Mortgage – HousingWire |

- Red flag: Guild finds gaps in internal controls

- Cash-out refis starting to slow despite equity gains

- Mike Simonsen: How rising rates impact the housing market

| Red flag: Guild finds gaps in internal controls Posted: 14 Mar 2022 01:12 PM PDT  The parent company of California-based Guild Mortgage reported on Monday it has identified material weaknesses in its internal control over financial reporting, according to its annual 10K document filed with the U.S. Securities and Exchange Commission (SEC). The nonbank lender said it did not have sufficient staff with the experience to design and operate its controls over financial reporting. In addition, the company did not perform an effective risk assessment, including the risk of fraud. "This resulted in ineffective general information technology controls over user access and change management within the general ledger and loan systems," the company said. KPMG, Guild's independent accounting firm, indicated the problem in its report about the company's consolidated financial statements. So far, the gap in control risks has not resulted in misstatements to the financial statements, but it could in the future, Guild said in the 10K report, which is required for publicly traded companies. Guild’s top executives mentioned the gaps in its control risks during a conference call with analysts on March 10. They said there's been no impact on the financial statements: controls were in place but not appropriately documented. Guild said it has decided to adopt some measures to address the problem. Among these measures are hiring additional finance, accounting, and IT staff; enhancing risk assessment; designing and implementing controls to formalize roles and responsibilities; and regularly reporting the remediation plan to the audit committee. However, the company said they "cannot assure you that the measures we have taken to date and may take in the future, will be sufficient to remediate the control deficiencies that led to the material weaknesses in internal control over financial reporting or that they will prevent or avoid potential future material weaknesses." The document also mentioned that management excluded Residential Mortgage Services (RMS), acquired in July, from the assessment of the internal control effectiveness. Maine-headquartered retail lender RMS represented 5% of the assets and 7% of the consolidated net revenue last year. Guild reported on Thursday $36.8 billion in origination volume in 2021, up 5% from 2020. The company's net income declined to $283.8 million in 2021 from $370.6 million in 2020, a 23% decrease. The post Red flag: Guild finds gaps in internal controls appeared first on HousingWire. |

| Cash-out refis starting to slow despite equity gains Posted: 14 Mar 2022 01:01 PM PDT Mortgage origination activity took a major hit in February, with rate hikes squeezing out refinance activity, both for rate-term refis and cash-outs. Overall origination activity in February was down 5.4% from January, according to the latest monthly Mortgage Monitor report from Black Knight. Purchase locks, which are not as rate-sensitive as refinancings, were up 7.2% in February over the prior month, with volumes up 5.6% from the same time last year. But larger macroeconomic forces significantly depressed interest for refis. According to Black Knight, rate-term refi originations were down 34.1% from January and cash-out refis fell 15.3%. Overall lock activity was down 34.5%. The mix of refi volume fell to just 35%, the lowest point since May of 2019, when interest rates were at a comparable level – just above 4%. "Driven by Fed policy and exacerbated by global instability, we've seen the spread between 30-year conforming rates and 10-year Treasury yields climb more than 40 basis points in just three months, topping 2.25% in February," said Scott Happ, president of Black Knight’s Optimal Blue division. Rate-term refinance lending activity was down for the fifth consecutive month – falling to the lowest level in three years – and is down 80% from 2021 levels. Cash-out locks – which have been somewhat insulated due to strengthening home values, were down 6.3% over last year. Cash-out refis had a current value of 49 (total volume indexed to 100 in February 2018) and rate-term refis had a current value of 22, while purchase was at 132 in value in February. The refi pull-thru fell to just 68.6%, according to Black Knight. "While refinance activity took a hit in February due to sharp rises in conforming rates, purchase lending rose again on strong homebuyer demand," Happ said in a statement. "The 7.2% month-over-month increase in purchase locks pushed February purchase volumes up 5.6% from the same time last year. The average home loan amount continues to climb in the face of rising home prices and tightening affordability. Indeed, February's $6,500 jump pushed that average to just under $354,000. In turn, nonconforming products – including both jumbos and loans with expanded guidelines – accounted for a full 17% of the month's lock activity." Black Knight found that rate lock volume declined the most in the San Diego-Carlsbad, CA region, down 17.6% from the month prior. That market had the highest share of refis in the country at 45%, largely on the basis that home values had accelerated so greatly. Las Vegas-Henderson, Paradise, Nevado had the highest increase in rate lock volume, at 3.7%. The post Cash-out refis starting to slow despite equity gains appeared first on HousingWire. |

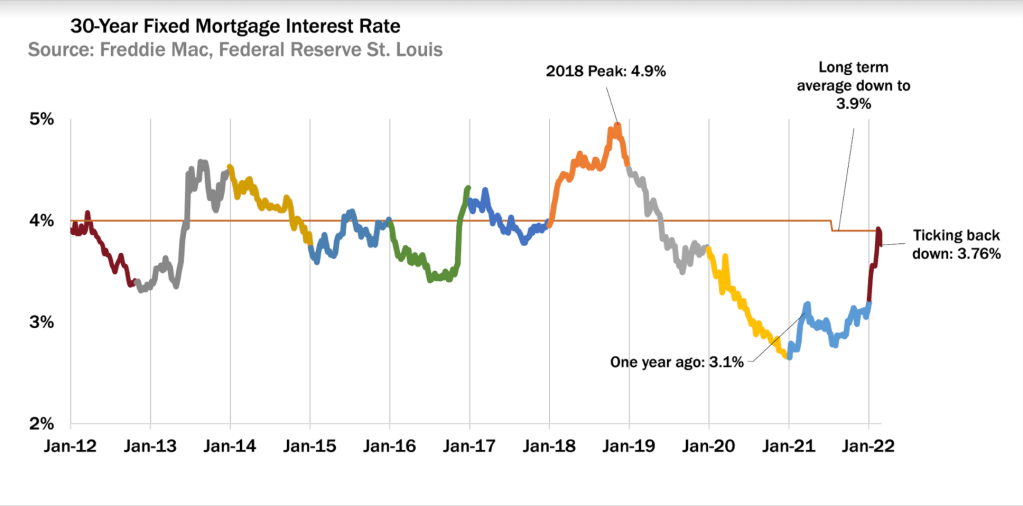

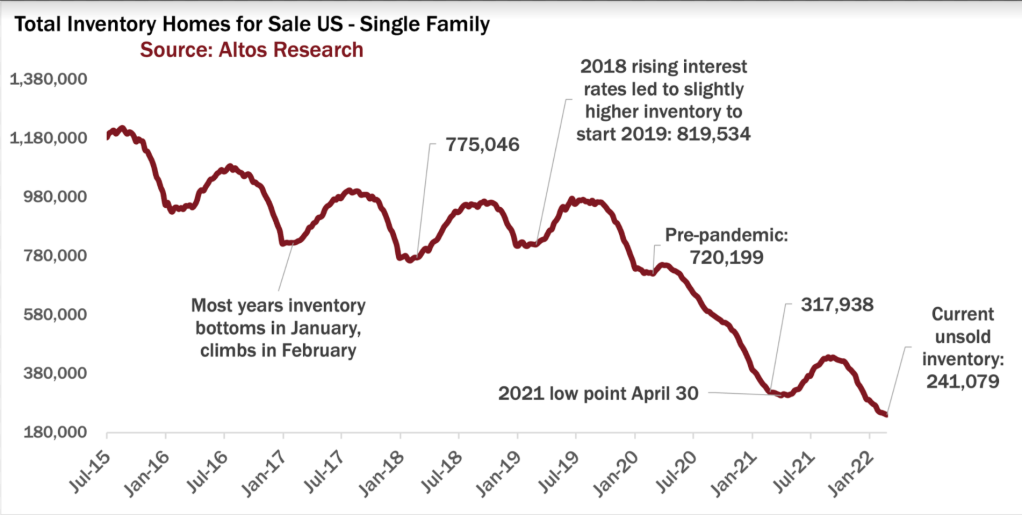

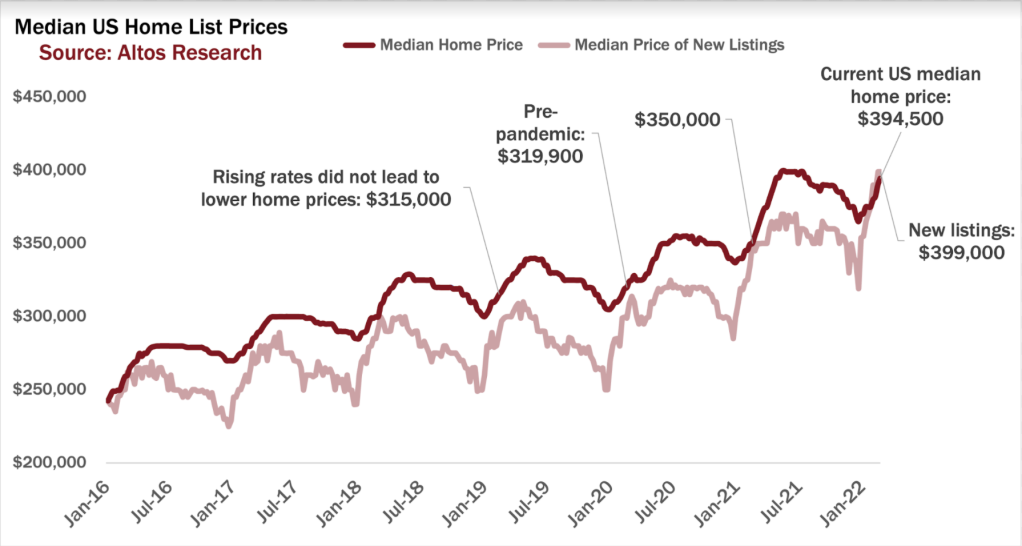

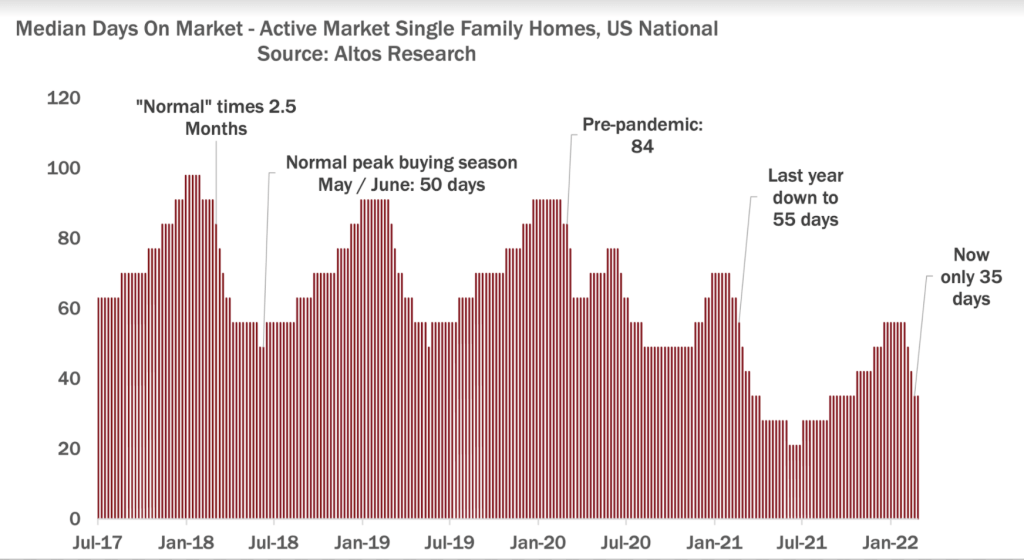

| Mike Simonsen: How rising rates impact the housing market Posted: 14 Mar 2022 09:16 AM PDT  One of the biggest questions in real estate right now is how rising interest rates will impact the housing market. This used to be a pretty easy question to answer: when interest rates go up, it costs more to purchase a home, and demand drops. Price appreciation slows, and homes take longer to sell. More expensive money also meant fewer investors holding homes so inventory would climb too. This year, the numbers aren't that straightforward. The market has been so hot, many worry that rising rates will finally be the catalyst to pop the bubble. Yet, even as rates have begun to climb, homes are still flying off the market nearly three times faster than before the pandemic. The price of new listings continues to rise, which is a very bullish indicator for sales prices in the coming months. Americans have been lined up to buy homes for so long that increased costs haven't deterred any demand… at least, not yet. That being said, if interest rates continue to rise, we may see some small shifts in the market, and a short window of opportunity for eager buyers.  Fortunately we have 2018 as a guide to understand the impact of rising interest rates on the housing market in 2022. From September 2017 through November 2018, the 30-year mortgage rate rose from 3.8% to 4.9%, which was the highest point in the whole decade. Based on the patterns from 2018, here's what to expect, and the most important signals to watch: 1. Inventory will inch up… but not much.  In the 2010s, as interest rates remained low, more and more Americans became real estate investors, and available inventory of homes for sale dropped every year. That trend reversed for a short time in 2018 when mortgage rates rose, and in 2019 we began the year with 7% more inventory than in the previous year. If interest rates climb above 4.5%, we're likely to see this pattern repeat, which would add some more listings to inventory. But because nearly all American homeowners have a 30-year fixed mortgage below 4%, most will choose to hold onto that mortgage instead of selling. 2. Home price growth will slow, but don't expect prices to drop. With so much demand and rapidly shrinking inventory, home prices have continued to rise in Q1, even with higher interest rates. The median home price for single family homes this week is $394,500, which is about 12% higher than last year at this time. Other leading indicators of home prices in the data are all bullish for future transaction prices. Let's look at what happened in 2018: even as interest rates rose and payments got more expensive, this didn't result in any price drop. In fact, the median home price rose from $299,000 in early 2018 to $319,000 one year later. Why? Because in real terms, those mortgage payments were still a good deal.  Also, you can't fight demographics. In 2018, demand was accelerating as Millennials moved into prime home-buying years. This is just as true today and will remain true further into the 2020s. As a mortgage lender recently told me about his first-time home buyer business, "life events don't care about mortgage rates." And let's not forget the effect of inflation. "Real" interest rates are the difference between inflation rates and mortgage rates, and in the inflationary economy of 2022, real interest rates are negative. Inflation is currently running at 7% annually. If your mortgage is at 3%, 4%, or even 6%(!) you're still in a better financial position than you were last year. 3. Homes will take a little longer to sell. In a "normal" market, we generally expect it to take an average of 80-100 days to sell a home; over the past two years, that's dropped to just 35 days. In fact, according to Altos Research data, one-third of homes are now sold in hours or just a few days.  If prices and mortgage rates continue to rise, we're likely to see the breakneck pace of the market slow down a little bit. There will be a little less competition. Buyers may be able to take their time and do full diligence on a house and not have to make an offer that afternoon. We will also likely see price reductions start to tick up, because more people who overprice their home won't be getting those immediate offers. Of course, these numbers may look different depending on the location, and investor-heavy markets such as Phoenix will likely be more sensitive to interest rate changes. Deals get less appealing when money gets more expensive. Look for slightly more inventory, slightly longer market time in these markets. So to sum it all up: as we enter into spring, while all the leading indicators continue to show robust demand, rising interest rates could have a small cooling effect on the market. Buyers should move quickly during this window of opportunity. If history is any indication, it won't last for long. Mike Simonsen is the Founder and CEO of Altos Research. The post Mike Simonsen: How rising rates impact the housing market appeared first on HousingWire. |

| You are subscribed to email updates from Mortgage – HousingWire. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment