applicants. WSFS did not respond to a request to comment. This back-and-forth has played out numerous times in recent years. Each year, the Federal Reserve, in reports to Congress, provides statistics on its merger review activity. Its latest, in 2021, showed that while only 3% of mergers receive adverse comments, those that do face an additional 168 days of review, on average. But none of those reviews lead to a scotched merger. "The fact that the bank responds … means almost nothing to us," said Kevin Stein, deputy director of the California Reinvestment Coalition. "Conceptually it's a good thing. But it's not like we can't wait to see what they say." Reboot the CRABanking regulators are aware that redlining is festering, they say, and are working on it. "We are evaluating how public comments are addressed, including any allegations of redlining, as part of the OCC's current comprehensive review of the Bank Merger Act," an OCC spokesperson said.  "The FDIC takes allegations of redlining or other fair lending concerns very seriously during our review and analysis of any merger application," an FDIC spokesperson wrote. "As a general matter, a finding of a pattern and practice of illegal discrimination is inconsistent with a determination that the application meets the convenience and needs of the community." The Federal Reserve declined to comment. In July 2021, President Biden issued an executive order asking banking regulatory agencies and the DOJ to make a plan for the "revitalization of merger oversight." The order drew attention to the toll shuttering 10,000 banks over the past four decades took on minority communities, closures partly due to mergers and acquisitions. CFPB Director Rohit Chopra and FDIC Acting Chair Martin Gruenberg, then member of the FDIC Board of Directors (of which Chopra is a member), sought public input on bank mergers in December 2021. The two questioned whether a CRA grade of satisfactory is a sufficiently high standard for a merger approval, and even suggested CFPB personnel be formally consulted during a merger review. FDIC chairwoman Jelena McWilliams, though, found the seeking of public input on bank mergers too rash a move. McWilliams was overruled in her opposition to public comment, and subsequently resigned. At the same time, CRA may finally directly address race. An advanced notice of public rulemaking, spearheaded by Federal Reserve Governor Lael Brainard in October 2020, included a pointed question on racial inequality. "In considering how the CRA's history and purpose relate to the nation's current challenges," the notice read, "What modifications and approaches would strengthen CRA regulatory implementation in addressing ongoing systemic inequity in credit access for minority individuals and communities?" Brainard said the notice would "build a foundation for the banking agencies to converge on a consistent approach that has broad support." Brainard's notice, in turn, gave mortgage lenders clarity and predictability, according to trade associations representing them. But the notice also came amid squabbles among banking agencies over CRA revision. In 2019, the FDIC and the OCC proposed its own revised CRA rule, under the leadership of then-Comptroller Joseph Otting, but without the support of the Federal Reserve. Brainard sharply criticized the proposed rule. She said it was "more important to get the reforms done right than to do them quickly." (Brainard is consistent in her deliberate approach. There has not been an update issued on Brainard's 18-month-old advanced notice.) According to Hsu, the acting OCC comptroller, "in the not-too-distant future," federal banking agencies will take the iterative but significant step of a joint CRA notice of proposed rulemaking. "It will reflect the herculean efforts of staff from all three banking agencies, who have been working around the clock for months, building off each of their many years of practical experience with the CRA and thinking about how to make it better," Hsu said. Something's better than nothingFew community groups have the firepower of NCRC, which brought in nearly $40 million in revenue in 2020, in part from renting out two office buildings in downtown Washington, D.C.. But NCRC acknowledges it can only make a limited mark on combating lending discrimination. One challenge: The terms of the community benefit agreements obtained from banks are frequently not public.  "The system lacks any means for enforcing the agreements, most of which are obscured from the public, leading to questions of whether banks are holding up their ends of the deals," the St. Louis Business Journal reported. "What we've always argued is that these community benefits agreements should be bigger than they are, but we are constrained by the regulatory landscape," said Jesse Van Tol, CEO of NCRC. "Look, what the bank regulators have done has been bullshit, but I wouldn't want them to take over and say, 'We know what the community needs are.'" But for NCRC, a flawed community benefits agreement is better than none at all. Let's return to Delaware. WSFS refused to meet with the NCRC to negotiate, the community group said. Despite their opposition, the Federal Reserve unanimously approved the WSFS merger eight months after its application. There were no public conditions for the approval, and no community benefits agreement. One factor in the application sailing through was the bank's outstanding CRA rating. It was WSFS's ninth acquisition in 10 years. Horacio Mendez, a former banker who is now CEO of the Woodstock Institute, an affordable housing advocacy group in Chicago, is waiting to see if the CRA is strengthened to mention race. But Mendez wonders if even efforts within government to strengthen the anti-redlining law's teeth matter – whether the OCC, FDIC, and Federal Reserve civil servants who review bank mergers "take this seriously at all." "It's been my experience during the last CRA reform process that the agencies do not see themselves as social justice warriors," Mendez said. "They see their role as being the guardians of the safety and soundness of the financial system. By both word and action, it's been clear that making the financial system work for everyone is a side project." The post Inside the government’s feeble fight to end redlining appeared first on HousingWire. |

| HMDA: The top 10 FHA lenders by volume in 2021 Posted: 29 Mar 2022 05:00 AM PDT Origination volume for FHA-insured loans increased by 3% in 2021, growing from $324 billion in 2020 to $332.24 billion, an analysis of Home Mortgage Disclosure Act (HMDA) data by Polygon Research application HMDAVision found. Of the origination volume, retail lenders originated $276.4 billion worth of FHA loans, while wholesale lenders originated $57.64 billion. The top FHA mortgage originator by volume was Freedom Mortgage Corp., originating $25.5 billion worth of loans, a 16% decline from 2020. Rocket Mortgage came in a close second by volume, increasing originations by 54% year-over-year to $25.48 billion, while United Wholesale Mortgage came in third, originating $11.6 billion, a whopping 71% increase from 2020. Caliber Home Loans, acquired by New Residential Investment Corp. in 2021, came in fourth place, originating $10.2 billion worth of loans. Maryland-based Lakeview Loan Servicing nabbed fifth place, originating $8.1. billion, which was up 71% year over year. Fairway Independent Mortgage originated $8.1 billion, up 7% from 2020, while California based loanDepot's originations dipped by 1.25% from 2020 to $7.1 billion. Why lenders should implement automation sooner than later Now more than ever, there is a need to add automation tools into the loan origination process that help lenders see a return on investment. Presented by: DataVerifyTo round out the top-10 FHA lenders, Nationstar Mortgage originated $7 billion, PennyMac Financial originated $6.89 billion — an increase of 112.02% year-over-year — and CrossCountry Mortgage originated $6.7 billion worth of FHA loans. The HMDA data also revealed that the average FHA loan size in 2021 was $251,371, while the average interest rate was 3.03%. Wells Fargo, which originated $1 billion worth of FHA loans, had an average 3.37% interest rate on FHA loans in 2021, while Fairway Independent Mortgage had an average interest rate of 3.27%. loanDepot had an average interest rate of 3.23% for FHA loans and Nationstar Mortgage had average interest rates of 3.22%. Millennials made up 57% of applicants for FHA loans in 2021, with borrowers in the age bracket of 25 to 34 making up 28.1% of applicants, while borrowers ranging from 35 to 44 represented 28.9% of FHA applicants. Applicants in the 55 to 64 age bracket made up a mere 10.1%, HMDAVision shows. The post HMDA: The top 10 FHA lenders by volume in 2021 appeared first on HousingWire. |

| The big nonbanks stir up a non-QM turf war Posted: 28 Mar 2022 10:09 AM PDT  As the end of the first quarter of 2022 approaches, the expected blossoming of the non-QM lending space in the private label market is well underway. Some three dozen non-QM securitizations sponsored by about two dozen different entities have made their way to bond-rating firms so far in 2022. This year's non-QM volume numbers are impressive, up nearly threefold over the first three months of this year, compared with 2021. The figures are drawn from the prime and nonprime (or non-QM) residential mortgage-backed securities deals tracked by Kroll Bond Rating Agency (KBRA). Year to date as of March 25, a total of 29 non-QM securitizations were completed or underway valued at $12 billion, compared to 17 deals valued at $4.8 billion over the first full three months of 2021, the most recent KBRA's data show. An additional eight non-QM securitization offerings were active over the first three months of this year as well but didn't show up among the deals tracked by KBRA — although they were rated by other agencies, such as Fitch Ratings. If those eight non-QM private label transactions are added into the mix, the total number of deals over the period rises to 37 valued at $15.2 billion. With mortgage rates now hovering around 5%, compared with 3% or lower for much of last year, the low-hanging fruit of the refinancing market is now pretty much picked over. Consequently, the hunt is on for opportunities in the purchase market, and that's why non-QM lending is expected to become a sweet spot in the mortgage market, according to industry observers. In fact, executives at several legacy lenders in the non-QM market said they fully expect competition in the space to heat up across the mortgage arena. "Everyone, in one form or another, will look into the non-QM sector [in 2022] and figure out where their tolerances are in terms of trying to do the business, and across the board that will happen," said Thomas Yoon, president and CEO of non-QM lender Excelerate Capital, based in Newport Beach, California. "I think the mega-platforms, like the loanDepots, Rocket Mortgages and UWMs — they will get into non-QM, but they will do it in a very small sector because of the manual nature [of underwriting non-QM loans] and the expertise needed. "It’s virtually impossible for them to do that at scale," Yoon added. "They would have to reinvent a different department, a different company to actually do that properly." The sponsors and loan aggregators in the private label securities (PLS) deals that have come to market so far this year include affiliates of real estate investment trusts, private equity firms as well as more familiar names in the non-QM space, such as Verus Mortgage Capital, Ellington Financial, Angel Oak and Deephaven Mortgage. Not on the list of PLS dealmakers so far are the large, publicly traded originators that Yoon referred to, like United Wholesale Mortgage(UWM) or Homepoint — both of which recently announced new non-QM product launches. UWM recently rolled out bank statement loans targeting the self-employed as well as investor loans. Likewise, Homepoint is unveiling bank-statement loans as well as non-QM cash-flow loans for real estate investors. (Several other big nonbanks have investor loan products as well.) Non-QM mortgages include loans that cannot command a government, or "agency," stamp through Fannie Mae or Freddie Mac. Non-QM loans typically make use of alternative-income documentation because borrowers cannot rely on conventional payroll records or otherwise fall outside agency credit guidelines. The pool of non-QM borrowers includes real estate investors, property flippers, foreign nationals, business owners, gig workers and the self-employed, as well as a smaller group of homebuyers facing credit challenges, such as past bankruptcies. "Non-QM guidelines iterate on a quarterly basis, sometimes on a monthly basis," Yoon said. "Unlike agency loans that stay pretty stagnant for a period of time, non-QM is ever-changing as the market evolves. "So, that requires a lot of manpower and expertise. Imagine a mega-platform having to dive into that and move. It would be virtually impossible." Unlike the smaller nonbank lenders and investment firms specializing in non-QM lending, however, large platform lenders like UWM and Homepoint have a different agenda in pursuing that market. They see non-QM as an expansion of the product menu, not the main course. "I think people talk about non QM because it’s something different, but … run the numbers … and you’ll see that it’s like less than 5% to 10% of business," said Mat Ishbia, president and CEO of Pontiac, Michigan-based UWM, in a recent HousingWire podcast interview. "…We're not going to be doing $30 billion in non-QM, but at the same time, if it moves the needle a little bit and helps brokers succeed, then we’re going to do it." Will Pendleton, senior managing director and head of the non-agency segment for Ann Arbor, Michigan-based Home Point Financial, which does business as Homepoint, offered a similar take on why the lender is expanding its reach in the non-QM market. In a recent online interview, Pendleton agreed with Yoon in describing non-QM lending as "a very complex product set." A major goal for Homepoint in expanding in the segment, he added, is to "nurture and protect" its relationships with its business partners, which include brokers, and to be a "one-stop shop" for them "to capture more of the marketplace." "When you trust us with your loans, we’re going to deliver great service and execution, even if we have a very complex product set, and let's face it, non-QM products are inherently complex," Pendleton said. Spokespersons for UWM and Homepoint each said company executives did not wish to comment further for this story. For smaller shops specializing for years now in non-QM lending, the story is different. Non-QM loans are their lifeblood, not a simply a segment of a much larger product mix. "The vast majority of the borrowers we offer financing solutions to are self-employed borrowers that are in small businesses," said Mack Walker, vice president of capital markets for Deephaven Mortgage, a longtime non-QM lender based in Charlotte. "So, each business is slightly different and has a different story to tell there. You need underwriters with the experience to get in there and understand the story." For all of 2021, based on KBRA's tracking, non-QM securitization volume hit about $27 billion, with volume estimates for this year expected to double. Several lenders in the non-QM space late last year forecasted a 2022 non-QM market just north of $40 billion. Based on the pace of deals so far in 2022, that $40 billion estimate could end up well shy of the actual yearend mark. The PLS market mirrors some, but not all, of the origination activity in the non-QM mortgage origination market. Still, it's a good indicator of the direction of the market, and some three months into the year, non-QM PLS deals accounted for nearly 50,000 mortgages based on the size of the loan pools in those deals. Given the self-employed who are part of the gig economy represent anywhere between 11% to a third of the U.S. workforce, depending on the source of the analysis, it appears there's still plenty of room for the non-QM market to grow. As more lenders jump into the non-QM space, regardless of whether their goals are to bolster product offerings or to focus exclusively on that growing market niche, it seems clear borrowers will have plenty of options to choose from in the coming year. And lenders will have plenty of opportunity ahead. Manish Valecha, head of client solutions at Angel Oak Capital, part of Atlanta-based Angel Oak Cos., another veteran non-QM lender, says the non-QM market "as a percentage of the overall market is about 10% to 12% in a normalized environment" — adding that was the size of the non-QM market in the early 2000s, prior to the global financial crisis. That means the potential size of the non-QM market today, according to Velecha's calculations, is about $175 billion to $200 billion. "There’s lots of people that I refer to as dipping their toes into non-QM, and there’s good and bad about it," said Tom Hutchens, executive vice president of production at Angel Oak Mortgage Solutions, also part of the Angel Oak family of companies. "The good part is that it absolutely increases the exposure of non-QM to a broader swath of the market, but the downside is that it’s hard to dabble in non-QM. "Agency [Fannie Mae and Freddie Mac] loans can be thought of as click a button and get a mortgage. Well, that's not the case with non-QM. You don’t click a button and get mortgage." The post The big nonbanks stir up a non-QM turf war appeared first on HousingWire. |

| You are subscribed to email updates from Mortgage – HousingWire. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment