Mortgage – HousingWire |

- Mortgage rates blow past industry predictions

- As the market shifts to purchase, LOs get creative

- Will rising interest rates impact VA loans for first-time homebuyers?

- Mr. Cooper, Sagent to jointly build cloud servicing platform

| Mortgage rates blow past industry predictions Posted: 11 Feb 2022 01:58 PM PST Some mortgage rate indices topped 4% on Thursday, blowing past predictions that rates might reach those levels by the end of 2022. Economists had predicted rates would rise as the overall economy stabilized. The latest mortgage rate survey from Freddie Mac puts rates for the 30-year fixed-rate mortgage at 3.69%, while the average rate in the latest mortgage application survey from the Mortgage Bankers Association was 3.83%. Other indices put mortgage rates even higher. Black Knight‘s Optimal Blue, which provides data for the secondary market, reported the average rate for 30-year conforming mortgages was 4.071% on Friday morning. It reported the 30-year rate for FHA-insured mortgages was even higher, at 4.122%. Joel Kan, associate vice president of economic and industry forecasting, at the Mortgage Bankers Association said rates could head even higher in 2022. "If conditions stay in the current state, we'll certainly see higher rates," said Kan. "But it's also useful to know that we've seen rates drop pretty quickly if there is some other kind of economic news that's unexpected." Rates could quickly head in the other direction, Kan said, "if something abroad rocks the boat," such as an armed conflict with Russia and Ukraine, an emergent Covid variant, or a sudden change in certain commodity prices. Mortgage rates declined at the onset of the Delta variant, although the effect on mortgage rates was less pronounced with the Omicron variant. Sponsored Video "Bad news for the general economy is paradoxically good for the housing market in so far as rates would decline," said Len Kiefer, deputy chief economist of Freddie Mac. Few industries are as impacted by market fluctuations as housing. The current higher rates — an increase of nearly 50 basis points over the past month — will lead to "an enormous contraction of refinance activity," Kiefer said. On the ground, that means that lenders' gain on sale margins will contract, as originating purchase mortgages is more costly than refinances. Margins have already fallen in the case of Wells Fargo and loanDepot. And it means that lenders, many of whom ramped up hiring in the past two years to keep up with demand for refinances, are now shedding loan officers. Randy Howell, president of Mortgage Power Inc., expects the layoffs trend to intensify in light of higher rates. He also pointed out that originators, who may feel "desperate" in the current environment, might cut corners. LOs are "going to lower their standards of ethics and try to get things past underwriters," he said. And while overall, the share of refinances will drop, they will not disappear completely. Gary Hughes, LO at RPM Mortgage Inc., said there may even be a rush of borrowers who refinance before rates go even higher, to "try and cap the ‘hurt’ from missing out on lower rates." Higher rates are seen as bad news for many parts of the mortgage market. But two categories are not as susceptible to higher interest rates: cash-out refis and home equity lines of credit. "Those are two business channels right now that will probably flourish for the rest of the year, because there’s a lot of equity-rich homeowners out there," Hughes said. "They may want to leverage that money and realize that 4% or 4.5% is still better than what they might get elsewhere." The post Mortgage rates blow past industry predictions appeared first on HousingWire. |

| As the market shifts to purchase, LOs get creative Posted: 11 Feb 2022 11:42 AM PST  Maryland has over a dozen Eastern European stores that sell products like caviar, pumpernickel bread and salo, a Ukrainian-style bacon. Apart from selling produce that is popular in former Soviet countries, these stores represent a marketing opportunity for Alex Naumovych, a loan officer at Draper and Kramer Mortgage Corporation. Just before a customer buys a container of pre-made Borscht, they see Naumovych's business cards and flyers that lay neatly near the checkout area. This advertising strategy, among a handful of others, has helped the LO connect with Russian-speaking Realtors and win the business of borrowers from former Soviet countries. "I have my business cards everywhere because the more people that see your cards and face, the better," Naumovych said. "Borrowers have called me from seeing my advertising in the stores and a couple of Realtors, too." According to the Mortgage Bankers Association's yearly forecast, purchase mortgage originations are expected to grow by 9% to $1.73 trillion in 2022, while refinance origination will dip by 62% to $860 billion from $2.26 trillion in 2021. The reasons for the dip in refis this year, the trade group said, will stem from higher mortgage rates –which have already eclipsed 4%, faster than the projections— and fewer eligible homeowners. With the market shift, LOs whose businesses were mainly driven by refinances in 2020 and 2021, must quickly shift gears and figure out ways to bring in purchase leads. LOs interviewed by HousingWire say that they have actively ramped up their attempts to connect with prospective borrowers and real estate agents. Some LOs are making inroads with potential clients through use of social media, leaning on their multilingual skills and doing old fashioned cold calling. Meanwhile, others worry that they will soon wash out of the industry. TikTok, Facebook and LinkedIn Christian Hernandez, vice president of mortgage lending at Guaranteed Rate, has leaned heavily on social media platforms to generate new leads and build relationships with borrowers and real estate agents. In a TikTok video with "Call Me Maybe" playing in the background, Hernandez, who's based out of Arizona, includes subtitles that have her contact information instructing borrowers to reach out to her. The mortgage-related content that she makes on her TikTok is then uploaded to her LinkedIn and Facebook profile. Hernandez said that about 30% of her leads flow in from her social media outreach. "I actively use social media and I have built my brand this way," Hernandez said. "Once I saw how easy it was to generate content through TikTok and use voice-overs and music, I started connecting with people on an emotional level." She added, "The mortgage process can be very intimidating for people and especially right now, there is so much competition. But by putting myself out there and connecting my face to the name and showing borrowers that there is an actual human being with emotions that has had an impact on my business. The power of being multilingual Naumovych in an interview with HousingWire said that he uses his connections to the Eastern European diaspora and his knowledge of the Ukrainian and Russian language to generate new leads. The LO markets himself at Ukrainian-owned businesses, the Ukrainian Orthodox Church and at Ukrainian festivals, which happen every year in Silver Spring, MD. "I have my own booth at the festival," said Naumovych. "During the festival last year, 40 people gave me their contact information and I've been in touch with them. The pastor of the Ukrainian church is currently looking to buy a house and I'm working on his pre approval." Fahad Janvekar, an LO at Fairway Independent Mortgage, speaks Hindi and Urdu and relies on a "fixer" in his community to connect him with prospective borrowers. "This guy is a fixer, and he fixes people's problems, whatever they are," said Janvekar. "He's great at recalling people and he directs me to talk to people that may be looking for a mortgage in the community." Hernandez, who speaks fluent Spanish, also said that she uses her multilingual capabilities to connect with more borrowers. However, she noted that she doesn't limit her outreach to only the Hispanic diaspora and wants to be inclusive. Finding business the traditional way And though there are many creative avenues to get purchase business, cold calling and appearing at open houses to connect with real estate agents is here to stay, LOs told HousingWire. A sales manager, who requested anonymity, said that he helps newbie LOs by reviewing their strategies to pull in business at open houses. Additionally, he said that he helps his LOs clean up their social media pages and sets up plans for them to be more active in marketing themselves. "There’s a million places you can get business,whether it’s social media, online networking in person networking, realtors, financial planners, it’s finding, where you haven’t explored yet," said the manager. Janvekar on the other hand, who has been an LO for over a year, reaches out to human resource personnel and benefits managers at mid-tiered companies that don't have "a full-fledged relocation set-up." "I'm getting on their radar and consistently communicating with them and introducing myself," Janvekar said. "My strategy is different and it's a slow burn strategy." Janvekar hopes to see the fruit of his labor come to fruition in the spring and summertime when borrowers are most likely to move. However, some newcomers to the industry haven't been lucky in growing their book of business. La Toya Davis, LO at mortgage broker shop Right Now Mortgage, LLC, said that in her year as a certified LO, she has not had the guidance she believes is necessary to be successful in a purchase market. "It has been very, very slow," said Davis. "I posted a few times on Facebook and was connected with a Realtor and we closed four purchase deals with her since I started with the company." However, Davis' relationship with the agent turned sour and she has not yet been able to develop relationships with other agents. "I'm in the process of going to work for a new company where they will train me and teach me the tools of how to be a successful loan officer," she said. The post As the market shifts to purchase, LOs get creative appeared first on HousingWire. |

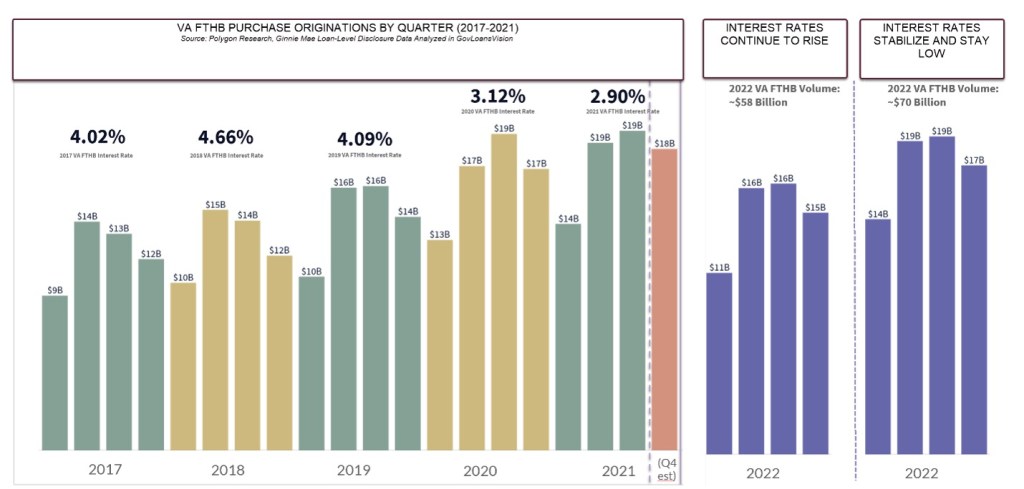

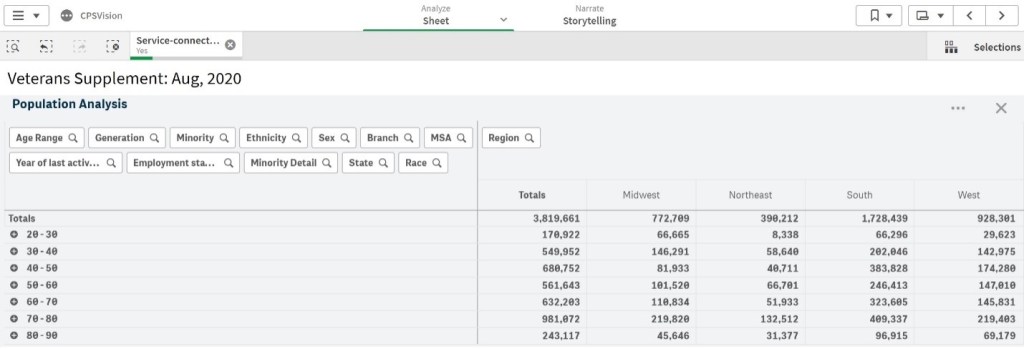

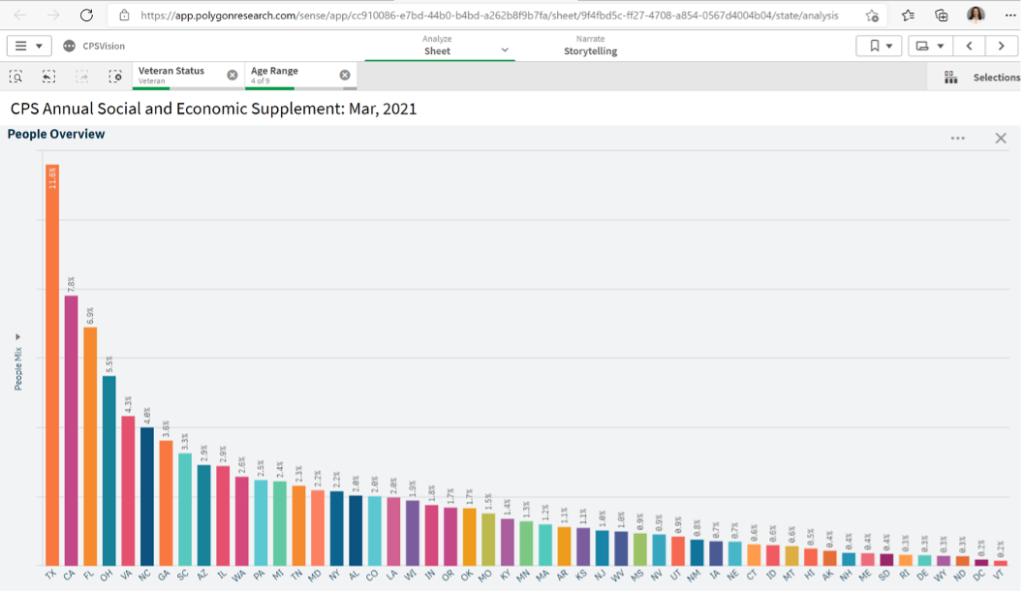

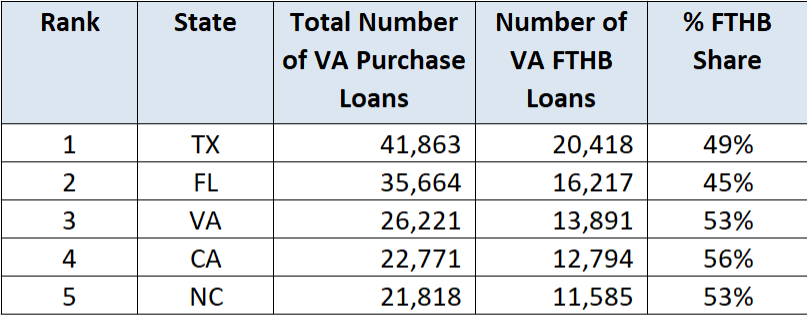

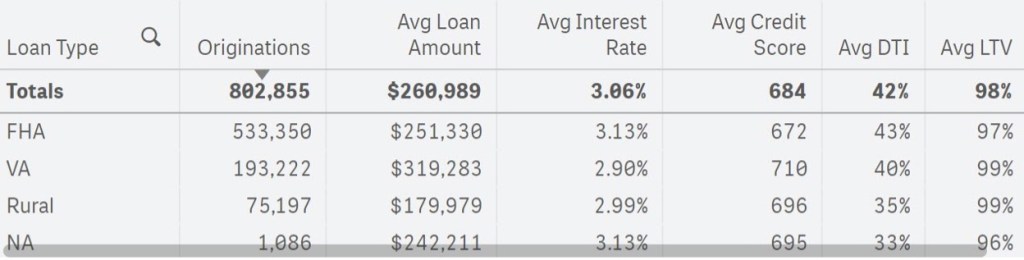

| Will rising interest rates impact VA loans for first-time homebuyers? Posted: 11 Feb 2022 11:09 AM PST The VA loan is an important financing tool for VA-eligible borrowers to achieve their homeownership dream. In 2021 one in two VA borrowers was a first-time homebuyer (FTHB). Last year, mortgage interest rates reached record lows. The average VA FTHB's interest rate was 2.90% and the quarterly FTHB VA purchase loan volume stayed elevated. In Q3 2021, it reached a record level of over $19 billion for that quarter, $174 million higher than Q3 2020. And since 2017, VA purchase loans helped roughly 200,000-230,000 VA-eligible first-time home buyers per year become homeowners. This translates into an average of $56 billion in mortgage originations per year. In 2021, the VA FTHB segment reached an estimated $69 billion, according to Ginnie Mae loan-level disclosure data updated through January 2022, analyzed in GovLoansVision. So, what will 2022 look like for the VA FTHB borrowers?Our scratch pad calculations tell us that if interest rates continue to climb, we might see a lower VA FTHB volume of around $58 billion in 2022. On the other hand, if rates stabilize and stay in low to mid 3's, we might see the VA FTHB purchase volume at $70 billion in 2022. Figure 1: VA FTHB Purchase Originations Forecast Source: Polygon Research. Forecasts are updated monthly. What is the Size of the VA Borrower Addressable Market?VA FTHB borrowers will mostly come from the U.S. Veteran population (with the rest from current service members and eligible veteran family members). The U.S. Veteran population stood at 18.44 million in 2020 with median age of 68 years old, according to CPS Veteran Supplement (2020), analyzed by Polygon Research in CPSVision. To narrow the sizing of the VA Borrower Addressable Market, we investigate two subsegments: Veterans with service-related disability and Veterans 50 years-old or younger. In 2020, 3.82 million Veterans had service-connected disability, making them eligible for a wide range of benefits, including waiver of VA funding fee on a mortgage loan. Figure 2 provides a breakdown of these Veterans by age range and location. Figure 2: Veterans with Service-Connected Disability by Age Range and Geography (Region) Source: Polygon Research, CPSVision, Veterans Supplement August 2020 Loan originators can educate themselves about the Veterans with service-related disability in their communities and markets and look for opportunities to provide high quality education and financing in an efficient and transparent manner. Broadening the scope to include all Veterans within a certain age range regardless of disability status, we estimate that about 4 million Veterans are under the age of 50, with a median household income of $91,400 according to March 2021 ASEC. (source: Polygon Research, CPSVision). Figure 3: Distribution of Veterans 50 Years–Old or Younger by State  Source: Polygon Research, CPSVision, ASEC March 2021 This statistical distribution of Veterans (50-years or younger) by state in Figure 3 closely follows the VA FTHB purchase mortgage originations data found in the Ginnie Mae loan-level disclosure data. The top five states for Veterans who were first-time home buyers and used VA purchase loans to buy homes were TX, FL, VA, CA, and NC – Figure 4. Figure 4: Top 5 States by Number of VA FTHB Borrowers Source: Polygon Research, GovLoansVision updated through January 2022 What was the credit profile of VA First-Time Home Buyers? In 2021, the average VA first-time home buyer had a credit score of 710, DTI of 40%, borrowed 99% LTV loans of $319,000 at 2.90% (see Figure 5). VA FTHB borrowers had higher credit score and lower DTI than FHA FTHB borrowers. In the Vetted VA community, as a controlled sample, the average VA purchase borrower (both FTHB and repeat) had a credit score of 717 and a DTI of 40.7% and borrowed 98% LTV loans of $394,000 at 2.69%. Figure 5: 2021 First-Time Home Buyer Purchase Originations Source: Polygon Research, GovLoansVision, updated through January 2022 Given the good creditworthiness of VA borrowers, and especially first-time homebuyers, and given the size of the VA FTHB lending market – an estimated $58B to $70B – loan originators and companies may find VA lending as an excellent business opportunity in 2022. But with this opportunity comes a great responsibility – providing the highest service to our Active Duty, Veterans, and their spouses, and protecting them from abusive lending practices. Understanding the VA-eligible borrower and understanding the financing tools to serve their credit needs is not only an ethical thing to do, but also a necessary professional skill in order to achieve scale and profitability. Data: VA First-Time Home Buyer (FTHB) Borrower is the actual reported data found in Ginnie Mae loan-level disclosure data sets containing 800 million+ rows and modeled in GovLoansVision by Polygon Research. Veteran analysis is extracted from CPSVision, which includes monthly CPS data through December 2021, the ASEC of March 2021, and the Veteran Supplement of August 2020. Statistical records of 325+ million people and 127+ million households.• Forecast are updated monthly. Nathan Knottingham is the COO of Vetted VA. This column does not necessarily reflect the opinion of RealTrends' editorial department and its owners. To contact the author of this story: To contact the editor responsible for this story: The post Will rising interest rates impact VA loans for first-time homebuyers? appeared first on HousingWire. |

| Mr. Cooper, Sagent to jointly build cloud servicing platform Posted: 11 Feb 2022 10:19 AM PST Mr. Cooper, one of the nation's top servicers, and Sagent, a loan servicing software developer, announced on Friday that they will join forces to create a cloud-native servicing platform. The definitive agreement reached by both parties stipulates that Mr. Cooper will sell certain intellectual property rights related to its proprietary, cloud-based technology platform for mortgage servicing to Sagent. Meanwhile, Mr. Cooper will receive a minority equity stake in the fintech company. Additionally, under the terms of the agreement, Jay Bray, CEO of Mr. Cooper, as well as Chris Marshall, vice chairman of Mr. Cooper Group, will have a spot on Sagent's board. According to a joint press release, Sagent will integrate Mr. Cooper's consumer-first platform into a cloud-native core and then will license the resulting cloud-based servicing platform to banks and independent mortgage companies. The fintech company said that it expects the servicing platform to be ready for marketing by 2023. Bray noted in a statement that the partnership – which will last for seven years- will "[accelerate] the future of mortgage servicing software." Building the next generation of tech: Three ways to digitize home lending It is important to accept that digitalization is inevitable – customers are already hooked and there is no going back. The home lending industry has a massive opportunity to digitalize to create efficiencies and to deliver a simpler end-to-end user experience that would benefit both borrowers and servicers. Presented by: Mr. CooperBray added: "This agreement also provides us with meaningful efficiencies and allows us to accelerate our development of customer-facing applications that will delight our customers with personalized, friction-free solutions." In August 2021, Sagent also announced a partnership with fintech lender Figure Technologies. Sagent said last year that it will power Figure's mortgage servicing and help the lender accelerate its "transformative blockchain vision." In an earnings presentation on Friday, Mr. Cooper reported $155 million in net income in the fourth quarter, down 48.2% sequentially from Q3. Net income from originations came in at $181 million during the fourth quarter, down from $271 million in the third quarter. In all, Mr. Cooper originated $17.17 billion in mortgages in the fourth quarter, a 13.9% drop from the prior quarter. Mr. Cooper’s servicing segment generated $87 million in pre-tax income in Q4, down from $197 million in the prior quarter. The servicing arm ended the fourth quarter with $710 billion in UPB, up from $668 billion in Q3. The post Mr. Cooper, Sagent to jointly build cloud servicing platform appeared first on HousingWire. |

| You are subscribed to email updates from Mortgage – HousingWire. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment